Question: 1. Molson Hull and Intel both need a 3-year loan of $300 million, with MolsonHull preferring a floating rate and ADM a fixed rate. Some

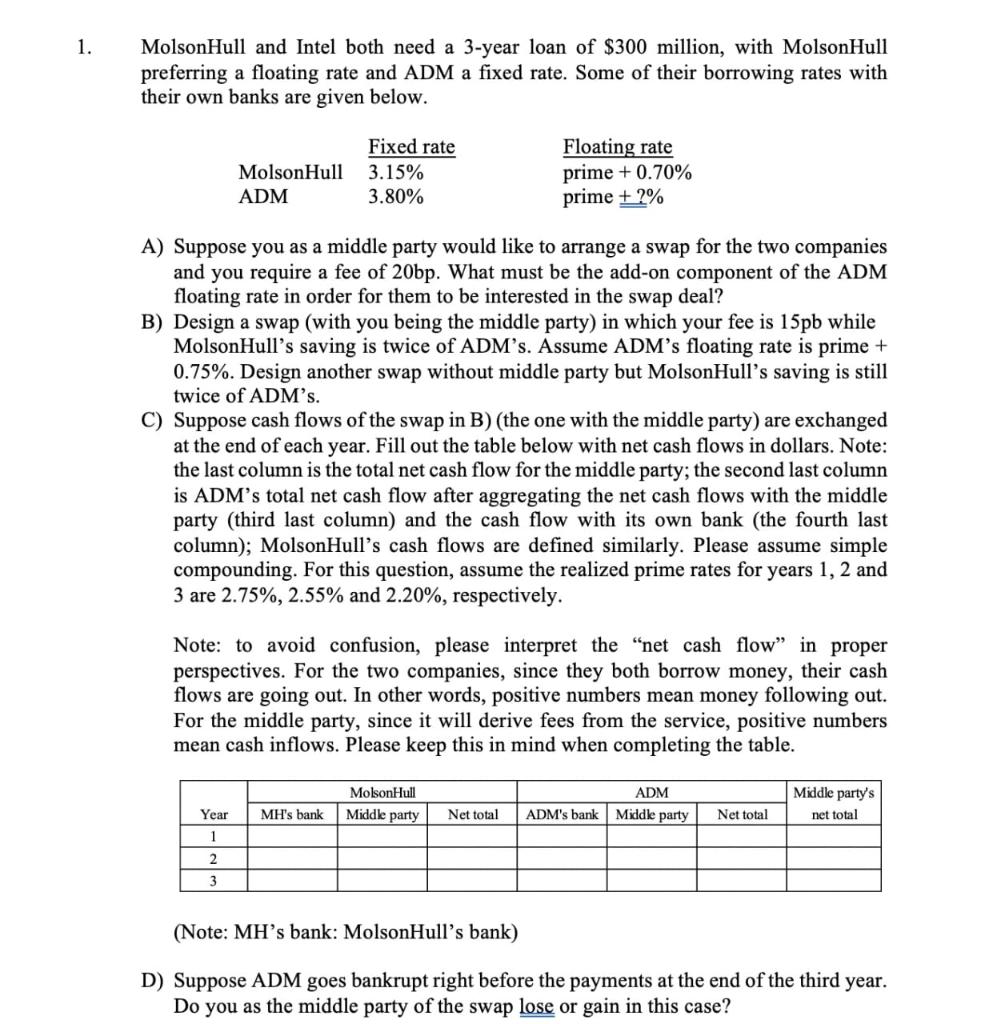

1. Molson Hull and Intel both need a 3-year loan of $300 million, with MolsonHull preferring a floating rate and ADM a fixed rate. Some of their borrowing rates with their own banks are given below. MolsonHull ADM Fixed rate 3.15% 3.80% Floating rate prime + 0.70% prime + ?% A) Suppose you as a middle party would like to arrange a swap for the two companies and you require a fee of 20bp. What must be the add-on component of the ADM floating rate in order for them to be interested in the swap deal? B) Design a swap (with you being the middle party) in which your fee is 15pb while MolsonHull's saving is twice of ADM's. Assume ADM's floating rate is prime + 0.75%. Design another swap without middle party but Molson Hull's saving is still twice of ADM's. C) Suppose cash flows of the swap in B) (the one with the middle party) are exchanged at the end of each year. Fill out the table below with net cash flows in dollars. Note: the last column is the total net cash flow for the middle party; the second last column is ADM's total net cash flow after aggregating the net cash flows with the middle party (third last column) and the cash flow with its own bank (the fourth last column); Molson Hull's cash flows are defined similarly. Please assume simple compounding. For this question, assume the realized prime rates for years 1, 2 and 3 are 2.75%, 2.55% and 2.20%, respectively. Note: to avoid confusion, please interpret the "net cash flow in proper perspectives. For the two companies, since they both borrow money, their cash flows are going out. In other words, positive numbers mean money following out. For the middle party, since it will derive fees from the service, positive numbers mean cash inflows. Please keep this in mind when completing the table. MolsonHull ADM ADM's bank Middle party Middle party's net total MH's bank Middle party Net total Net total Year 1 2 3 (Note: MH's bank: MolsonHull's bank) D) Suppose ADM goes bankrupt right before the payments at the end of the third year. Do you as the middle party of the swap lose or gain in this case? 1. Molson Hull and Intel both need a 3-year loan of $300 million, with MolsonHull preferring a floating rate and ADM a fixed rate. Some of their borrowing rates with their own banks are given below. MolsonHull ADM Fixed rate 3.15% 3.80% Floating rate prime + 0.70% prime + ?% A) Suppose you as a middle party would like to arrange a swap for the two companies and you require a fee of 20bp. What must be the add-on component of the ADM floating rate in order for them to be interested in the swap deal? B) Design a swap (with you being the middle party) in which your fee is 15pb while MolsonHull's saving is twice of ADM's. Assume ADM's floating rate is prime + 0.75%. Design another swap without middle party but Molson Hull's saving is still twice of ADM's. C) Suppose cash flows of the swap in B) (the one with the middle party) are exchanged at the end of each year. Fill out the table below with net cash flows in dollars. Note: the last column is the total net cash flow for the middle party; the second last column is ADM's total net cash flow after aggregating the net cash flows with the middle party (third last column) and the cash flow with its own bank (the fourth last column); Molson Hull's cash flows are defined similarly. Please assume simple compounding. For this question, assume the realized prime rates for years 1, 2 and 3 are 2.75%, 2.55% and 2.20%, respectively. Note: to avoid confusion, please interpret the "net cash flow in proper perspectives. For the two companies, since they both borrow money, their cash flows are going out. In other words, positive numbers mean money following out. For the middle party, since it will derive fees from the service, positive numbers mean cash inflows. Please keep this in mind when completing the table. MolsonHull ADM ADM's bank Middle party Middle party's net total MH's bank Middle party Net total Net total Year 1 2 3 (Note: MH's bank: MolsonHull's bank) D) Suppose ADM goes bankrupt right before the payments at the end of the third year. Do you as the middle party of the swap lose or gain in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts