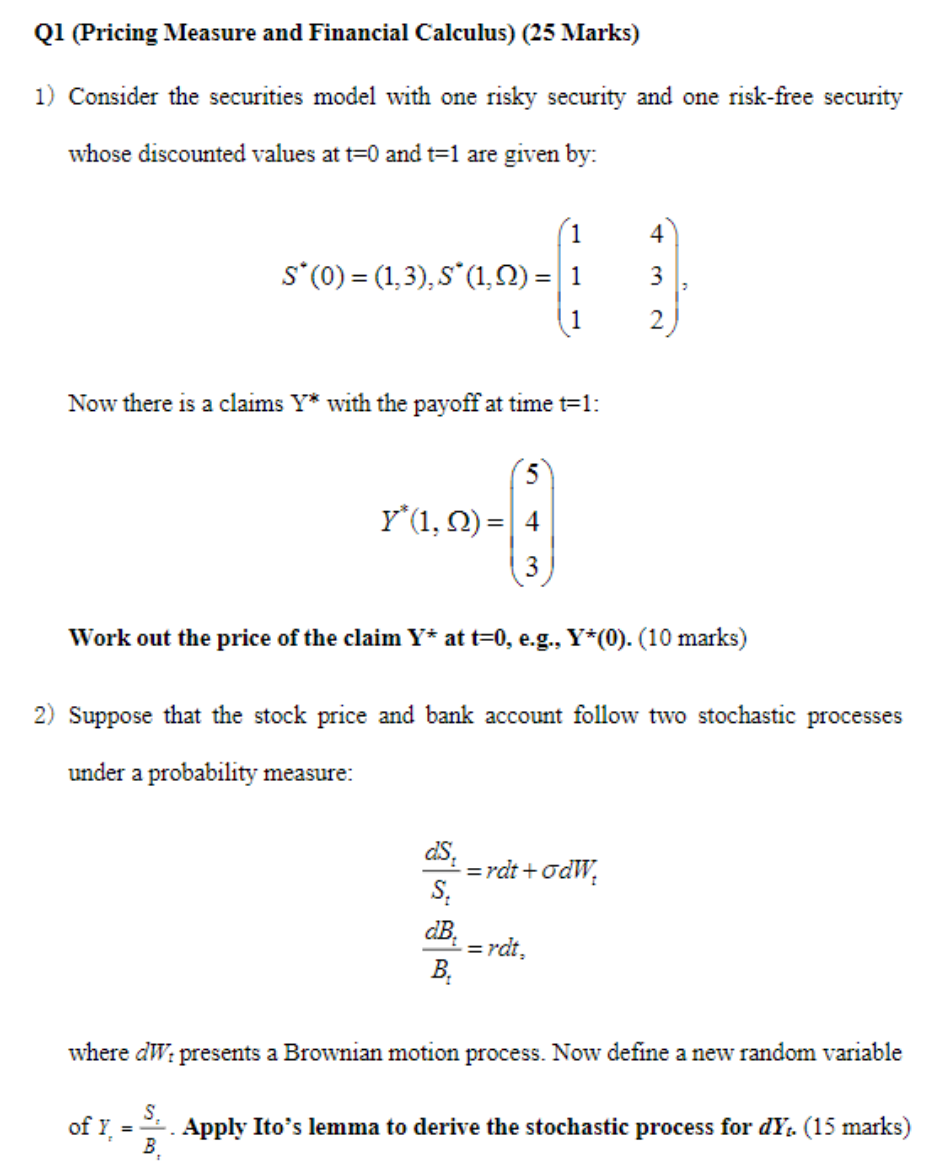

Question: 1) Consider the securities model with one risky security and one risk-free security whose discounted values at t=0 and t=1 are given by: S(0)=(1,3),S(1,)=111432 Now

1) Consider the securities model with one risky security and one risk-free security whose discounted values at t=0 and t=1 are given by: S(0)=(1,3),S(1,)=111432 Now there is a claims Y with the payoff at time t=1 : Y(1,)=543 Work out the price of the claim Y at t=0, e.g., Y(0).(10 marks) 2) Suppose that the stock price and bank account follow two stochastic processes under a probability measure: StdSt=rdt+dWtBtdBt=rdt, where dWt presents a Brownian motion process. Now define a new random variable of Yt=BtSt. Apply Ito's lemma to derive the stochastic process for dYt.(15 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock