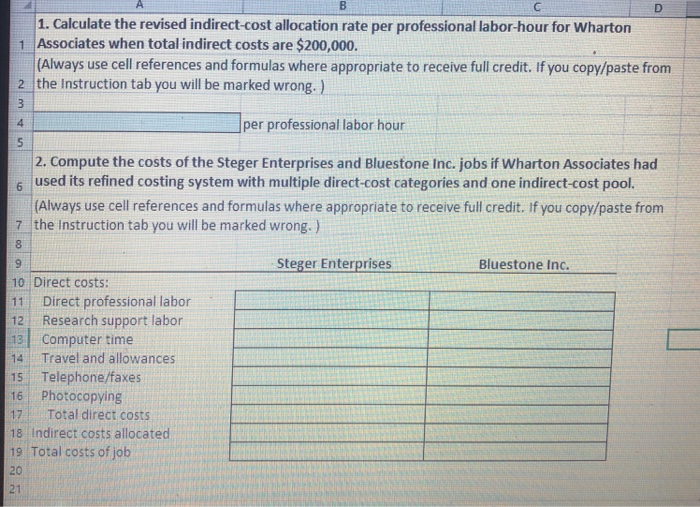

Question: 1. Calculate the revised indirect-cost allocation rate per professional labor-hour for Wharton 1 Associates when total indirect costs are $200,000. (Always use cell references and

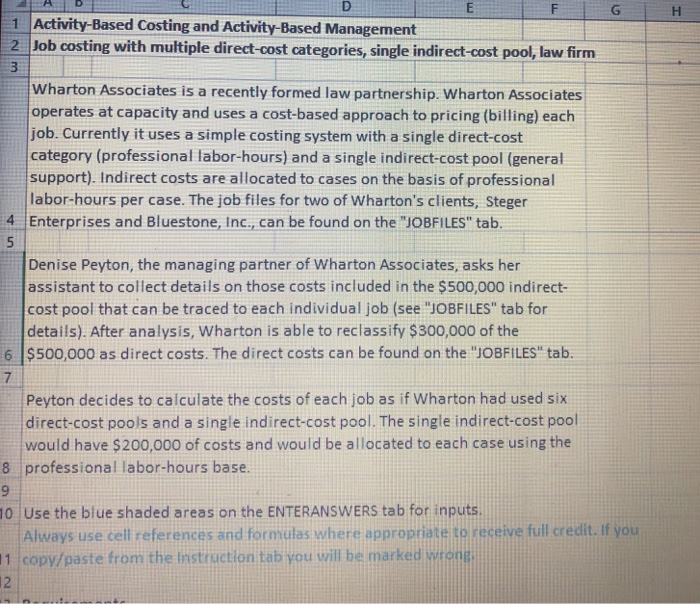

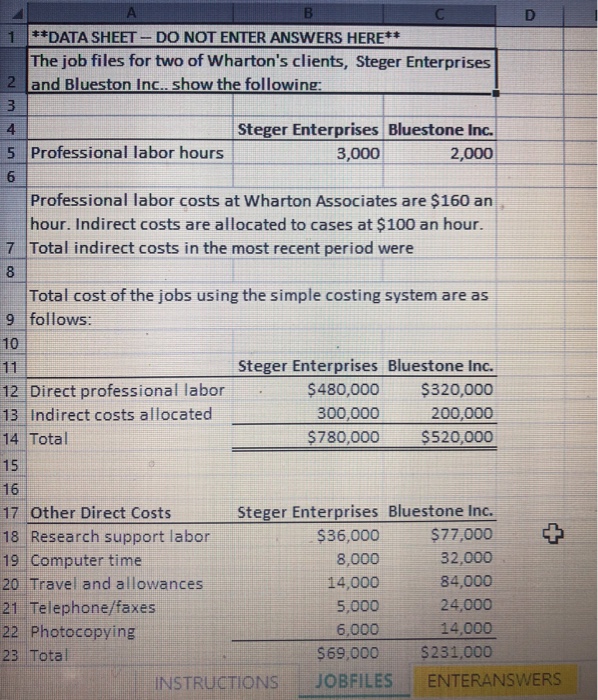

1. Calculate the revised indirect-cost allocation rate per professional labor-hour for Wharton 1 Associates when total indirect costs are $200,000. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from 21 the Instruction tab you will be marked wrong. ) 4. per professional labor hour 5 2. Compute the costs of the Steger Enterprises and Bluestone Inc. jobs if Wharton Associates had 6 used its refined costing system with multiple direct-cost categories and one indirect-cost pool. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from 7 the Instruction tab you will be marked wrong.) 8 9 10 Direct costs: 11 Direct professional labor 12 Research support labor 13 Computer time 14 Travel and allowances 15 Telephone/faxes 16 Photocopying 17 Total direct costs 18 Indirect costs allocated 19 Total costs of job 20 21 Steger Enterprises Bluestone Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts