Question: Problem 3 : Consider an at-the-money American style call option (price today equals strike price) on a non-dividend paying stock with 1 year to maturity

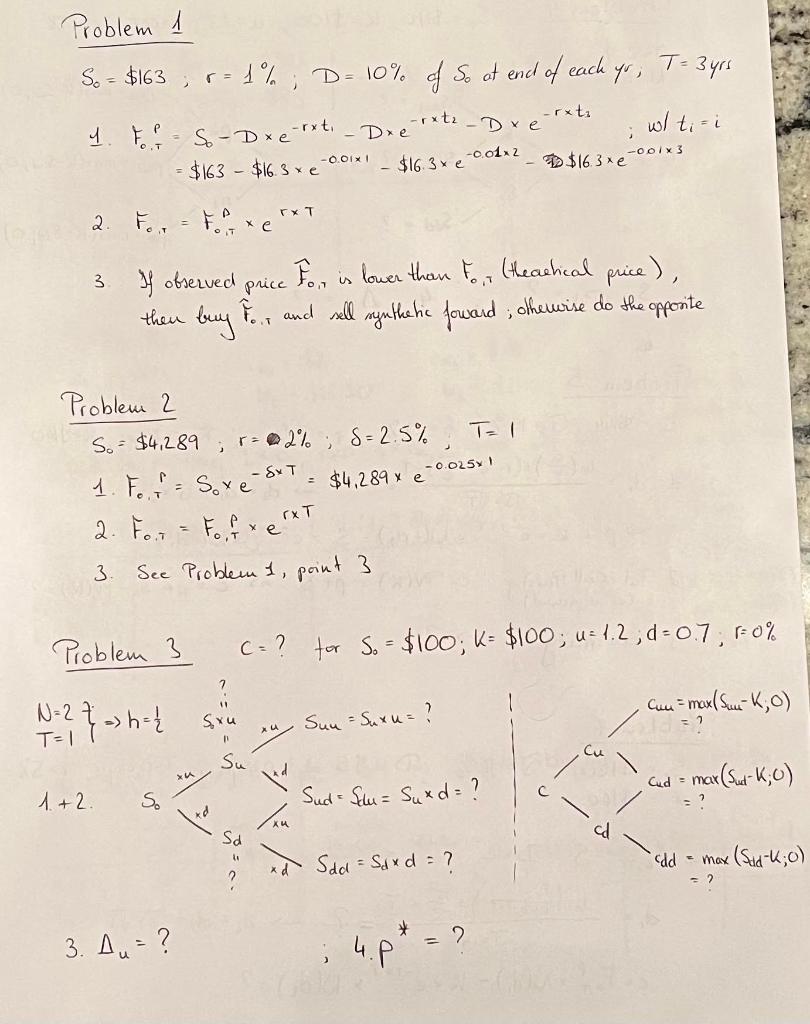

Problem 3: Consider an at-the-money American style call option (price today equals strike price) on a non-dividend paying stock with 1 year to maturity and a strike price of $100. Assume risk-free rate to be 0%. Construct a 2-period binomial model assuming the stock price can only move up by 20% and down by 30%

- Show the binomial tree for the stock prices over the next year.

- What are the possible call option payoffs in one years time?

- What is the Delta of the call option in 6 months if the stock price goes up?

- What is the risk-neutral probability of an up move?

-rxtz orxt: - Dxe -ooix 3 Problem 1 So= $163 ; r = 1 %; D = 10% of So at end of each yo, T= 3 yrs 1. F? So-D xerxt, _ Dr w/ ti=i = $163 - $16.3 x 6 0.01x $16.3xe For too xerxT for is lower than ton (theachical price), then buy for and sell synthetic foward; the wise do the opposite $16 3 1 - 2 2 3 If observed price -0.025%! - Problem 2 S. - $4,289;rl%; S = 2.5%; T=1 1. Fer=Soxe SXT = $4,289 x 2. For = Fo, fx e XT 3 See Problem I point 3 xe Problem 3 C=? for So= $100; K= $100; u = 1.2, d=0.7, 50% 7 2 Can = max( Suu K;o) N-27 -> h=/ Sxu Sun - Suxu= ? T Cu Su Cud - max max (Sud-K;O) 1.+2. S. Sud - Slu= Suxd= ? 4 Sd Sdd = Sdxd = ? dd - max (Suid-K;o) e ? 2 3. Au = ? 4.P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts