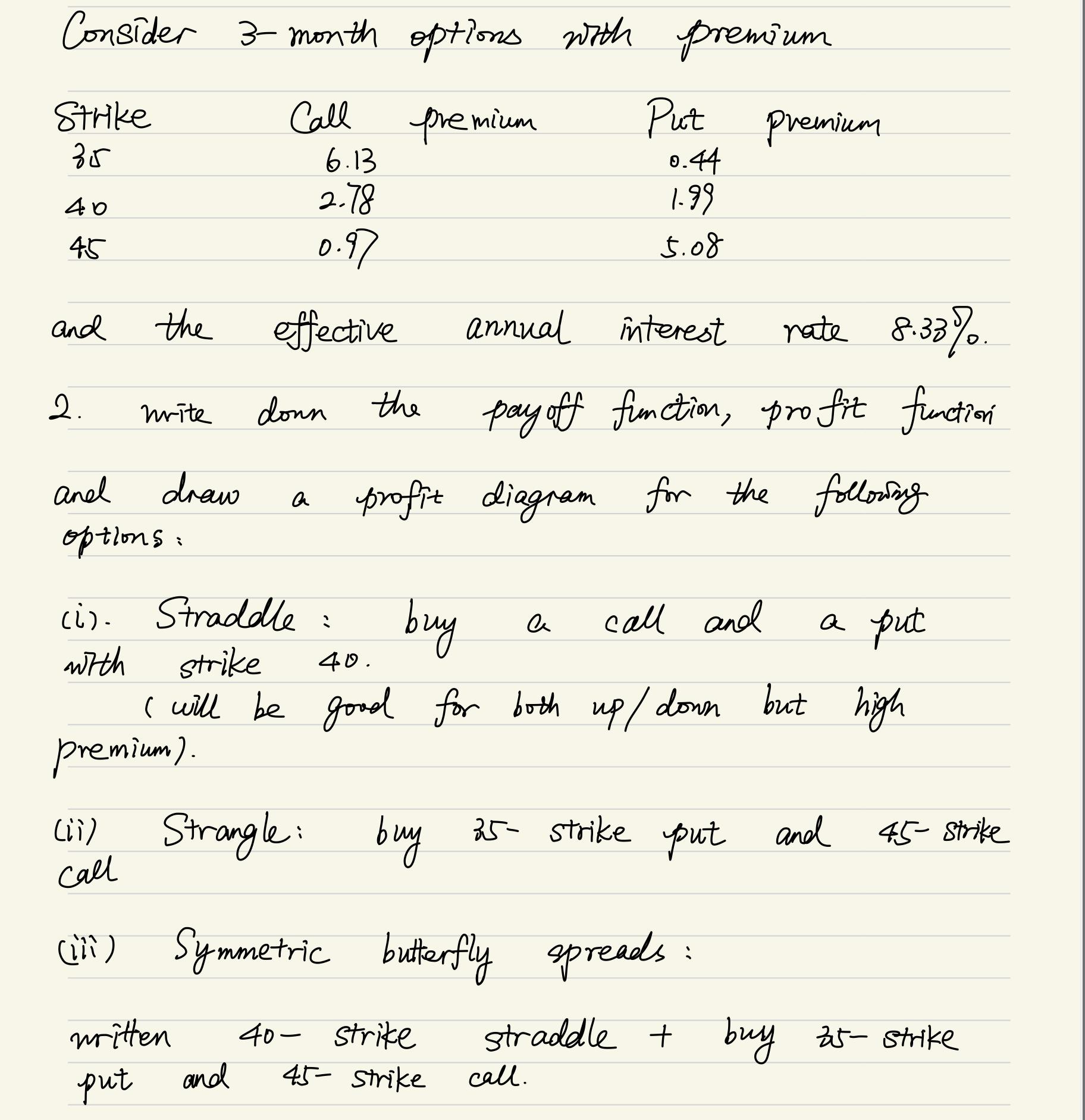

Question: Consider 3-month options with premium Strike 35 Call premium 40 45 and 2. the write and options: draw premium). (ii) Call (iii) 6.13 2.78

Consider 3-month options with premium Strike 35 Call premium 40 45 and 2. the write and options: draw premium). (ii) Call (iii) 6.13 2.78 0.97 effective written put donn and the (i). Straddle : buy call and a put with strike 40. I will be good for both up/down but high Put premium 0.44 1.99 5.08 annual interest nate 8.33%. pay off function, profit function profit diagram for the following Strangle: buy 25- strike put and Symmetric butterfly spreads: 40- strike 45- Strike a 45- strike straddle + buy 25- strike call.

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

To visualize the payoff and profit functions for the given options strategies we can plot the diagrams Here are the diagrams for the three options str... View full answer

Get step-by-step solutions from verified subject matter experts