Question: 1. Argo Airlines is looking to buy Aerial Airlines. Your boss, the CFO, wants a quick and dirty valuation of Aerial. You choose to

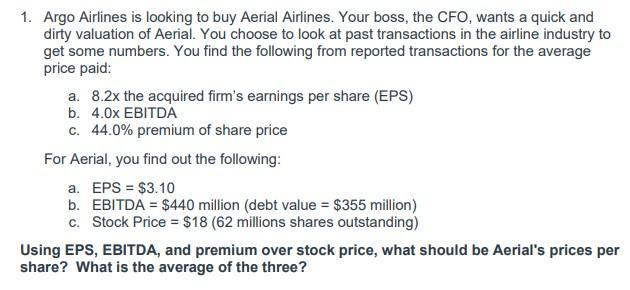

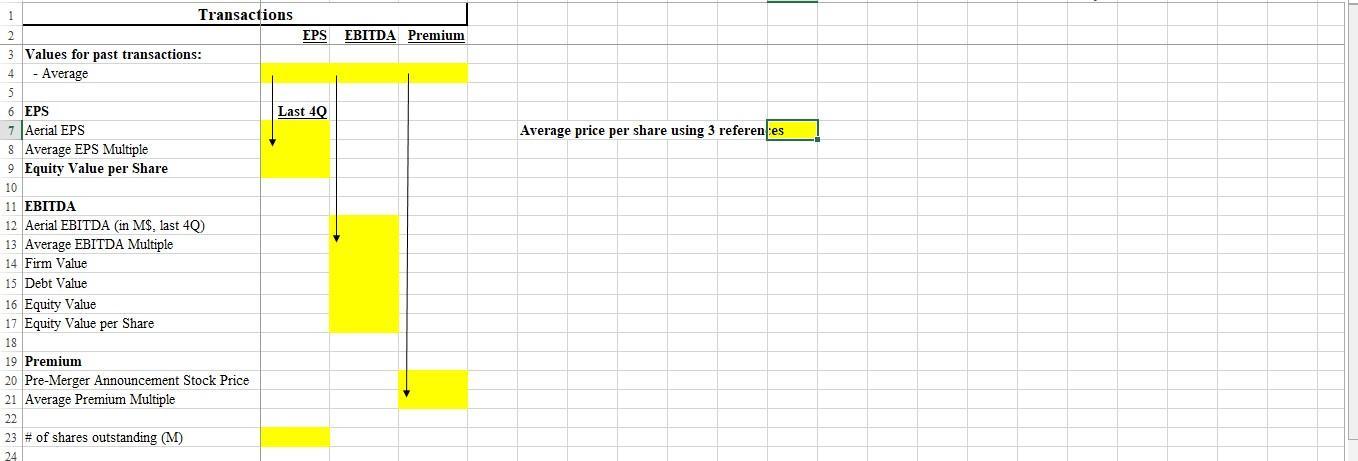

1. Argo Airlines is looking to buy Aerial Airlines. Your boss, the CFO, wants a quick and dirty valuation of Aerial. You choose to look at past transactions in the airline industry to get some numbers. You find the following from reported transactions for the average price paid: a. 8.2x the acquired firm's earnings per share (EPS) b. 4.0x EBITDA c. 44.0% premium of share price For Aerial, you find out the following: a. EPS = $3.10 b. EBITDA = $440 million (debt value = $355 million) c. Stock Price = $18 (62 millions shares outstanding) Using EPS, EBITDA, and premium over stock price, what should be Aerial's prices per share? What is the average of the three? Transactions 3 Values for past transactions: 4 - Average 5 6 EPS 7 Aerial EPS 8 Average EPS Multiple 9 Equity Value per Share 10 11 EBITDA 12 Aerial EBITDA (in M$, last 4Q) 13 Average EBITDA Multiple 14 Firm Value 15 Debt Value 16 Equity Value 17 Equity Value per Share 18 19 Premium 20 Pre-Merger Announcement Stock Price 21 Average Premium Multiple 22 23 # of shares outstanding (M) 24 EPS EBITDA Premium Last 40 Average price per share using 3 references

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts