Question: 1. Now run a so called Fama-MacBeth regression (2nd step), that is: each month regress excess returns on MarketCap only, then compute the average coefficient

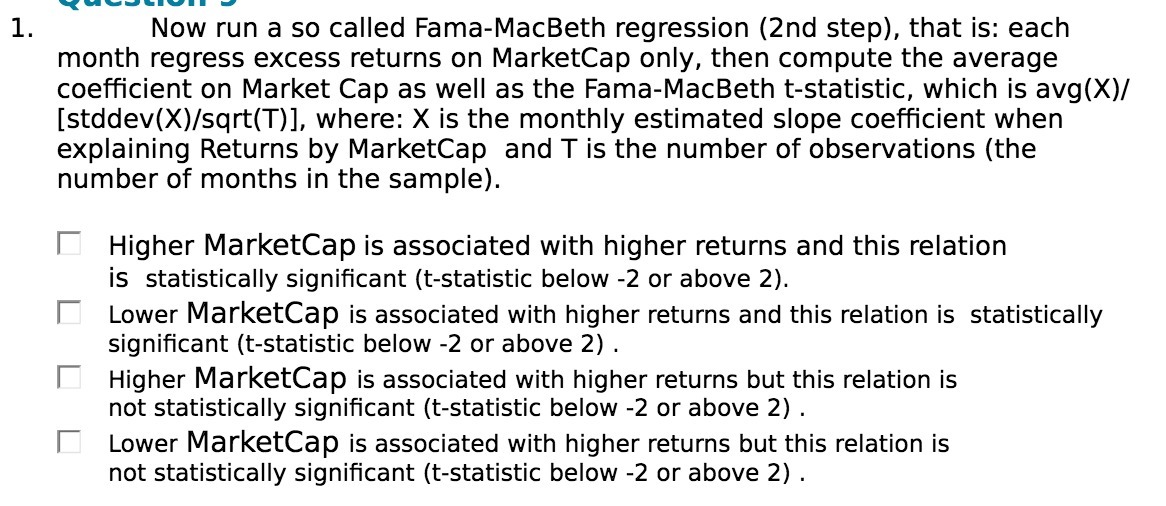

1. Now run a so called Fama-MacBeth regression (2nd step), that is: each month regress excess returns on MarketCap only, then compute the average coefficient on Market Cap as well as the Fama-MacBeth t-statistic, which is avg(X)/ [stddev(X)/sqrt(T)], where: X is the monthly estimated slope coefficient when explaining Returns by MarketCap and T is the number of observations (the number of months in the sample). Higher MarketCap is associated with higher returns and this relation is statistically significant (t-statistic below -2 or above 2). Lower MarketCap is associated with higher returns and this relation is statistically significant (t-statistic below -2 or above 2) . Higher MarketCap is associated with higher returns but this relation is not statistically significant (t-statistic below -2 or above 2) . Lower MarketCap is associated with higher returns but this relation is not statistically significant (t-statistic below -2 or above 2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts