Question: Question 2 Consider a single-period binomial model for the stock price process {St:t= 0,1} traded at time t=0,1. Let S0=100 and let the price rise

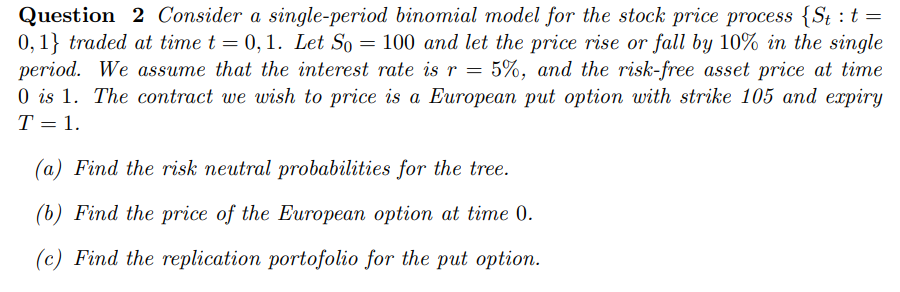

Question 2 Consider a single-period binomial model for the stock price process {St:t= 0,1} traded at time t=0,1. Let S0=100 and let the price rise or fall by 10% in the single period. We assume that the interest rate is r=5%, and the risk-free asset price at time 0 is 1. The contract we wish to price is a European put option with strike 105 and expiry T=1 (a) Find the risk neutral probabilities for the tree. (b) Find the price of the European option at time 0. (c) Find the replication portofolio for the put option. Question 2 Consider a single-period binomial model for the stock price process {St:t= 0,1} traded at time t=0,1. Let S0=100 and let the price rise or fall by 10% in the single period. We assume that the interest rate is r=5%, and the risk-free asset price at time 0 is 1. The contract we wish to price is a European put option with strike 105 and expiry T=1 (a) Find the risk neutral probabilities for the tree. (b) Find the price of the European option at time 0. (c) Find the replication portofolio for the put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts