Question: 1. Chapter MC, Section .05, Problem 018 The YTMs of three $1,000 face value bonds that mature in 10 years and have the same level

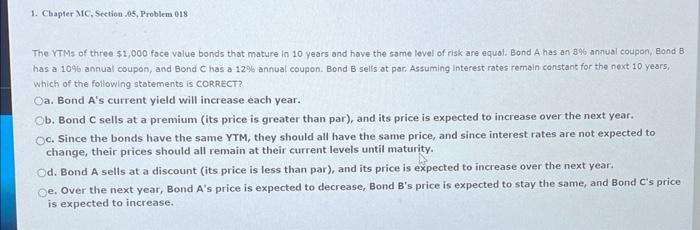

1. Chapter MC, Section .05, Problem 018 The YTMs of three $1,000 face value bonds that mature in 10 years and have the same level of risk are equal. Bond A has an 8% annual coupon, Bond B has a 10% annual coupon, and Bond C has a 12% annual coupon. Bond B sells at par. Assuming interest rates remain constant for the next 10 years, which of the following statements is CORRECT? Oa. Bond A's current yield will increase each year. Ob. Bond C sells at a premium (its price is greater than par), and its price is expected to increase over the next year. Oc. Since the bonds have the same YTM, they should all have the same price, and since interest rates are not expected to change, their prices should all remain at their current levels until maturity. Od. Bond A sells at a discount (its price is less than par), and its price is expected to increase over the next year. Oe. Over the next year, Bond A's price is expected to decrease, Bond B's price is expected to stay the same, and Bond C's price is expected to increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts