Question: 1. A, B an C are equal partners in the ABC Medical Practice. a. A decides to open a T-shirt shop in Guadalajara and wants

1. A, B an C are equal partners in the ABC Medical Practice.

a. A decides to open a T-shirt shop in Guadalajara and wants to leave the partnership. The other partners never much liked A anyway, thought he was a lousy doctor, and are happy to be rid of him. The partnership agrees to pay A $11,000 per year for three years for his partnership interest. Describe the tax consequences assuming the partnership agreement makes no provision for goodwill.

b. Returning to the facts of "a", what if the payment was $12,000 per year, with the additional provision that the payments drop by $1,000 per year if A engages in competitive activities within the geographic area in which the partnership currently does business? What if instead the partnership agrees to pay A 20% of partnership profits for three years and that turns out to be $11,000 per year?

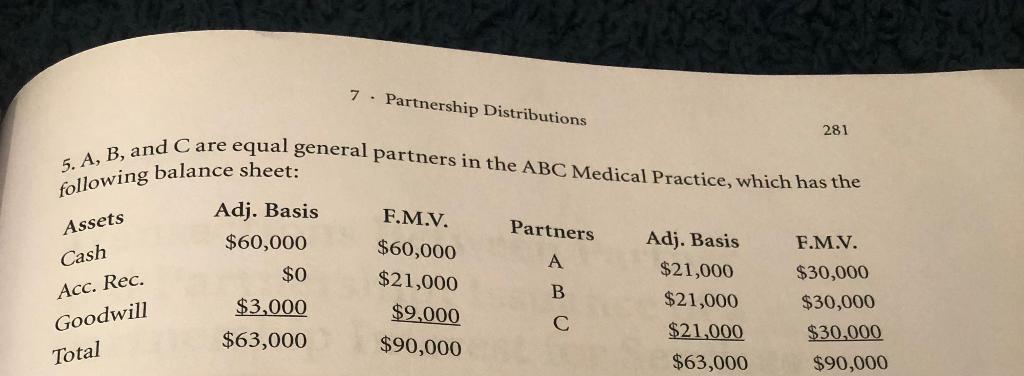

Assets 5. A, B, and C are equal general partners in the ABC Medical Practice, which has the following balance sheet: Cash Acc. Rec. Goodwill Total Adj. Basis $60,000 7 Partnership Distributions $0 $3,000 $63,000 F.M.V. $60,000 $21,000 $9,000 $90,000 Partners A B C 281 Adj. Basis $21,000 $21,000 $21,000 $63,000 F.M.V. $30,000 $30,000 $30,000 $90,000

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

a As tax consequences will depend on whether the 1100... View full answer

Get step-by-step solutions from verified subject matter experts