Question: 1. Compared to the non-callable bond, a callable bond has a lower yield and higher price. TRU FALSE 2. Delta of a callable bond will

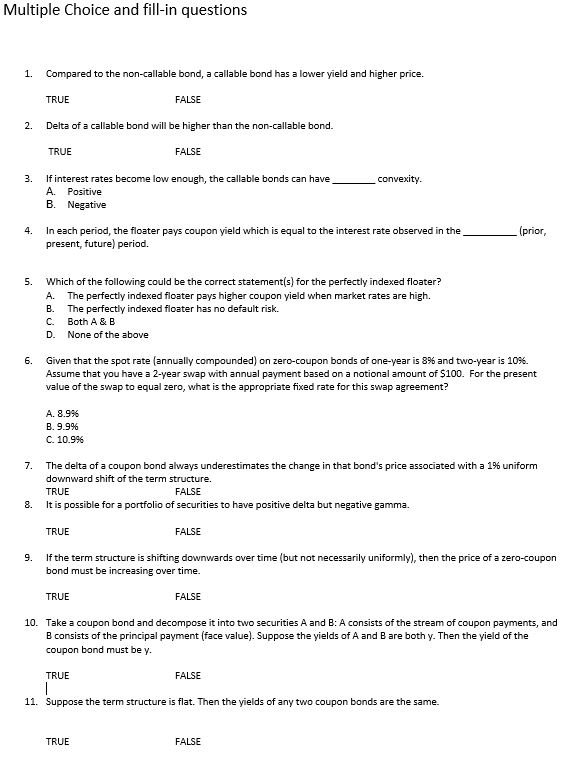

1. Compared to the non-callable bond, a callable bond has a lower yield and higher price. TRU FALSE 2. Delta of a callable bond will be higher than the non-callable bond. TRUE FALSE 3. If interest rates become low enough, the callable bonds can have convexity. A. Positive B. Negative 4. In each period, the floater pays coupon yield which is equal to the interest rate observed in the (prior, present, future) period. 5. Which of the following could be the correct statement(s) for the perfectly indexed floater? A. The perfectly indexed floater pays higher coupon yield when market rates are high. B. The perfectly indexed floater has no default risk. C. Both A \& B D. None of the above 6. Given that the spot rate (annually compounded) on zero-coupon bonds of one-year is 8% and two-year is 10%. Assume that you have a 2-year swap with annual payment based on a notional amount of $100. For the present value of the swap to equal zero, what is the appropriate fixed rate for this swap agreement? A. 8.986 B. 9.9% C. 10.9% 7. The delta of a coupon bond always underestimates the change in that bond's price associated with a 1% uniform downward shift of the term structure. TRUE FALSE 8. It is possible for a portfolio of securities to have positive delta but negative gamma. TRUE FALSE 9. If the term structure is shifting downwards over time (but not necessarily uniformly), then the price of a zero-coupon bond must be increasing over time. TRUE FALSE 10. Take a coupon bond and decompose it into two securities A and B : A consists of the stream of coupon payments, and B consists of the principal payment (face value). Suppose the yields of A and B are both y. Then the yield of the coupon bond must be y. TRI FALSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts