Question: 1. List 4 stock valuation models for estimating the proper price for a company's stock. 2. Using the P/E method, calculate the expected stock price

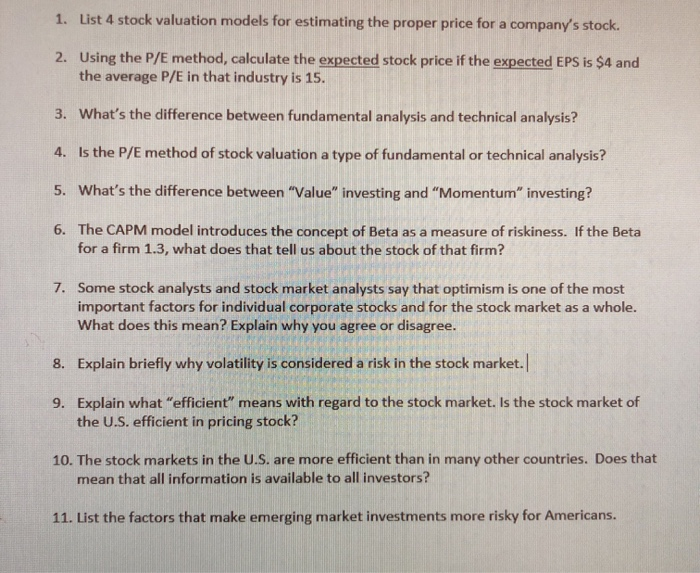

1. List 4 stock valuation models for estimating the proper price for a company's stock. 2. Using the P/E method, calculate the expected stock price if the expected EPS is $4 and the average P/E in that industry is 15. 3. What's the difference between fundamental analysis and technical analysis? 4. Is the P/E method of stock valuation a type of fundamental or technical analysis? 5. What's the difference between "Value" investing and "Momentum" investing? 6. The CAPM model introduces the concept of Beta as a measure of riskiness. If the Beta for a firm 1.3, what does that tell us about the stock of that firm? 7. Some stock analysts and stock market analysts say that optimism is one of the most important factors for individual corporate stocks and for the stock market as a whole. What does this mean? Explain why you agree or disagree. 8. Explain briefly why volatility is considered a risk in the stock market. 9. Explain what "efficient" means with regard to the stock market. Is the stock market of the U.S. efficient in pricing stock? 10. The stock markets in the U.S. are more efficient than in many other countries. Does that mean that all information is available to all investors? 11. List the factors that make emerging market investments more risky for Americans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts