Question: 1. In facing competition, Apple Inc. is debating whether to enter the smart eye glass business by launch a new product called AppleGlass or

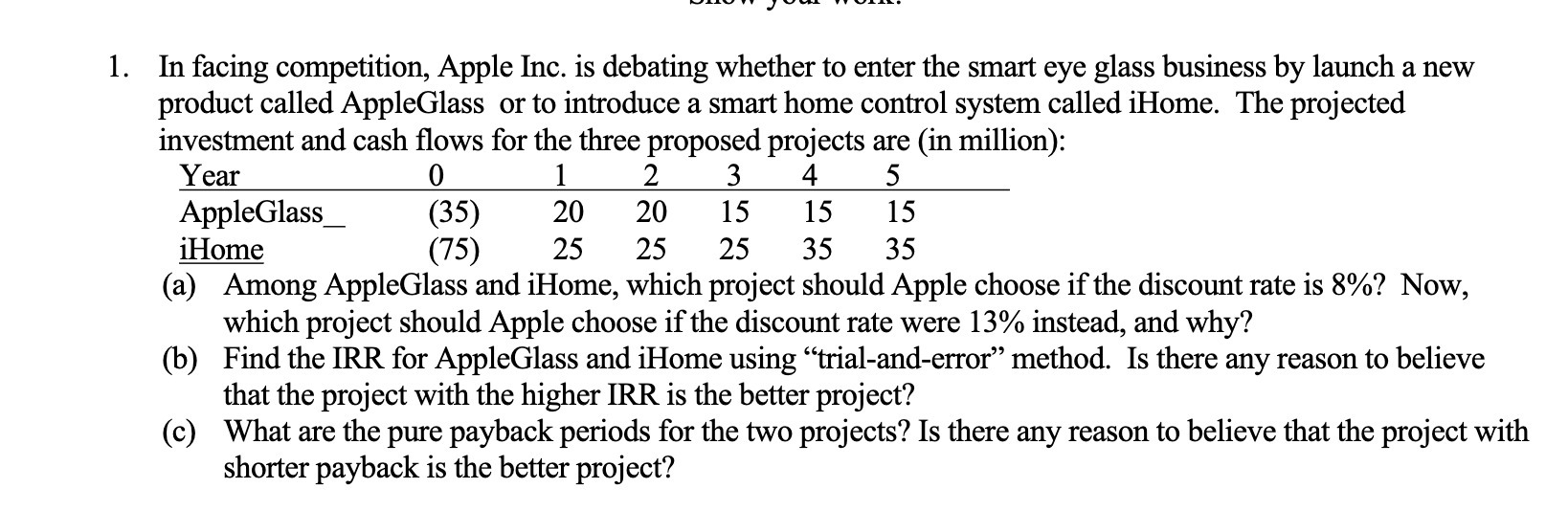

1. In facing competition, Apple Inc. is debating whether to enter the smart eye glass business by launch a new product called AppleGlass or to introduce a smart home control system called iHome. The projected investment and cash flows for the three proposed projects are (in million): Year AppleGlass iHome 0 1 2 3 4 5 (35) 20 20 15 15 15 (75) 25 25 25 35 35 (a) Among AppleGlass and iHome, which project should Apple choose if the discount rate is 8%? Now, which project should Apple choose if the discount rate were 13% instead, and why? (b) Find the IRR for AppleGlass and iHome using "trial-and-error" method. Is there any reason to believe that the project with the higher IRR is the better project? (c) What are the pure payback periods for the two projects? Is there any reason to believe that the project with shorter payback is the better project?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts