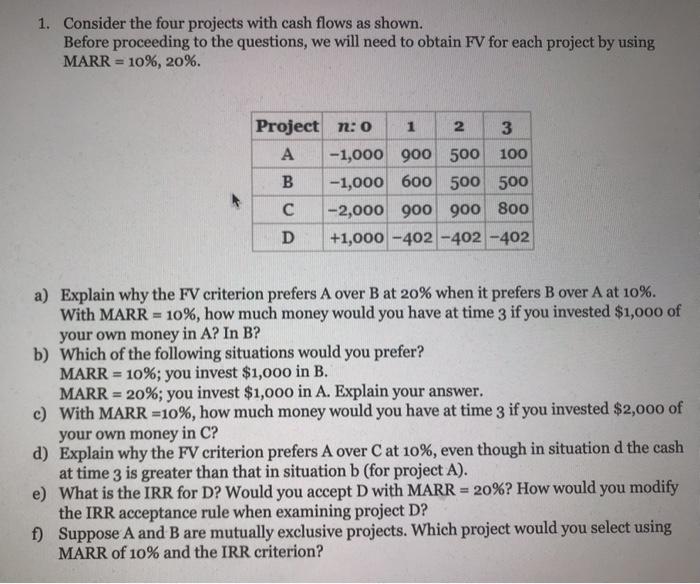

Question: 1. Consider the four projects with cash flows as shown. Before proceeding to the questions, we will need to obtain FV for each project by

1. Consider the four projects with cash flows as shown. Before proceeding to the questions, we will need to obtain FV for each project by using MARR = 10%, 20%. 2 Project n:o 1 2 3 A -1,000 900 500 100 B -1,000 600 500 500 -2,000 900 900 800 D +1,000 -402-402-402 a) Explain why the FV criterion prefers A over B at 20% when it prefers B over A at 10%. With MARR = 10%, how much money would you have at time 3 if you invested $1,000 of your own money in A? In B? b) Which of the following situations would you prefer? MARR = 10%; you invest $1,000 in B. MARR = 20%; you invest $1,000 in A. Explain your answer. c) With MARR =10%, how much money would you have at time 3 if you invested $2,000 of your own money in C? d) Explain why the FV criterion prefers A over C at 10%, even though in situation d the cash at time 3 is greater than that in situation b (for project A). e) What is the IRR for D? Would you accept D with MARR = 20%? How would you modify the IRR acceptance rule when examining project D? f) Suppose A and B are mutually exclusive projects. Which project would you select using MARR of 10% and the IRR criterion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts