Question: 1. Integrative Case Problem 2: Manufacturing Expansion Decision. ABC Corp is a manufacturing company that is considering expanding its production capacity by investing in

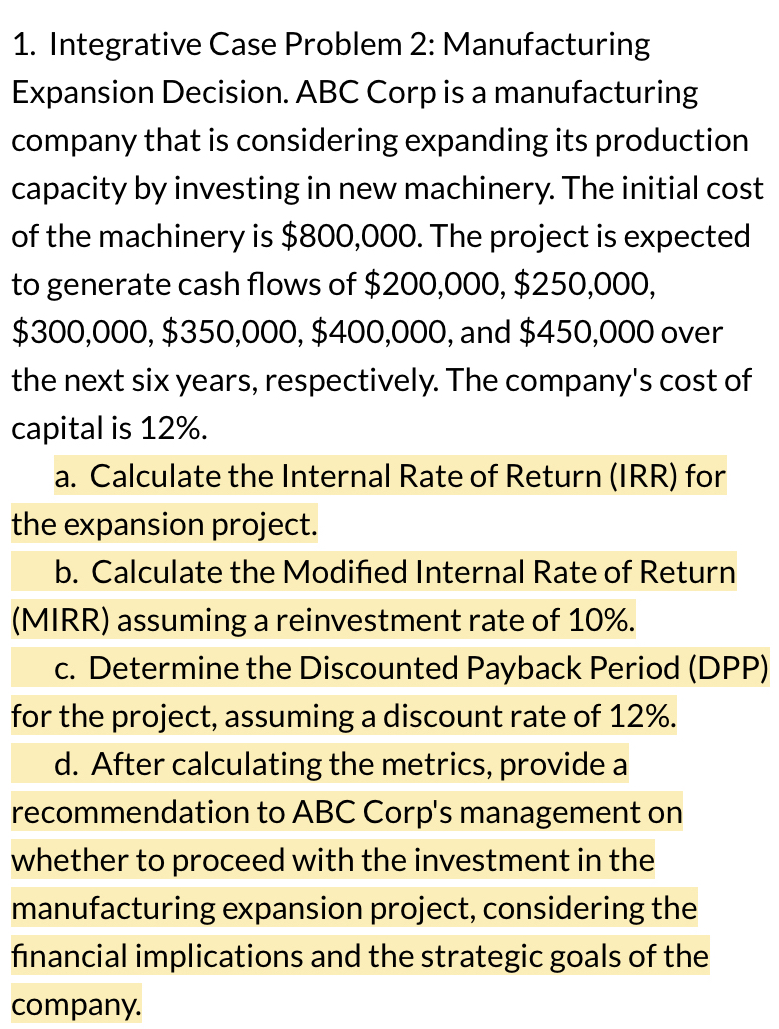

1. Integrative Case Problem 2: Manufacturing Expansion Decision. ABC Corp is a manufacturing company that is considering expanding its production capacity by investing in new machinery. The initial cost of the machinery is $800,000. The project is expected to generate cash flows of $200,000, $250,000, $300,000, $350,000, $400,000, and $450,000 over the next six years, respectively. The company's cost of capital is 12%. a. Calculate the Internal Rate of Return (IRR) for the expansion project. b. Calculate the Modified Internal Rate of Return (MIRR) assuming a reinvestment rate of 10%. c. Determine the Discounted Payback Period (DPP) for the project, assuming a discount rate of 12%. d. After calculating the metrics, provide a recommendation to ABC Corp's management on whether to proceed with the investment in the manufacturing expansion project, considering the financial implications and the strategic goals of the company.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts