Question: 1. Construct the Cashflow Statement for 2021. 2. Calculate any TWO relevant financial ratios for each of the following areas to determine Top Glove's: a.

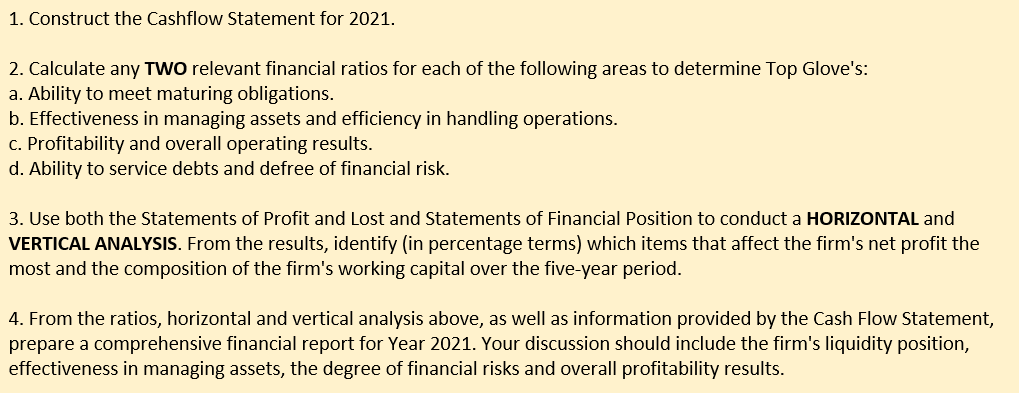

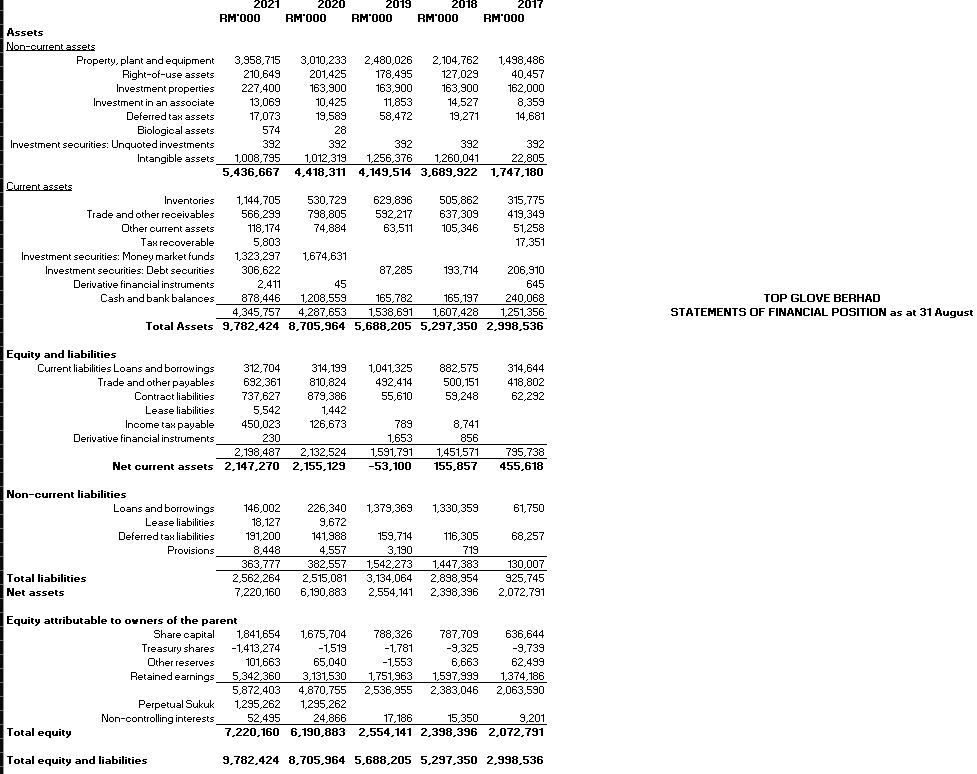

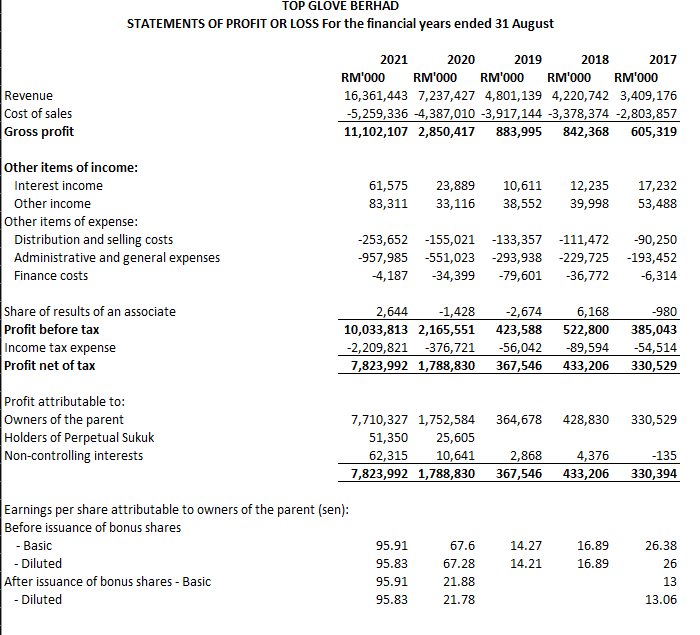

1. Construct the Cashflow Statement for 2021. 2. Calculate any TWO relevant financial ratios for each of the following areas to determine Top Glove's: a. Ability to meet maturing obligations. b. Effectiveness in managing assets and efficiency in handling operations. c. Profitability and overall operating results. d. Ability to service debts and defree of financial risk. 3. Use both the Statements of Profit and Lost and Statements of Financial Position to conduct a HORIZONTAL and VERTICAL ANALYSIS. From the results, identify (in percentage terms) which items that affect the firm's net profit the most and the composition of the firm's working capital over the five-year period. 4. From the ratios, horizontal and vertical analysis above, as well as information provided by the Cash Flow Statement, prepare a comprehensive financial report for Year 2021. Your discussion should include the firm's liquidity position, effectiveness in managing assets, the degree of financial risks and overall profitability results. TOP GLOVE BERHAD STATEMENTS OF FINANCIAL POSITION as at 31 August c 1. Construct the Cashflow Statement for 2021. 2. Calculate any TWO relevant financial ratios for each of the following areas to determine Top Glove's: a. Ability to meet maturing obligations. b. Effectiveness in managing assets and efficiency in handling operations. c. Profitability and overall operating results. d. Ability to service debts and defree of financial risk. 3. Use both the Statements of Profit and Lost and Statements of Financial Position to conduct a HORIZONTAL and VERTICAL ANALYSIS. From the results, identify (in percentage terms) which items that affect the firm's net profit the most and the composition of the firm's working capital over the five-year period. 4. From the ratios, horizontal and vertical analysis above, as well as information provided by the Cash Flow Statement, prepare a comprehensive financial report for Year 2021. Your discussion should include the firm's liquidity position, effectiveness in managing assets, the degree of financial risks and overall profitability results. TOP GLOVE BERHAD STATEMENTS OF FINANCIAL POSITION as at 31 August c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts