Question: 1. How is a bond's value determined? What is the value of a 10-year, R1,000 par value bond with a 10% annual coupon if its

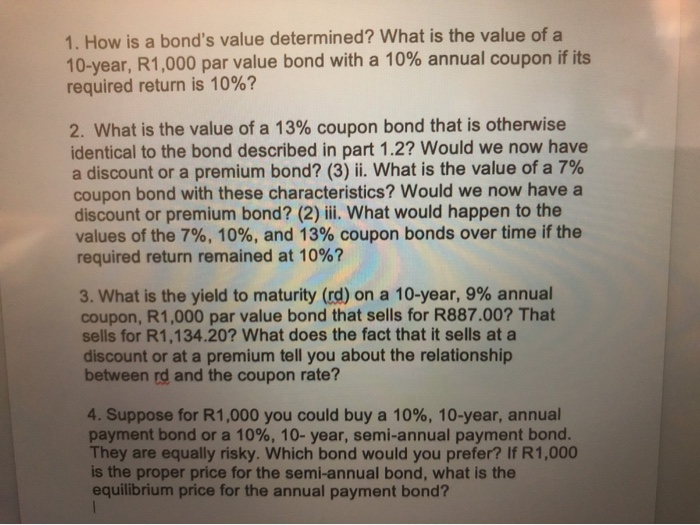

1. How is a bond's value determined? What is the value of a 10-year, R1,000 par value bond with a 10% annual coupon if its required return is 10%? 2. What is the value of a 13% coupon bond that is otherwise identical to the bond described in part 1.2? Would we now have a discount or a premium bond? (3) ii. What is the value of a 7% coupon bond with these characteristics? Would we now have a discount or premium bond? (2) iii. What would happen to the values of the 7%, 10%, and 13% coupon bonds over time if the required return remained at 10%? 3. What is the yield to maturity (rd) on a 10-year, 9% annual coupon, R1,000 par value bond that sells for R887.00? That sells for R1,134.20? What does the fact that it sells at a discount or at a premium tell you about the relationship between rd and the coupon rate? 4. Suppose for R1,000 you could buy a 10%, 10-year, annual payment bond or a 10%, 10-year, semi-annual payment bond. They are equally risky. Which bond would you prefer? If R1,000 is the proper price for the semi-annual bond, what is the equilibrium price for the annual payment bond? 1. How is a bond's value determined? What is the value of a 10-year, R1,000 par value bond with a 10% annual coupon if its required return is 10%? 2. What is the value of a 13% coupon bond that is otherwise identical to the bond described in part 1.2? Would we now have a discount or a premium bond? (3) ii. What is the value of a 7% coupon bond with these characteristics? Would we now have a discount or premium bond? (2) iii. What would happen to the values of the 7%, 10%, and 13% coupon bonds over time if the required return remained at 10%? 3. What is the yield to maturity (rd) on a 10-year, 9% annual coupon, R1,000 par value bond that sells for R887.00? That sells for R1,134.20? What does the fact that it sells at a discount or at a premium tell you about the relationship between rd and the coupon rate? 4. Suppose for R1,000 you could buy a 10%, 10-year, annual payment bond or a 10%, 10-year, semi-annual payment bond. They are equally risky. Which bond would you prefer? If R1,000 is the proper price for the semi-annual bond, what is the equilibrium price for the annual payment bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts