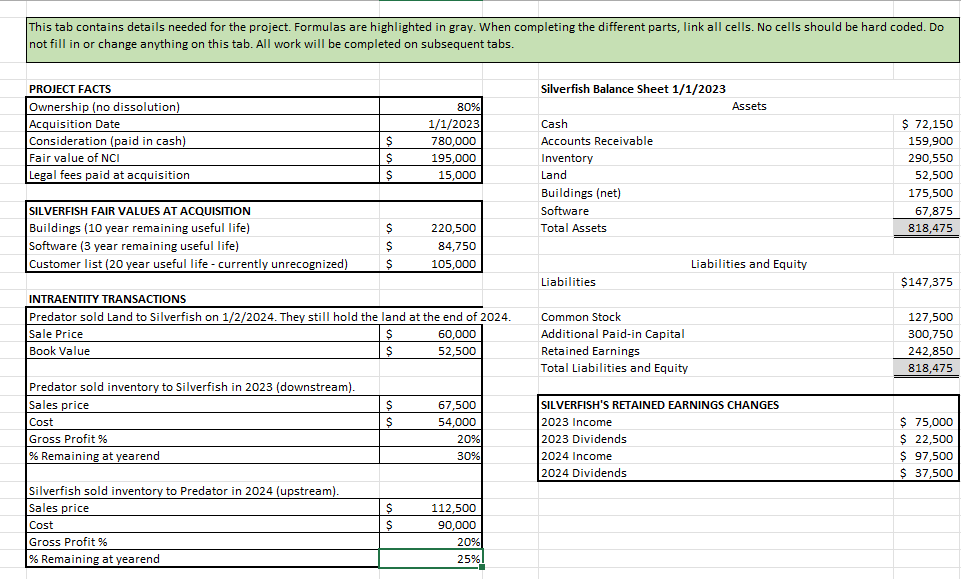

Question: 1 . Complete the fair - value allocation schedule, calculate the excess fair - value amortizations, and record the acquisition journal entries, including the legal

Complete the fairvalue allocation schedule, calculate the excess fairvalue amortizations, and record the acquisition journal entries, including the legal fees.

Complete the Consolidation Worksheet below.

Let's assume that the Goodwill balance gets completely impaired at the end of Record the journal entry to impair the Goodwill balance. The accounts for this journal entry were learned in previous courses.

Based on the information below, calculate the applicable ratios with and without impairment.

Without Impairment With Impairment Common Shares Outstanding Consolidated Net Income Loss Consolidated Assets, Consolidated Assets, Consolidated Equity, Consolidated Equity, Consolidated Liabilities EPS net income shares ROA net income average assets ROE net income average equity Debt to Equity liabilities equity

Answer the following questions:

a What is the effect on each ratio when all of the acquisition related goodwill is considered impaired?

b What are some potential upsides and downsides when an impairment loss is recorded?

c Who is impacted by a goodwill impairment loss being recorded?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock