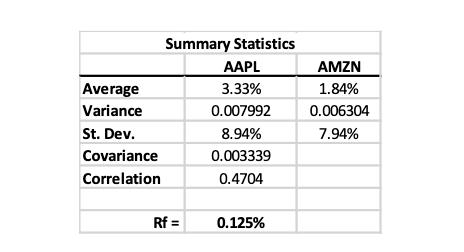

Question: 1. Based on the table 0.30 in AMZN? a. 1.84% b. 2.59% c. 2.63% d. 2.88% e. 3.12% f. 3.33% 2. Based on the

1. Based on the table 0.30 in AMZN? a. 1.84% b. 2.59% c. 2.63% d. 2.88% e. 3.12% f. 3.33% 2. Based on the table and 0.30 in AMZN? a. 5.88% b. 6.30% c. 7.67% d. 7.94% e. 8.64% f. 8.94% , what is the expected return of the portfolio with 0.70 invested in AAPL and a. Yes b. No ) what is the standard deviation of the portfolio with 0.70 invested in AAPL 3. Based on the table , construct the opportunity set for the portfolio invested into stocks AAPL and AMZN. Based on the opportunity set you've created, does the portfolio with investment weights of 60% invested in AAPL and 40 % invested in AMZN lie on the efficient frontier? c. Can not tell d. Depends on which stock was purchased first Average Variance St. Dev. Covariance Correlation Summary Statistics AAPL 3.33% 0.007992 Rf= 8.94% 0.003339 0.4704 0.125% AMZN 1.84% 0.006304 7.94%

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To answer these questions we will use the information from the provided summary statistic... View full answer

Get step-by-step solutions from verified subject matter experts