Question: (1) Did you read the Lang case? Good, so now explain in 2-3 sentences why you disagree with the textbook authors' comment in their Example

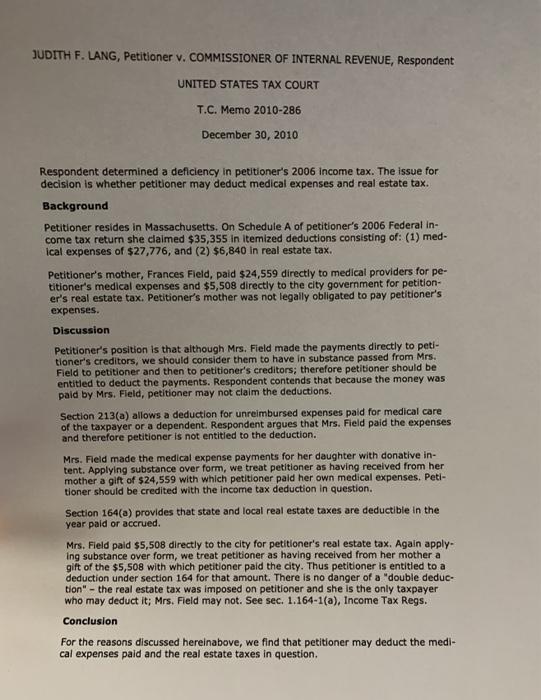

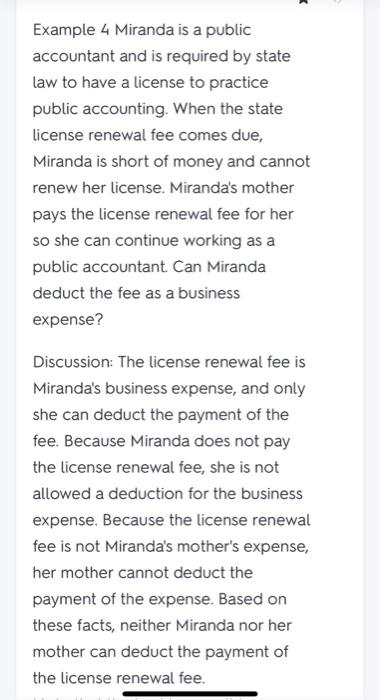

(1) Did you read the Lang case? Good, so now explain in 2-3 sentences why you disagree with the textbook authors' comment in their Example 4 discussion: "Because Miranda does not pay the license renewal fee, she is not allowed a de- duction for the business expense." JUDITH F. LANG, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent UNITED STATES TAX COURT T.C. Memo 2010-286 December 30, 2010 Respondent determined a deficiency in petitioner's 2006 income tax. The issue for decision is whether petitioner may deduct medical expenses and real estate tax. Background Petitioner resides in Massachusetts. On Schedule A of petitioner's 2006 Federal in- come tax return she claimed $35,355 in itemized deductions consisting of: (1) med- ical expenses of $27,776, and (2) $6,840 in real estate tax. Petitioner's mother, Frances Field, paid $24,559 directly to medical providers for pe- titioner's medical expenses and $5,508 directly to the city government for petition- er's real estate tax. Petitioner's mother was not legally obligated to pay petitioner's expenses. Discussion Petitioner's position is that although Mrs. Field made the payments directly to peti- tioner's creditors, we should consider them to have in substance passed from Mrs. Field to petitioner and then to petitioner's creditors; therefore petitioner should be entitled to deduct the payments. Respondent contends that because the money was paid by Mrs. Field, petitioner may not claim the deductions. Section 213(a) allows a deduction for unreimbursed expenses paid for medical care of the taxpayer or a dependent. Respondent argues that Mrs. Field paid the expenses and therefore petitioner is not entitled to the deduction. Mrs. Field made the medical expense payments for her daughter with donative in- tent. Applying substance over form, we treat petitioner as having received from her mother a gift of $24,559 with which petitioner paid her own medical expenses. Peti- tioner should be credited with the income tax deduction in question. Section 164(a) provides that state and local real estate taxes are deductible in the year paid or accrued. Mrs. Field paid $5,508 directly to the city for petitioner's real estate tax. Again apply- ing substance over form, we treat petitioner as having received from her mother a gift of the $5,508 with which petitioner paid the city. Thus petitioner is entitled to a deduction under section 164 for that amount. There is no danger of a "double deduc- tion" - the real estate tax was imposed on petitioner and she is the only taxpayer who may deduct it; Mrs. Field may not. See sec. 1.164-1(a), Income Tax Regs. Conclusion For the reasons discussed hereinabove, we find that petitioner may deduct the medi- cal expenses paid and the real estate taxes in question. Example 4 Miranda is a public accountant and is required by state law to have a license to practice public accounting. When the state license renewal fee comes due, Miranda is short of money and cannot renew her license. Miranda's mother pays the license renewal fee for her so she can continue working as a public accountant Can Miranda deduct the fee as a business expense? Discussion: The license renewal fee is Miranda's business expense, and only she can deduct the payment of the fee. Because Miranda does not pay the license renewal fee, she is not allowed a deduction for the business expense. Because the license renewal fee is not Miranda's mother's expense, her mother cannot deduct the payment of the expense. Based on these facts, neither Miranda nor her mother can deduct the payment of the license renewal fee