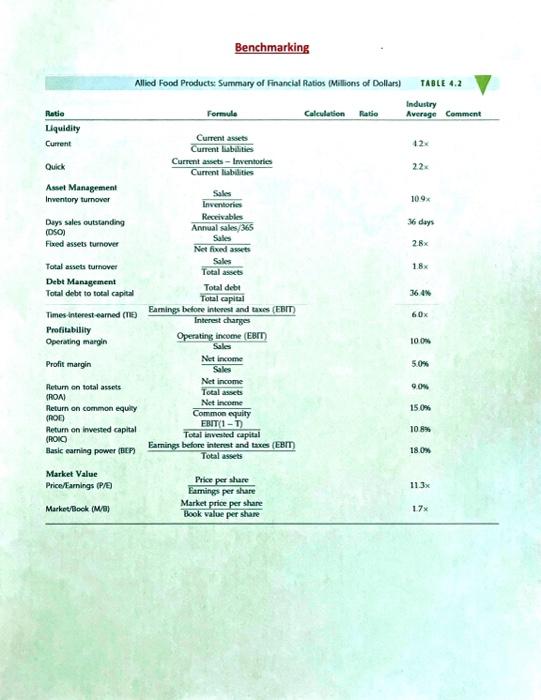

Question: 1. Based on the 2016 data, complete the infomation in the table below 2. Then perform dupont Analysis using the information from the sale down

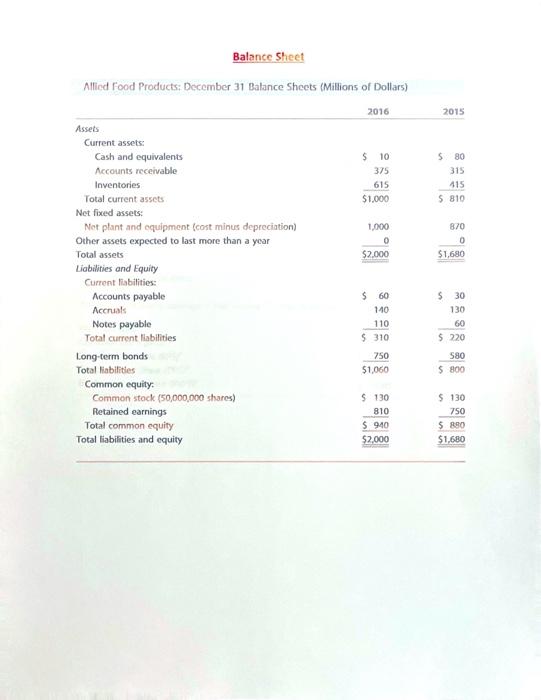

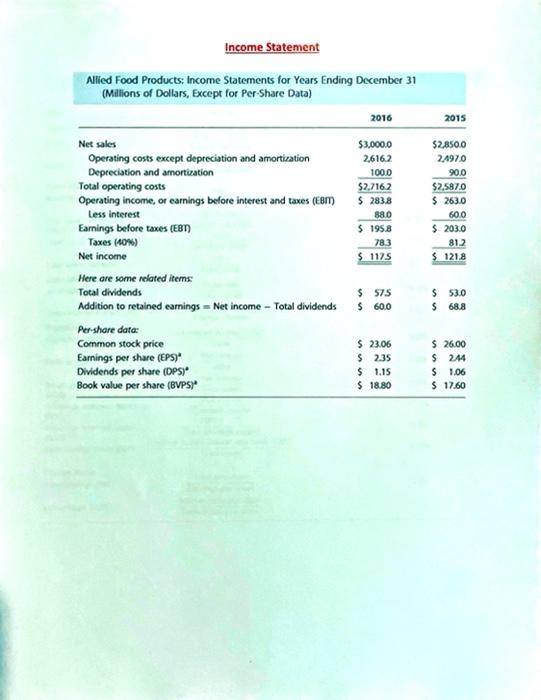

Balance Sheet 2015 S80 315 415 5810 870 0 $1,680 Allied Food Products: December 31 Balance Sheets (Millions of dollars) 2016 Assets Current assets: Cash and equivalents $ 10 Accounts receivable 375 Inventories 615 Total current assets $1.000 Net fixed assets: Not plant and equipment (cost minus depreciation) 1,000 Other assets expected to last more than a year 0 Total assets $2.000 Liabilities and Equity Current liabilities: Accounts payable $ 60 Accruals 140 Notes payable 110 Total current liabilities $ 310 Long-term bonds 750 Total liabilities 51,060 Common equity Common stock (50,000,000 shares) $ 130 Retained earnings 810 Total common equity $ 940 Total liabilities and equity $2.000 530 130 60 $ 220 580 $ 800 $ 130 750 $ 890 $1,680 Income Statement 2015 Allied Food Products: Income Statements for Years Ending December 31 (Millions of Dollars, Except for Per-Share Data) 2016 Net sales $3,000.0 Operating costs except depreciation and amortization 2,6162 Depreciation and amortization 100.0 Total operating costs $2,7162 Operating income, or earnings before interest and taxes (EBM $ 283.8 Less interest Earnings before taxes (EBT $ 1958 Taxes (40%) 78.3 $2850.0 2.4970 90.0 $2,587.0 $ 263.0 60.0 $ 203.0 812 $ 121.8 880 Net income $ 1125 $ 575 $ 60,0 $ 53.0 $ 68.8 Here are some related items Total dividends Addition to retained earnings = Net income - Total dividends Per-share data: Common stock price Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) $ 23.06 $ 2.35 $ 1.15 $ 18.80 $ 26,00 $ 214 $ 1.06 $17.60 Benchmarking Allied Food Products Summary of Financial Ratios (Millions of Dollars) TABLE 4.2 Industry Formule Calculation Ratio Average Comment Ratio Liquidity Current 42 Current assets Current liabilities Current assets - Inventories Current liabilities Quick 22 Asset Management Inventory turnover 109% 36 days Days sales outstanding (DSO) Fixed assets turnover 2.8% 1.8% 36.4% Total assets turnover Debt Management Total debt to total capital Times interest-earned (TE) Profitability Operating margin 60x Sales Inventori Receivables Annual sales 365 Sales Net fixed assets Sales Total assets Total debt Total capital Earnings before interest and taxes (EBIT) Interest charges Operating income (EBIT) Sales Net Income Sales Net income Total assets Net Income Common equity EBIT1-D Total invested capital Earnings before interest and taxes (EBIT) Total assets 100% Profit margin 5.0% Return on total assets 9.09 CROA 15.0% Return on common equiry (ROE Return on invested capital (ROIC Basic earning power (DE) 108 18.0% Market Value Price/Earnings P/E 11.3x Price per share Famings per share Market price per share Hook value per share MarketBook (wa) Balance Sheet 2015 S80 315 415 5810 870 0 $1,680 Allied Food Products: December 31 Balance Sheets (Millions of dollars) 2016 Assets Current assets: Cash and equivalents $ 10 Accounts receivable 375 Inventories 615 Total current assets $1.000 Net fixed assets: Not plant and equipment (cost minus depreciation) 1,000 Other assets expected to last more than a year 0 Total assets $2.000 Liabilities and Equity Current liabilities: Accounts payable $ 60 Accruals 140 Notes payable 110 Total current liabilities $ 310 Long-term bonds 750 Total liabilities 51,060 Common equity Common stock (50,000,000 shares) $ 130 Retained earnings 810 Total common equity $ 940 Total liabilities and equity $2.000 530 130 60 $ 220 580 $ 800 $ 130 750 $ 890 $1,680 Income Statement 2015 Allied Food Products: Income Statements for Years Ending December 31 (Millions of Dollars, Except for Per-Share Data) 2016 Net sales $3,000.0 Operating costs except depreciation and amortization 2,6162 Depreciation and amortization 100.0 Total operating costs $2,7162 Operating income, or earnings before interest and taxes (EBM $ 283.8 Less interest Earnings before taxes (EBT $ 1958 Taxes (40%) 78.3 $2850.0 2.4970 90.0 $2,587.0 $ 263.0 60.0 $ 203.0 812 $ 121.8 880 Net income $ 1125 $ 575 $ 60,0 $ 53.0 $ 68.8 Here are some related items Total dividends Addition to retained earnings = Net income - Total dividends Per-share data: Common stock price Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) $ 23.06 $ 2.35 $ 1.15 $ 18.80 $ 26,00 $ 214 $ 1.06 $17.60 Benchmarking Allied Food Products Summary of Financial Ratios (Millions of Dollars) TABLE 4.2 Industry Formule Calculation Ratio Average Comment Ratio Liquidity Current 42 Current assets Current liabilities Current assets - Inventories Current liabilities Quick 22 Asset Management Inventory turnover 109% 36 days Days sales outstanding (DSO) Fixed assets turnover 2.8% 1.8% 36.4% Total assets turnover Debt Management Total debt to total capital Times interest-earned (TE) Profitability Operating margin 60x Sales Inventori Receivables Annual sales 365 Sales Net fixed assets Sales Total assets Total debt Total capital Earnings before interest and taxes (EBIT) Interest charges Operating income (EBIT) Sales Net Income Sales Net income Total assets Net Income Common equity EBIT1-D Total invested capital Earnings before interest and taxes (EBIT) Total assets 100% Profit margin 5.0% Return on total assets 9.09 CROA 15.0% Return on common equiry (ROE Return on invested capital (ROIC Basic earning power (DE) 108 18.0% Market Value Price/Earnings P/E 11.3x Price per share Famings per share Market price per share Hook value per share MarketBook (wa)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts