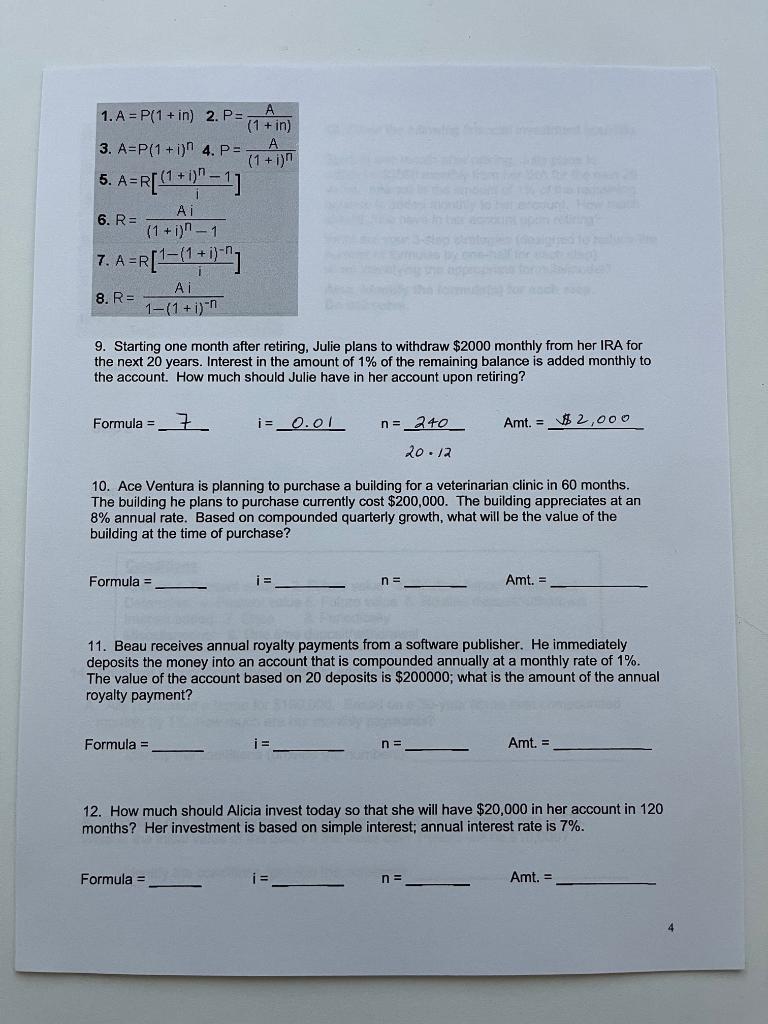

Question: 1. A = P(1 + in) 2. P- (1 + in) 3. A=P(1 + i) 4. P= A (1 + i) 5. A= A=R[(1+1)n-1] 6.

1. A = P(1 + in) 2. P- (1 + in) 3. A=P(1 + i)" 4. P= A (1 + i) 5. A= A=R[(1+1)n-1] 6. R= (1+i)n-1 7. AER =R[1=(1+i)="] 8. R= Ai 1-(1 + i)- 9. Starting one month after retiring, Julie plans to withdraw $2000 monthly from her IRA for the next 20 years. Interest in the amount of 1% of the remaining balance is added monthly to the account. How much should Julie have in her account upon retiring? Formula = 7 i = 0.01 n=_240 Amt. = $2,000 20.12 10. Ace Ventura is planning to purchase a building for a veterinarian clinic in 60 months. The building he plans to purchase currently cost $200,000. The building appreciates at an 8% annual rate. Based on compounded quarterly growth, what will be the value of the building at the time of purchase? Formula = n = Amt. = 11. Beau receives annual royalty payments from a software publisher. He immediately deposits the money into an account that is compounded annually at a monthly rate of 1%. The value of the account based on 20 deposits is $200000; what is the amount of the annual royalty payment? Formula = i = n = Amt. = 12. How much should Alicia invest today so that she will have $20,000 in her account in 120 months? Her investment is based on simple interest; annual interest rate is 7%. Formula n = Amt. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts