Question: 1. Consider a market with two assets, one a risk-less asset, like a bank account, earning 100R% interest, and the other a (risky asset) having

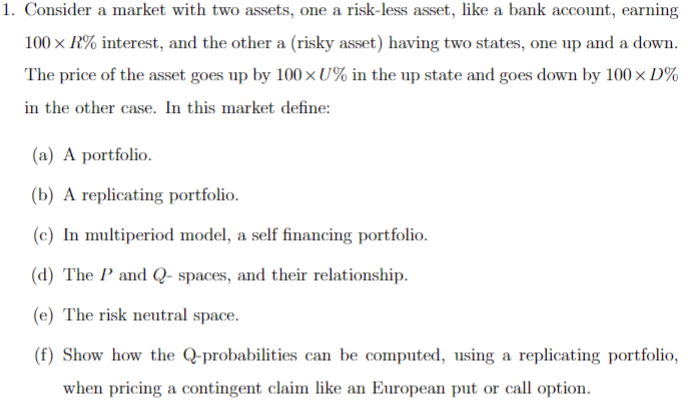

1. Consider a market with two assets, one a risk-less asset, like a bank account, earning 100R% interest, and the other a (risky asset) having two states, one up and a down. The price of the asset goes up by 100U% in the up state and goes down by 100D% in the other case. In this market define: (a) A portfolio. (b) A replicating portfolio. (c) In multiperiod model, a self financing portfolio. (d) The P and Q - spaces, and their relationship. (e) The risk neutral space. (f) Show how the Q-probabilities can be computed, using a replicating portfolio, when pricing a contingent claim like an European put or call option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock