Question: 1. A firm producing steel has a production function q = 1/3 k/3, so its MRTS(l, k) = . Suppose the wage is w

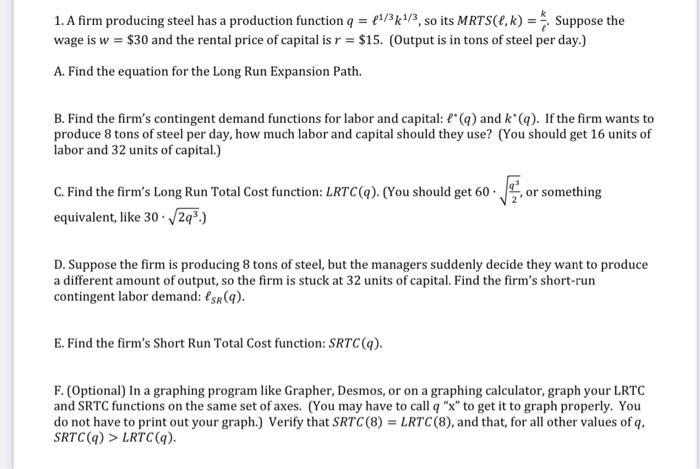

1. A firm producing steel has a production function q = 1/3 k/3, so its MRTS(l, k) = . Suppose the wage is w = $30 and the rental price of capital is r = $15. (Output is in tons of steel per day.) A. Find the equation for the Long Run Expansion Path. B. Find the firm's contingent demand functions for labor and capital: l'(q) and k' (q). If the firm wants to produce 8 tons of steel per day, how much labor and capital should they use? (You should get 16 units of labor and 32 units of capital.) C. Find the firm's Long Run Total Cost function: LRTC(q). (You should get 60, or something equivalent, like 30 2q.) D. Suppose the firm is producing 8 tons of steel, but the managers suddenly decide they want to produce a different amount of output, so the firm is stuck at 32 units of capital. Find the firm's short-run contingent labor demand: SR(q). E. Find the firm's Short Run Total Cost function: SRTC (q). F. (Optional) In a graphing program like Grapher, Desmos, or on a graphing calculator, graph your LRTC and SRTC functions on the same set of axes. (You may have to call q "x" to get it to graph properly. You do not have to print out your graph.) Verify that SRTC (8) LRTC (8), and that, for all other values of q, SRTC(q)> LRTC(q).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts