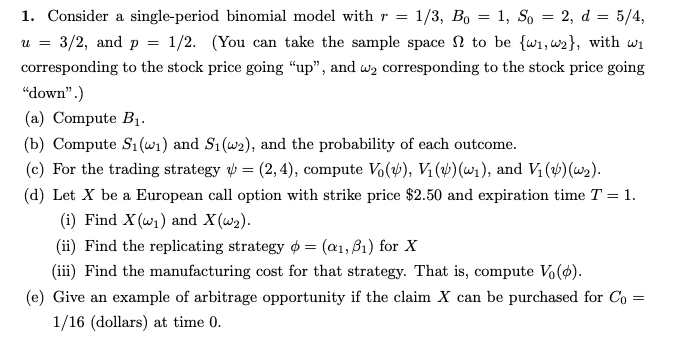

Question: 1. Consider a single-period binomial model with r = 1/3, Bo = 1, So = 2, d = 5/4, u = 3/2, and p =

1. Consider a single-period binomial model with r = 1/3, Bo = 1, So = 2, d = 5/4, u = 3/2, and p = 1/2. (You can take the sample space 12 to be {wi, w2}, with wi corresponding to the stock price going "up", and wcorresponding to the stock price going "down".) (a) Compute B1 (b) Compute Si(wi) and Siwa), and the probability of each outcome. (c) For the trading strategy y = (2,4), compute V.(V), Vi(u)(wi), and Vi(u)(w). (d) Let X be a European call option with strike price $2.50 and expiration time T = 1. (i) Find X(wi) and X(W2). (ii) Find the replicating strategy o = (Q1, 81) for X (iii) Find the manufacturing cost for that strategy. That is, compute Vo(o). (e) Give an example of arbitrage opportunity if the claim X can be purchased for Co = 1/16 (dollars) at time 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts