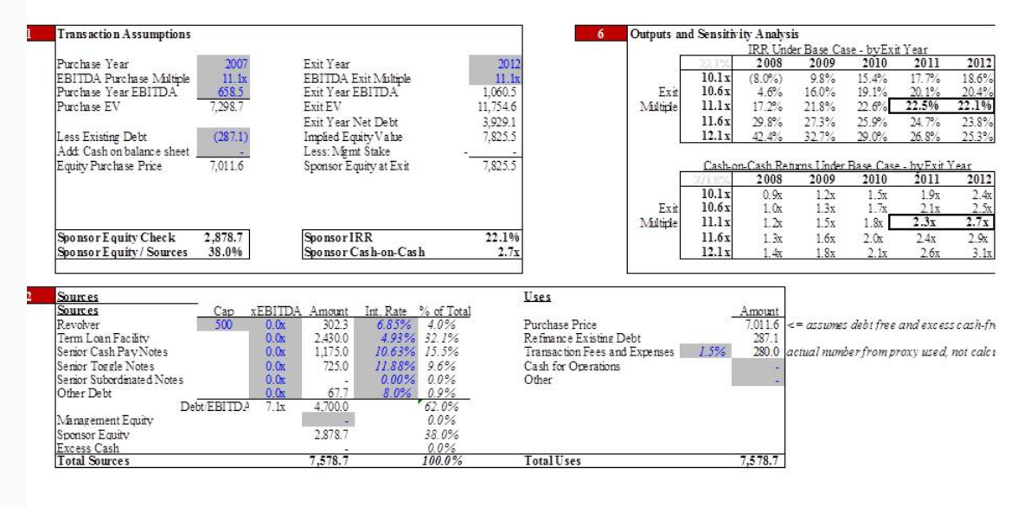

Question: 1. If the exit multiple changes by -0.5x versus the initial assumed exit multiple for an exit at the end of year 5, the MOIC

1. If the exit multiple changes by -0.5x versus the initial assumed exit multiple for an exit at the end of year 5, the MOIC would be: ????? (the correct answer is 2.5, but can you show me how to get the answer. Thank you so much.)

2. If debt market conditions are such that $5.100 billion of debt is raised, the equity contribution would change to ____%. Assume that the price paid for the company does not change. (Correct answer is 32.7%)

Transaction Assumptions Outputs and Sensitiv ity Analsis 2008 2009 2010 2011 2012 10.1 (8.0%) 9.5% 15.4% 17.7% 18.65 Exit Year EBITDA Exit Miltiple Exit Year EBITDA Exit EV Exit Year Net Debt Impied Equty Vabe Less: Mint Stake Sponsor Equiry at Exit hase Year 201 BITDA Purcha se Mltiple11 hase Year EBITDA hase EV 1,060.5 11,7546 3,929.1 7,825.5 Ex10.6 4.6% 16.0% 19.1% Mltiplel 11.1 17.2% 21.8% 22.6% 7,298.7 11.6x1 29.8% 27.3% 25.9% 24.7% 23.89 12.1 Less Existing Debt Add Cash on balance sheet Equity Purchase Price 7,011.6 7,825.5 2008 2009 2010 2011 2012 10.1 Ex 10.6x pe 11.1x 11.6x 0.9s 1.2x 1 1.9x 2.4x 1.0x13x1.7x2 1.2x 15x 1.S 1.3x 6x 2.0 24x 2.9 SponsorEquity Check 2,878.7 38.0% Sponsor IRR 22.1% nso r Equiv. / Sources nsor Cash-on-Cas h Uses 6.85%, 4.93% 10.63% 11.88% 0.00% 7.0116assumes debt free and excess cash-fn 0.0x 0.0x 2430.0 00x 0.0x 0.0x 4.0% 32.1% 15.5% 9.6% 0.0% Purchase Price Refnance Exsting Debt Transac ton rees and Expenses EE3%1 Cash for Operations Other 302.3 evotver Term Loan Faciity Senior Cash PayNotes Serior Toggle Notes Senior Subordinate dNotes 287.1 290.0 |actualnumderfromproxy used not calc| 1,175.0 725.0 r Debt Debt EBITDA .1x4.700.0 62.0% 0.0% 38.0% anagement Equity Sponsor Equity 2.878.7 urces otal Uses Transaction Assumptions Outputs and Sensitiv ity Analsis 2008 2009 2010 2011 2012 10.1 (8.0%) 9.5% 15.4% 17.7% 18.65 Exit Year EBITDA Exit Miltiple Exit Year EBITDA Exit EV Exit Year Net Debt Impied Equty Vabe Less: Mint Stake Sponsor Equiry at Exit hase Year 201 BITDA Purcha se Mltiple11 hase Year EBITDA hase EV 1,060.5 11,7546 3,929.1 7,825.5 Ex10.6 4.6% 16.0% 19.1% Mltiplel 11.1 17.2% 21.8% 22.6% 7,298.7 11.6x1 29.8% 27.3% 25.9% 24.7% 23.89 12.1 Less Existing Debt Add Cash on balance sheet Equity Purchase Price 7,011.6 7,825.5 2008 2009 2010 2011 2012 10.1 Ex 10.6x pe 11.1x 11.6x 0.9s 1.2x 1 1.9x 2.4x 1.0x13x1.7x2 1.2x 15x 1.S 1.3x 6x 2.0 24x 2.9 SponsorEquity Check 2,878.7 38.0% Sponsor IRR 22.1% nso r Equiv. / Sources nsor Cash-on-Cas h Uses 6.85%, 4.93% 10.63% 11.88% 0.00% 7.0116assumes debt free and excess cash-fn 0.0x 0.0x 2430.0 00x 0.0x 0.0x 4.0% 32.1% 15.5% 9.6% 0.0% Purchase Price Refnance Exsting Debt Transac ton rees and Expenses EE3%1 Cash for Operations Other 302.3 evotver Term Loan Faciity Senior Cash PayNotes Serior Toggle Notes Senior Subordinate dNotes 287.1 290.0 |actualnumderfromproxy used not calc| 1,175.0 725.0 r Debt Debt EBITDA .1x4.700.0 62.0% 0.0% 38.0% anagement Equity Sponsor Equity 2.878.7 urces otal Uses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts