Question: Please just do as much as you can and I will vote up. Thank you very much! 3. (12 marks) Consider a market of two

Please just do as much as you can and I will vote up.

Thank you very much!

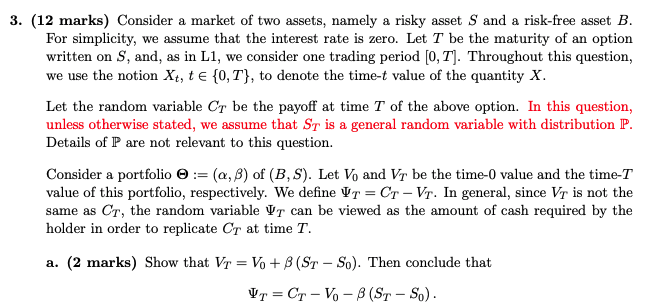

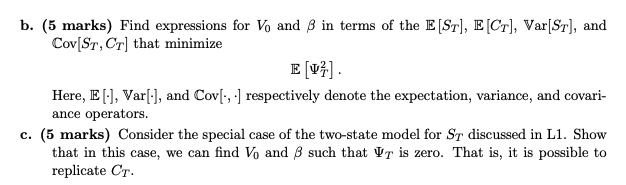

3. (12 marks) Consider a market of two assets, namely a risky asset S and a risk-free asset B. For simplicity, we assume that the interest rate is zero. Let T be the maturity of an option written on S, and, as in Li, we consider one trading period (0,T]. Throughout this question, we use the notion Xt, te {0, T}, to denote the time-t value of the quantity X. Let the random variable Cr be the payoff at time T of the above option. In this question, unless otherwise stated, we assume that Sr is a general random variable with distribution P. Details of P are not relevant to this question. Consider a portfolio := (a,b) of (BS). Let V and Vr be the time-0 value and the time-T value of this portfolio, respectively. We define VT=Cr-Vr. In general, since Vr is not the same as Cr, the random variable Ut can be viewed as the amount of cash required by the holder in order to replicate Cr at time T. a. (2 marks) Show that Vr = V0 + B (ST - S.). Then conclude that UT = Cr-V0-8 (ST-S.). b. (5 marks) Find expressions for V, and 8 in terms of the E [ST], E (Cr), Var[ST], and Cov[St, Cr] that minimize E[v] Here, E [-], Var[-], and Cov[,-) respectively denote the expectation, variance, and covari- ance operators. c. (5 marks) Consider the special case of the two-state model for Sr discussed in Ll. Show that in this case, we can find V and 8 such that Vr is zero. That is, it is possible to replicate Cr. 3. (12 marks) Consider a market of two assets, namely a risky asset S and a risk-free asset B. For simplicity, we assume that the interest rate is zero. Let T be the maturity of an option written on S, and, as in Li, we consider one trading period (0,T]. Throughout this question, we use the notion Xt, te {0, T}, to denote the time-t value of the quantity X. Let the random variable Cr be the payoff at time T of the above option. In this question, unless otherwise stated, we assume that Sr is a general random variable with distribution P. Details of P are not relevant to this question. Consider a portfolio := (a,b) of (BS). Let V and Vr be the time-0 value and the time-T value of this portfolio, respectively. We define VT=Cr-Vr. In general, since Vr is not the same as Cr, the random variable Ut can be viewed as the amount of cash required by the holder in order to replicate Cr at time T. a. (2 marks) Show that Vr = V0 + B (ST - S.). Then conclude that UT = Cr-V0-8 (ST-S.). b. (5 marks) Find expressions for V, and 8 in terms of the E [ST], E (Cr), Var[ST], and Cov[St, Cr] that minimize E[v] Here, E [-], Var[-], and Cov[,-) respectively denote the expectation, variance, and covari- ance operators. c. (5 marks) Consider the special case of the two-state model for Sr discussed in Ll. Show that in this case, we can find V and 8 such that Vr is zero. That is, it is possible to replicate Cr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts