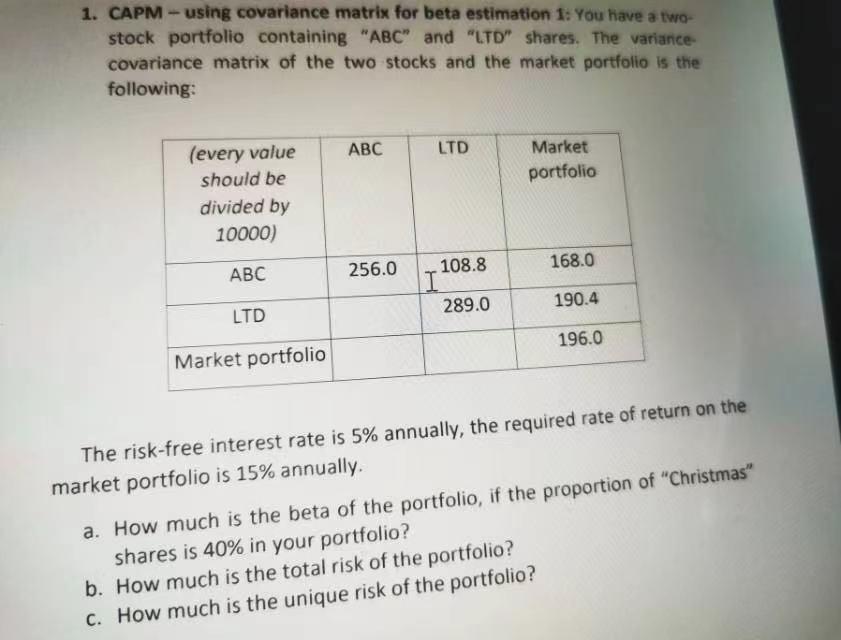

Question: 1. CAPM - using covariance matrix for beta estimation 1: You have a two- stock portfolio containing ABC and LTD shares. The variance covariance matrix

1. CAPM - using covariance matrix for beta estimation 1: You have a two- stock portfolio containing "ABC" and "LTD" shares. The variance covariance matrix of the two stocks and the market portfolio is the following: ABC LTD Market portfolio (every value should be divided by 10000) 256.0 168.0 ABC 108.8 I 289.0 190.4 LTD 196.0 Market portfolio The risk-free interest rate is 5% annually, the required rate of return on the market portfolio is 15% annually a. How much is the beta of the portfolio, if the proportion of "Christmas" shares is 40% in your portfolio? b. How much is the total risk of the portfolio? C. How much is the unique risk of the portfolio? 1. CAPM - using covariance matrix for beta estimation 1: You have a two- stock portfolio containing "ABC" and "LTD" shares. The variance covariance matrix of the two stocks and the market portfolio is the following: ABC LTD Market portfolio (every value should be divided by 10000) 256.0 168.0 ABC 108.8 I 289.0 190.4 LTD 196.0 Market portfolio The risk-free interest rate is 5% annually, the required rate of return on the market portfolio is 15% annually a. How much is the beta of the portfolio, if the proportion of "Christmas" shares is 40% in your portfolio? b. How much is the total risk of the portfolio? C. How much is the unique risk of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts