Question: (1) Consider a single-period binomial model with interest rate r = 0.2, where the stock's initial price So = 5 and the stock terminal price

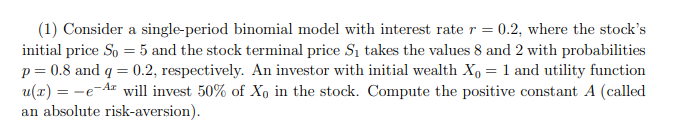

(1) Consider a single-period binomial model with interest rate r = 0.2, where the stock's initial price So = 5 and the stock terminal price Si takes the values 8 and 2 with probabilities p=0.8 and q = 0.2, respectively. An investor with initial wealth Xo = 1 and utility function u(I) = -e-At will invest 50% of X, in the stock. Compute the positive constant A (called an absolute risk-aversion)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts