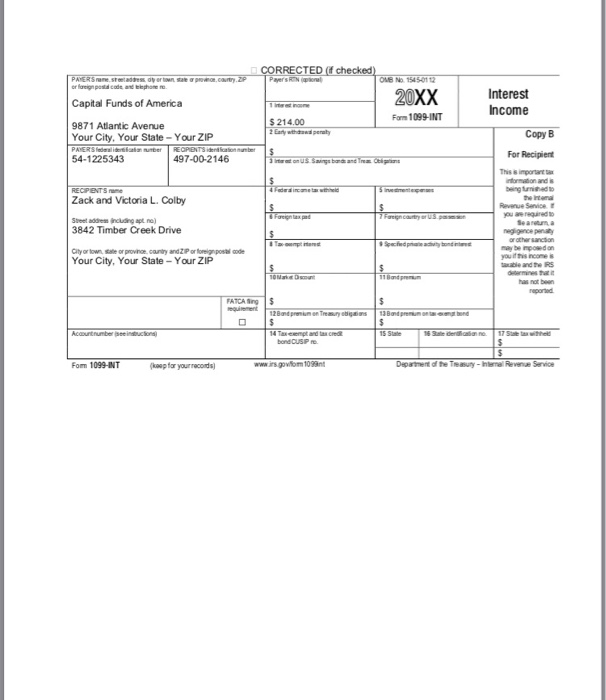

Question: 1. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Which form should be used to fle the

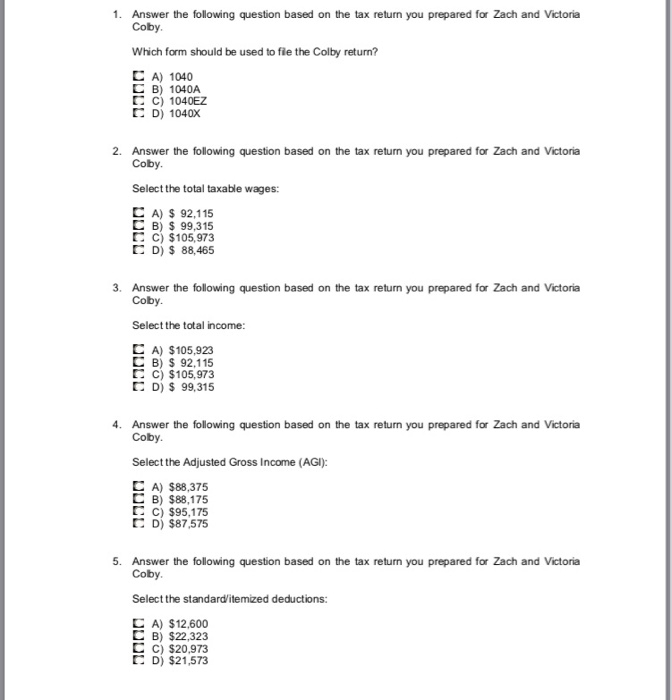

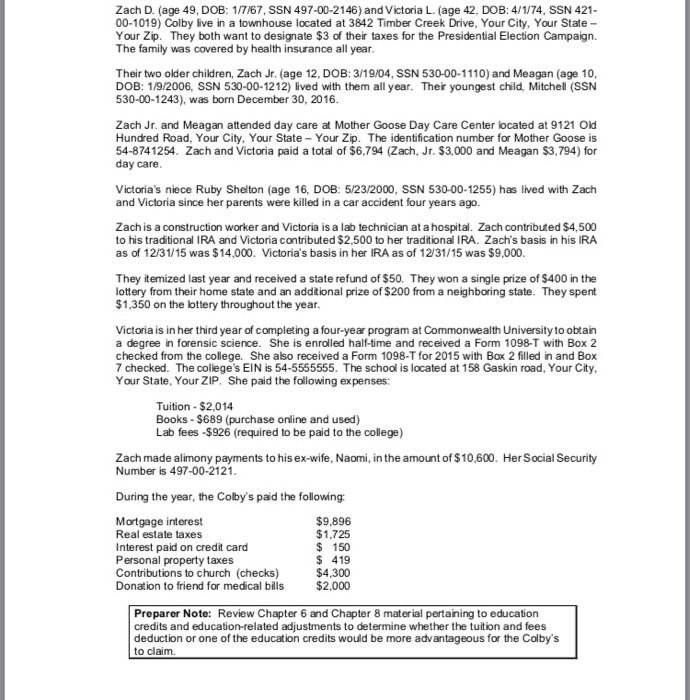

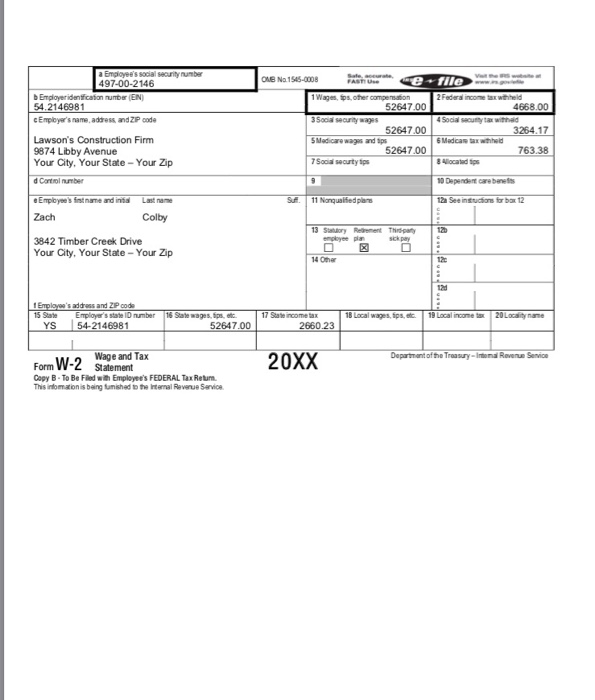

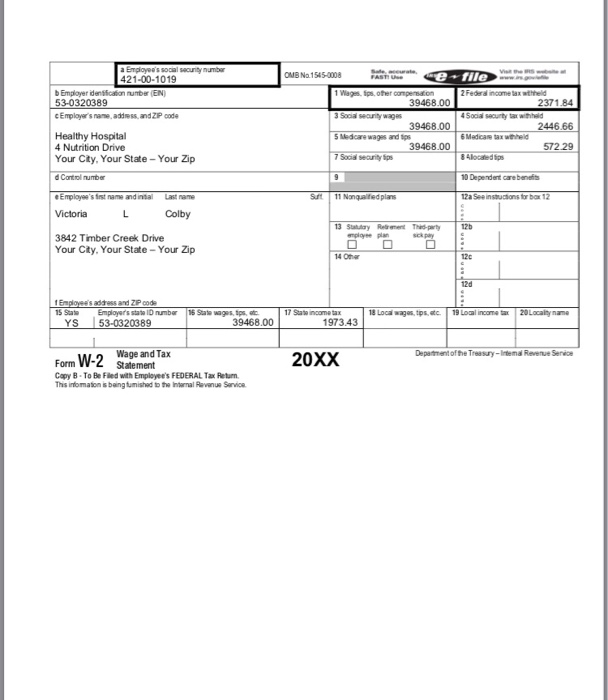

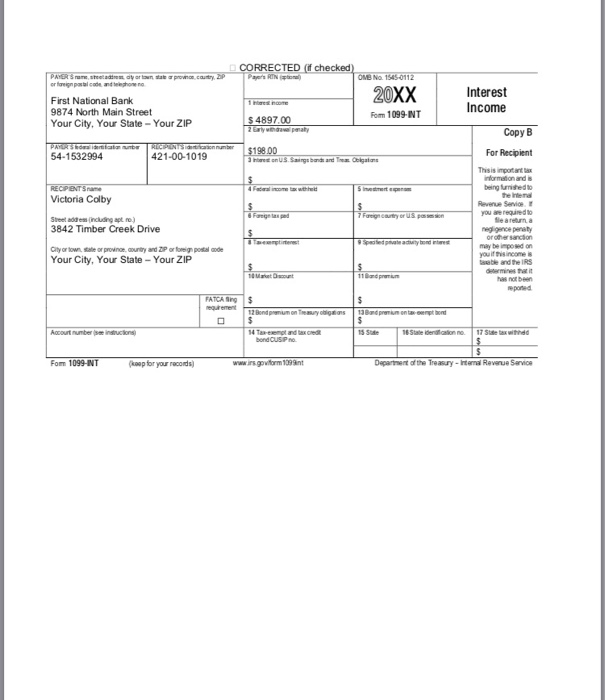

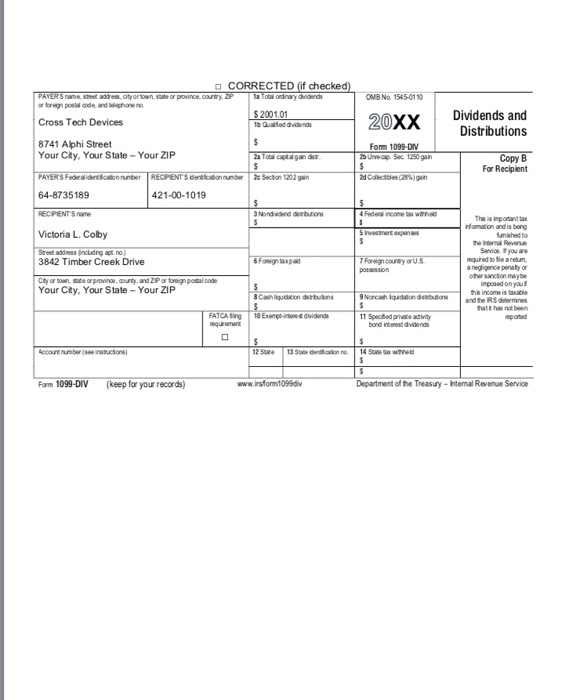

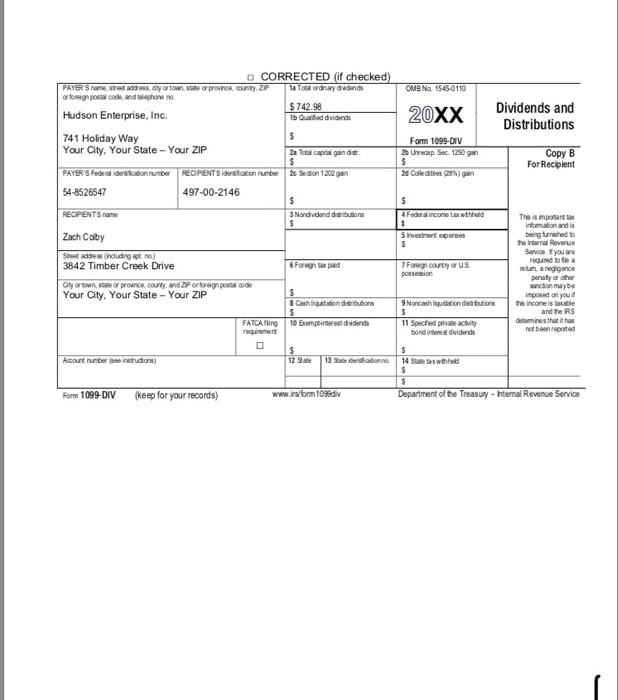

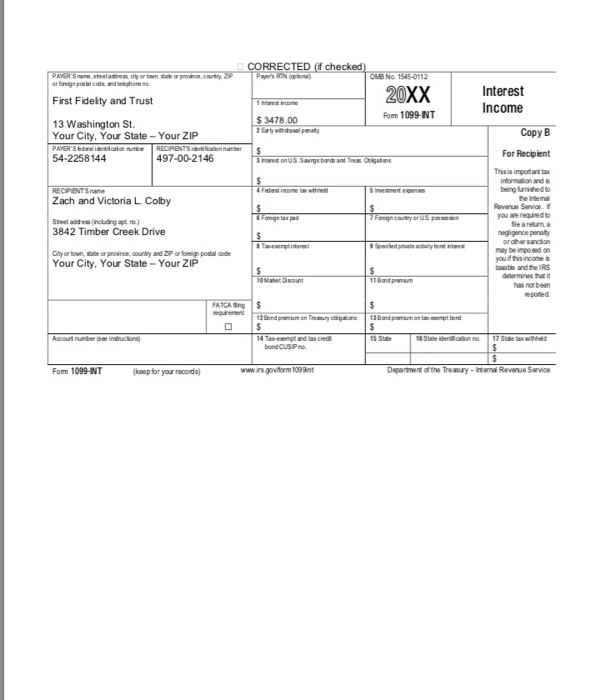

1. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Which form should be used to fle the Colby return? C A) 1040 C B) 1040A C C) 1040EZ E D) 1040X 2. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total taxable wages: C A) $ 92,115 C B) $ 99,315 C) $105,973 E D) S 88,465 3. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total income C A) $105,923 C B) $ 92.115 C) $105,973 C D) $ 99,315 4. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the Adjusted Gross Income (AGI): C A) $88,375 C B) $88,175 C C) $95,175 D) $87,575 5. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the standard/itemized deductions: C A) $12.600 C B) $22.323 C C) $20,973 E D) $21,573

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts