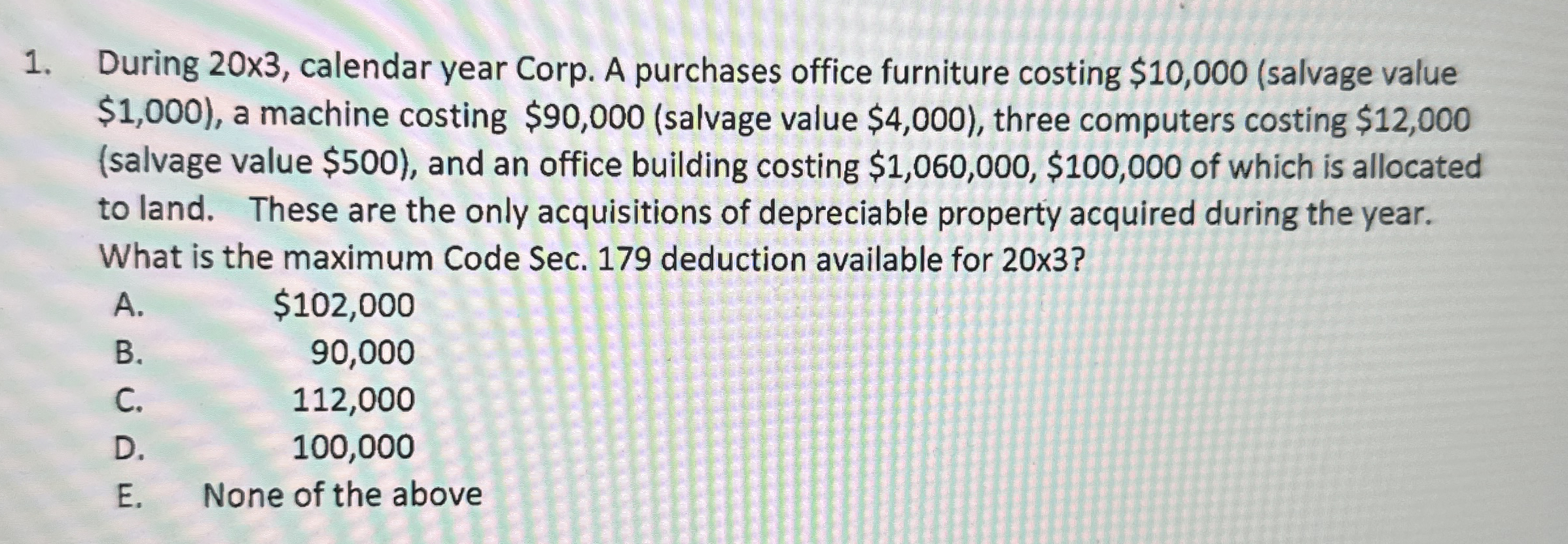

Question: During 2 0 x 3 , calendar year Corp. A purchases office furniture costing $ 1 0 , 0 0 0 ( salvage value $

During x calendar year Corp. A purchases office furniture costing $salvage value $ a machine costing $salvage value $ three computers costing $salvage value $ and an office building costing $$ of which is allocated to land. These are the only acquisitions of depreciable property acquired during the year. What is the maximum Code Sec. deduction available for

A $

B

C

D

E None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock