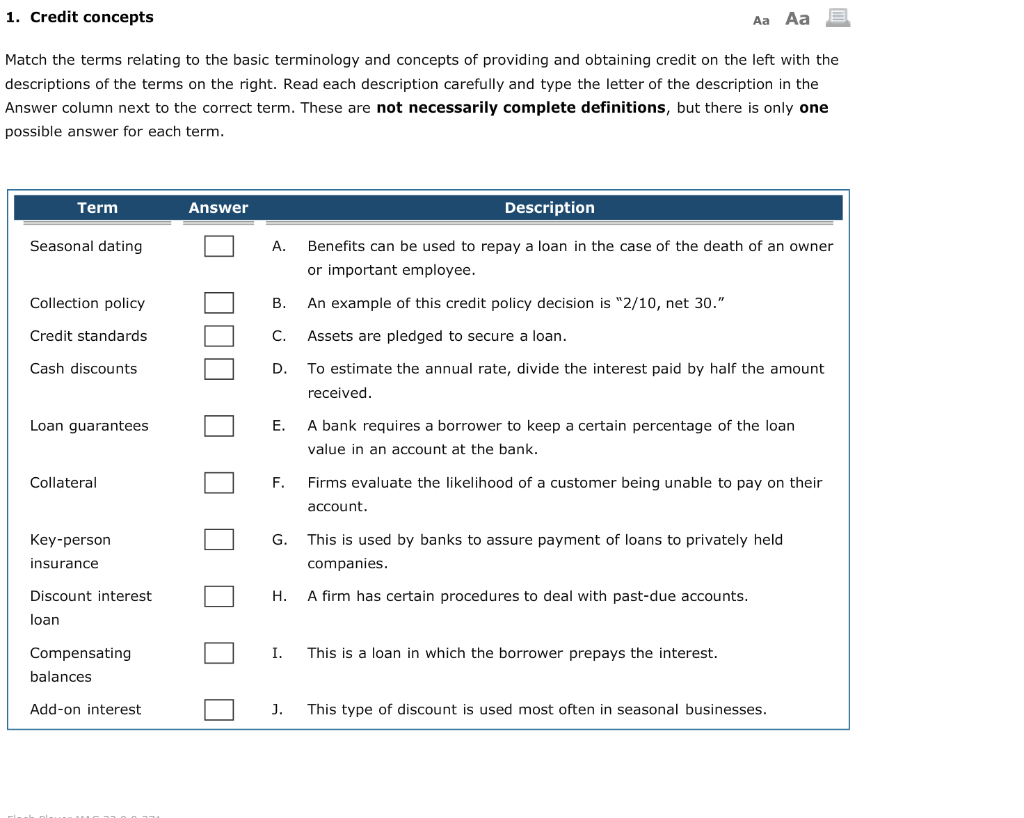

Question: 1. Credit concepts Match the terms relating to the basic terminology and concepts of providing and obtaining credit on the left with the descriptions of

1. Credit concepts Match the terms relating to the basic terminology and concepts of providing and obtaining credit on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. These are not necessarily complete definitions, but there is only one possible answer for each term. Term Answer Description Seasonal dating A. Benefits can be used to repay a loan in the case of the death of an owner or important employee. Collection policy B. Credit standards C An example of this credit policy decision is "2/10, net 30." Assets are pledged to secure a loan. To estimate the annual rate, divide the interest paid by half the amount received. Cash discounts D. Loan guarantees E. A bank requires a borrower to keep a certain percentage of the loan value in an account at the bank. Collateral F. Firms evaluate the likelihood of a customer being unable to pay on their account. G Key-person insurance This is used by banks to assure payment of loans to privately held companies. H A firm has certain procedures to deal with past-due accounts. Discount interest loan I. This is a loan in which the borrower prepays the interest. Compensating balances Add-on interest J. This type of discount is used most often in seasonal businesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts