Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Need to have at least 3 out of 5 attributes better than the benchmark (row 26, Cells D-I), duration can be longer if

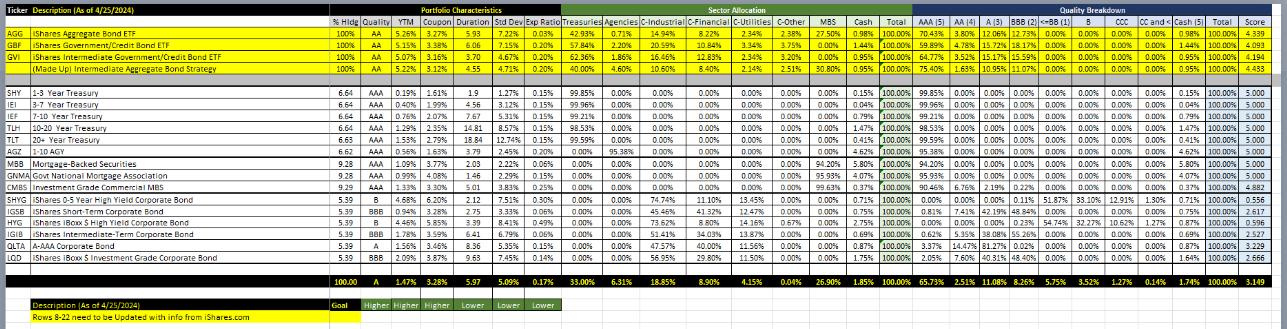

1. Need to have at least 3 out of 5 attributes better than the benchmark (row 26, Cells D-I), duration can be longer if you feel that the yields will drop 2. A minimum of 12 ETFS need to be used to build your portfolio, maximum allocation to AAA securities should be 10% and corporate ETFs be 7%, minimum allocation 2% across all ETFS 3. State the fees you plan to charge your client, your YTM need to exceed the benchmark's by at least that much 4. Your portfolio should be within two credit quality gradations versus the benchmark 5. State the environments when your portfolio will out and underperform the benchmark 6. Your outlook on the bond market (based on your benchmark) in the near term through the end of 2024 a paragraph, state various reasons: Fed expectations, Economy, Geopolitical factors, Investor behavior, Consumer sentiment, Supply chain disruptions, etc. Ticker Description (As of 4/25/2024) AGG Shares Aggregate Bond ETF GBF iShares Government/Credit Band ETF GVI iShares Intermediate Government/Credit Bond ETF (Made Up) Intermediate Aggregate Bond Strategy SHY 1-3 Year Treasury Portfolio Characteristics 100% AA 100% AA 100% AA AA 5.26% 3.27% 5.15% 3.38% 5.07% 3.16% 5.22 % 3.12% 0.20% 57.84% 2.20% Sector Allocation % Hide Quality YTM Coupon Duration Std Dev Exp Ratio Treasuries Agencies C-Industrial C-Financial C-Utilities C-Other MBS 5.93 7,22 % 0.03% 42.93% 0.71% 6.06 7.15% 3.70 4.67% 0.20% 62.36% 1.86% 4.55 4.71% 40.00% Quality Breakdown 14.94% 8.22% 20.59% 10.84% 2.34% 3.34% 16.46% 4.60% 10.60% 8.40% 2.14% 2.34% 3.20% 0.00% 30.80% AAA (5) AA [4] 2.38% 27.50% 0.98% 100.00% 70.43% 3.80% 3.75% 0.00% 1.44% 100.00% 59.89% 4.78% 0.95% 100.00% 64.77% 3.52 % 0.95% 100.00% 75.40% 1.63% Cash Total A (3) 888 (2)-88 (1) 12.06% 12.73% 0.00% 15.72 % 18.17 % 0.00 % 15.17 % 15.59 % 0.00 % 10.95% 11.07% 0.00% 0.00% COC CC and Cash (5) Total Score 0.00% 0.00% 0.98% 100.00% 4.339 0.00% 1.44% 100.00% 4.093 0.00% 0.00% 0.00% 0.95% 100.00% 4.194 0.00% 0.00% 0.00% 0.95% 100.00% 4.433 6.64 AAA 0.19 % TLH 3-7 Year Treasury IEF 7-10 Year Treasury 10-20 Year Treasury TLT 20+ Year Treasury AGZ 6.64 1.61% 0.40% 1.99% 1.9 6.64 AAA 0.76% 2.07% 1.27% 0.15% 4.56 3.12% 0.15% 99.96% 0.00% 5.31% 0.15% 99.21% 99.85% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 6.64 AAA 6.63 HYG 1-10 AGY MBB Mortgage-Backed Securities GNMA Govt National Mortgage Association CMBS Investment Grade Commercial MBS SHYG Shares 0-5 Year High Yield Corporate Bond IGSB Shares Short Term Corporate Bond Shares iBoxx $ High Yield Corporate Bond IGIB iShares Intermediate-Term Corporate Bond QLTA A-AAA Corporate Bond 6.62 9.28 9.28 9.29 5.39 5.39 LQD iShares iBoxx $ Investment Grade Corporate Bond 888 5.39 B 5.39 BBB 5.39 A 5.39 BBB 2.35% AAA 1.53% 2.79% AAA 0.56% 1.63% AAA 1.09% 3.77% AAA 0.99% 4.08% AAA 1.33% 3.30% 4.68% 6.20% 0.94% 3.28% 4.45% 5.85% 14.81 18.84 3.79 0.15% 98.53% 12.74% 0.15% 2.45% 0.20% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 95.38% 0.00% 0.00% 2.03 2.22% 0.06% 146 2.29% 0.15% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 94.20% 5.80% 0.15% 100.00% 99.85% 0.00% 0.00% 0.00% 0.04% 100.00% 99.96% 0.00% 0.00% 0.00% 0.79% 100.00% 99.21% 0.00% 0.00% 0.00% 1.47% 100.00% 98.53% 0.00% 0.00% 0.00% 0.41% 100.00% 99.59% 0.00% 0.00% 0.00% 4.62% 100,00% 95.38% 100.00%|| 94.20% 0.00% 0.00% 0.00% 0.00% 0.15% 100.00% 5.000 0.00% 0.00% 0.00% 0.00% 0.04% 100.00% 5.000 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.79% 100.00% 5.000 1.47% 100.00% 5.000 0.41% 100.00% 5.000 4.62% 100.00% 5.000 0.00% 5.80% 100.00% 5.000 0.00% 0.00% 0.00% 0.00% 5.01 1.78% 3.59% 1.56% 3.46% 2.09% 3.87% 3.83% 0.25% 7.51% 0.30% 2.75 3.33% 0.06% 3.39 8.41% 0.49% 6.41 6.79% 0.06% 8.36 5.35% 0.15% 9.63 7.45% 0.14% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 74.74% 45.45% 0.00% 0.00% 73.62% 0.00% 0.00% 51.41% 0.00% 0.00% 47.57% 0.00% 0.00% 56.95% 40.00% 29.80% 0.00% 11.10% 13.45% 0.00% 41.32% 12.47% 0.00% 8.80% 14.16% 067% 34.03% 13.87% 0.00% 11.56% 0.00% 11.50% 0.00% 0.00% 0.00% 95.93% 4.07 % 99.63% 0.37% 100.00% 90.46% 0.71% 100.00% 0,75% 100,00% 0.81% 0.00% 2.75% 100.00% 0.00% 0.00% 0.69% 100.00% 0.62% 0.00% 0.87% 100.00% 3.37% 0.00% 1.75% 100.00% 2.05% 100.00% 95.93% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 4.07% 100.00% 5.000 6.76% 2.19% 0.22% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.11% 51.87 % 33.10% 12.91 % 1.30% 7.41 % 42.19 % 48.84% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.23% 54.74% 32.27% 10.62% 1.27% 5.35% 38.08% 55.26% 0.00% 0.00% 0.00% 0.00% 14.47 % 81.27% 0.02 % 0.00% 0.00% 0.00% 0.00% 7.60% 40.31% 48.40% 0.00% 0.00% 0.00% 0.00% 0.37% 100.00% 4.882 0.71% 100.00% 0.556 0.75% 100.00% 2.617 0.87% 100.00% 0.596 0.69% 100.00% 2.527 0.87% 100.00% 3.229 1.64% 100.00% 2.666 100.00 A 1.47% 3.28% 5.97 5.09% 0.17% 33.00% 6.31 % 18.85% 8.90% 4.15% 0.04% 26.90% 1.85% 100.00% 65.73% 2.51% 11.08% 8.25% 5.75% 3.52% 1.27% 0.14% 1.74% 100.00% 3.149 Description (As of 4/25/2024) Rows 8-22 need to be Updated with info from iShares.com Goal Higher Higher Higher Lower Lower Lower

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started