Question: (1 point) Suppose S = $ 39, r = 5 %, 9 (the annualized dividend yield) is 11 %, o (the annualized stock volatility) is

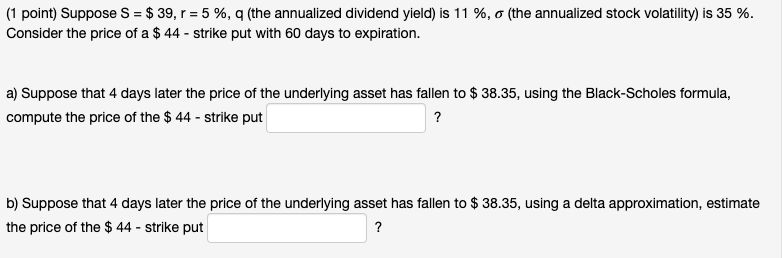

(1 point) Suppose S = $ 39, r = 5 %, 9 (the annualized dividend yield) is 11 %, o (the annualized stock volatility) is 35 %. Consider the price of a $ 44 - strike put with 60 days to expiration. a) Suppose that 4 days later the price of the underlying asset has fallen to $38.35, using the Black-Scholes formula, compute the price of the $ 44 - strike put b) Suppose that 4 days later the price of the underlying asset has fallen to $ 38.35, using a delta approximation, estimate the price of the $ 44 - strike put (1 point) Suppose S = $ 39, r = 5 %, 9 (the annualized dividend yield) is 11 %, o (the annualized stock volatility) is 35 %. Consider the price of a $ 44 - strike put with 60 days to expiration. a) Suppose that 4 days later the price of the underlying asset has fallen to $38.35, using the Black-Scholes formula, compute the price of the $ 44 - strike put b) Suppose that 4 days later the price of the underlying asset has fallen to $ 38.35, using a delta approximation, estimate the price of the $ 44 - strike put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts