Question: 1. Consider a single-period binomial model with r = 1/3, Bo = 1, So = 2, d = 5/4, u = 3/2, and p =

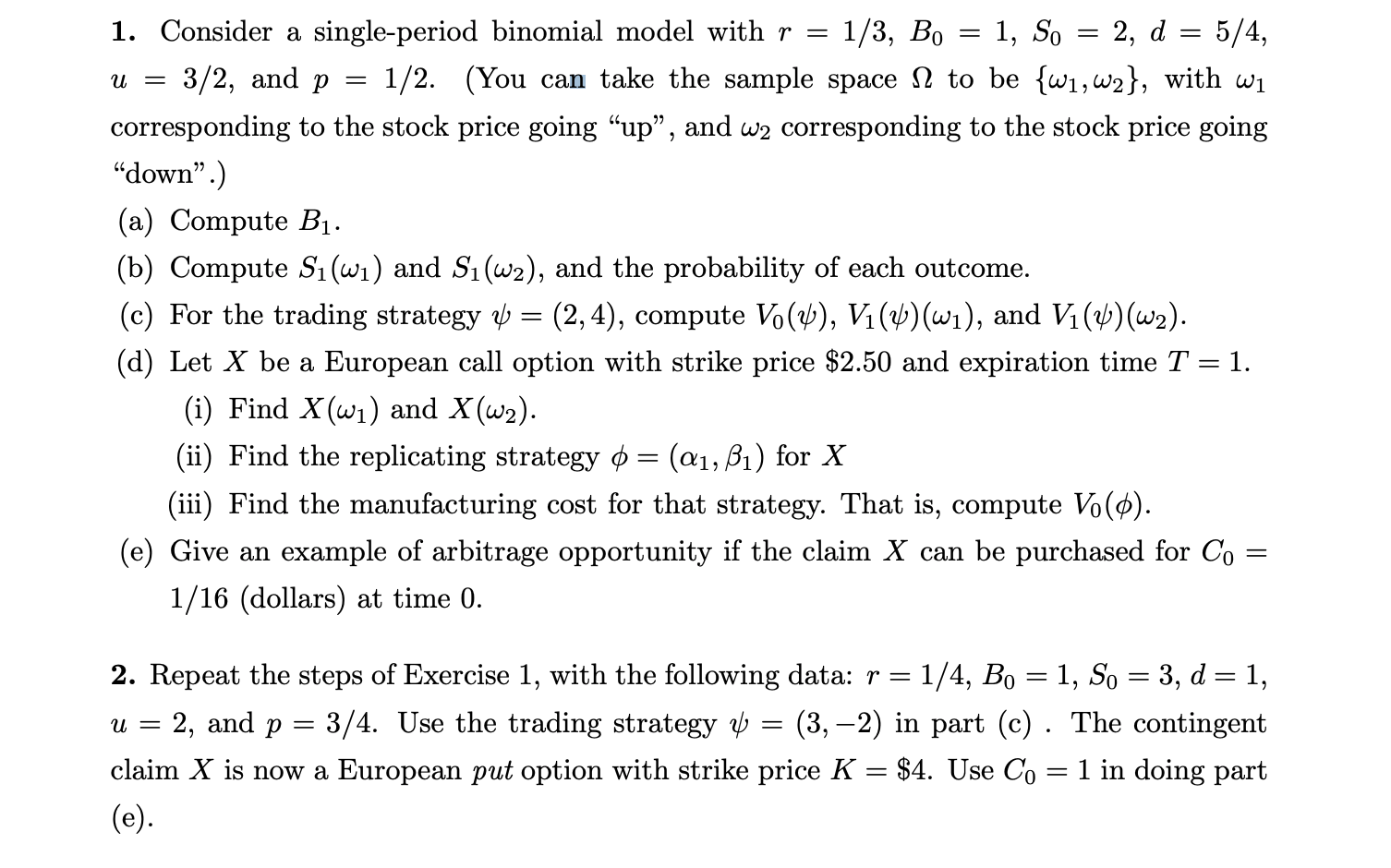

1. Consider a single-period binomial model with r = 1/3, Bo = 1, So = 2, d = 5/4, u = 3/2, and p = 1/2. (You can take the sample space 1 to be {w1,w2}, with wi corresponding to the stock price going up, and w2 corresponding to the stock price going "down.) (a) Compute Bl. (b) Compute S(wi) and S(w2), and the probability of each outcome. (c) For the trading strategy y = (2,4), compute Vo(4), V1(V)(wi), and Vi(V)(wa). (d) Let X be a European call option with strike price $2.50 and expiration time T = 1. (i) Find X(wi) and X(w2). (ii) Find the replicating strategy = (a1, B1) for X (iii) Find the manufacturing cost for that strategy. That is, compute Vo(o). (e) Give an example of arbitrage opportunity if the claim X can be purchased for Co = 1/16 (dollars) at time 0. 2. Repeat the steps of Exercise 1, with the following data: r = 1/4, Bo = 1, So = 3, d=1, u = 2, and p = 3/4. Use the trading strategy 4 = (3,-2) in part (c). The contingent claim X is now a European put option with strike price K = $4. Use Co = 1 in doing part (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts