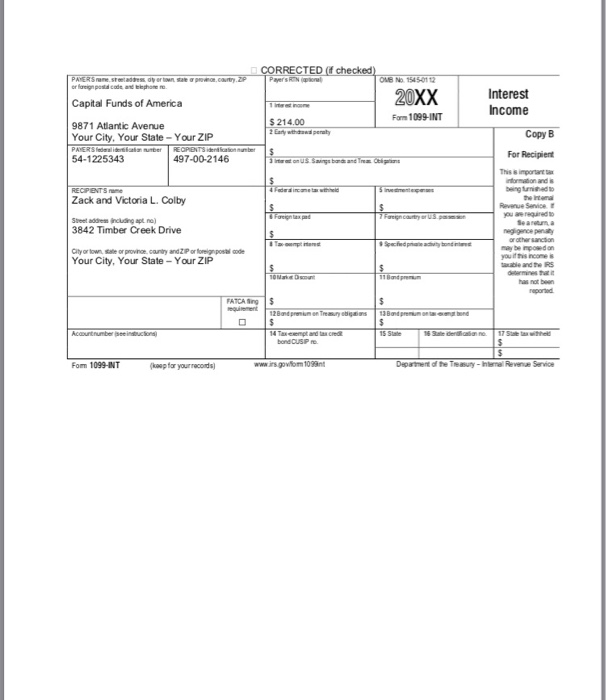

Question: 6. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total taxable income A) $54,032 C)

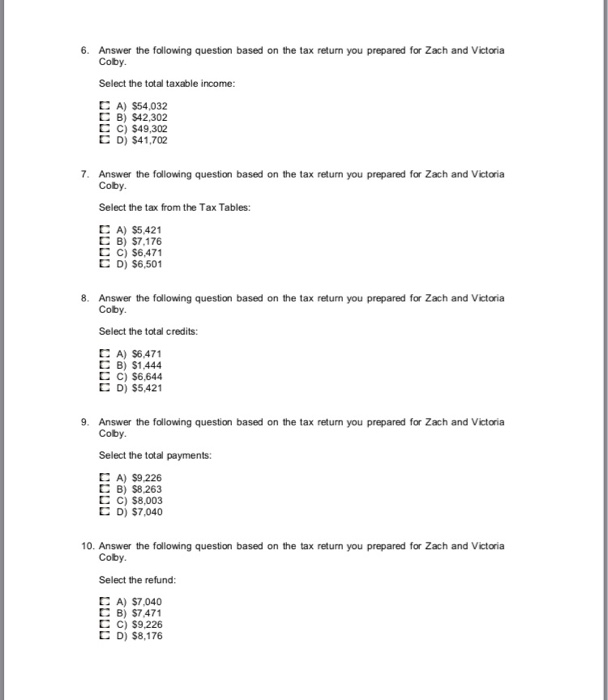

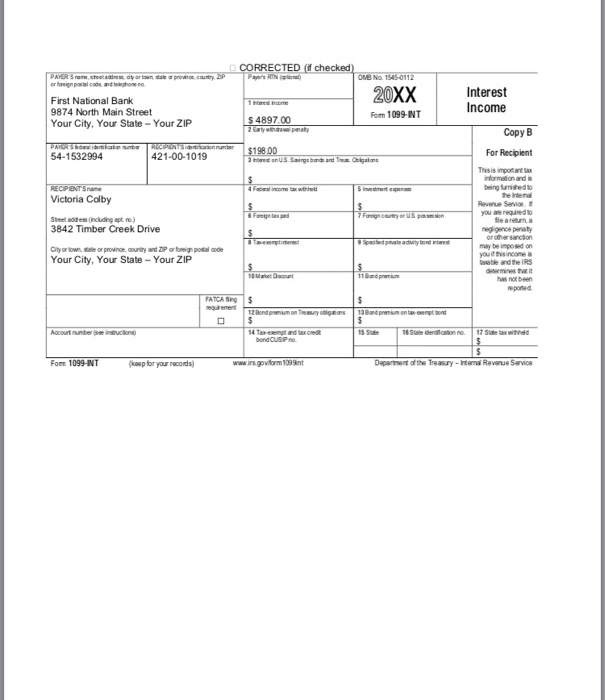

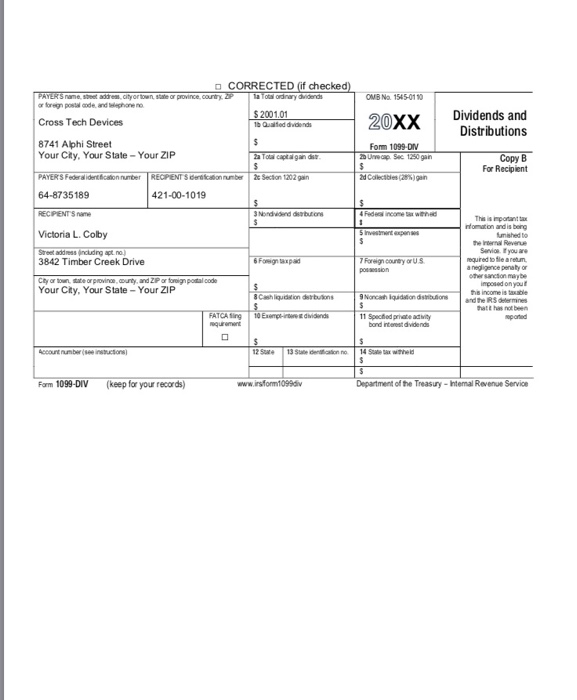

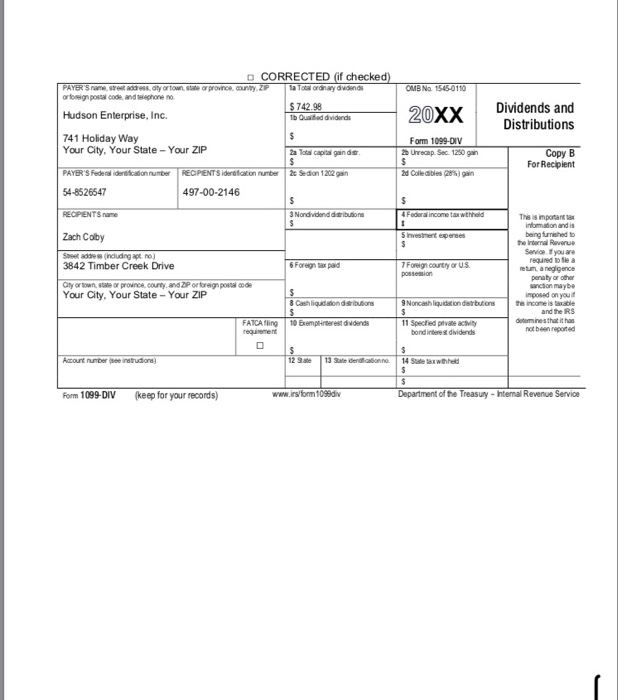

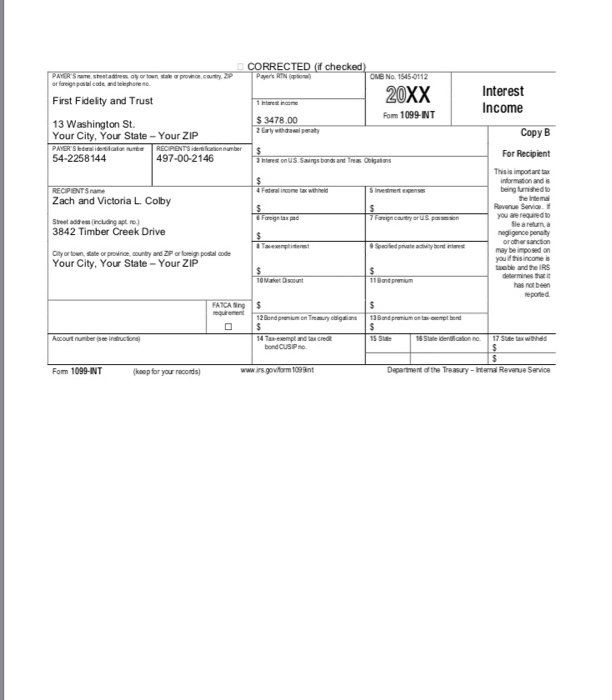

6. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total taxable income A) $54,032 C) $49.302 C D) $41,702 7. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the tax from the Tax Tables: C A) $5421 C B) $7.176 C) $6,471 D)$6,501 8. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total credits: A) $6,471 B) $1.444 C) $6,644 ? D) $5,421 9. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total payments: A) $9,226 C B) $8.263 C) $8,003 C D) $7,040 10. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the refund: A) $7,040 C B) $7471 C C) $9.226 C D) S8,176 6. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total taxable income A) $54,032 C) $49.302 C D) $41,702 7. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the tax from the Tax Tables: C A) $5421 C B) $7.176 C) $6,471 D)$6,501 8. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total credits: A) $6,471 B) $1.444 C) $6,644 ? D) $5,421 9. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the total payments: A) $9,226 C B) $8.263 C) $8,003 C D) $7,040 10. Answer the following question based on the tax return you prepared for Zach and Victoria Coby Select the refund: A) $7,040 C B) $7471 C C) $9.226 C D) S8,176

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts