Question: 1 points Save Answer QUESTION 16 Which one of the following i the price at which a dealer will buy a bond? A. Asked Price

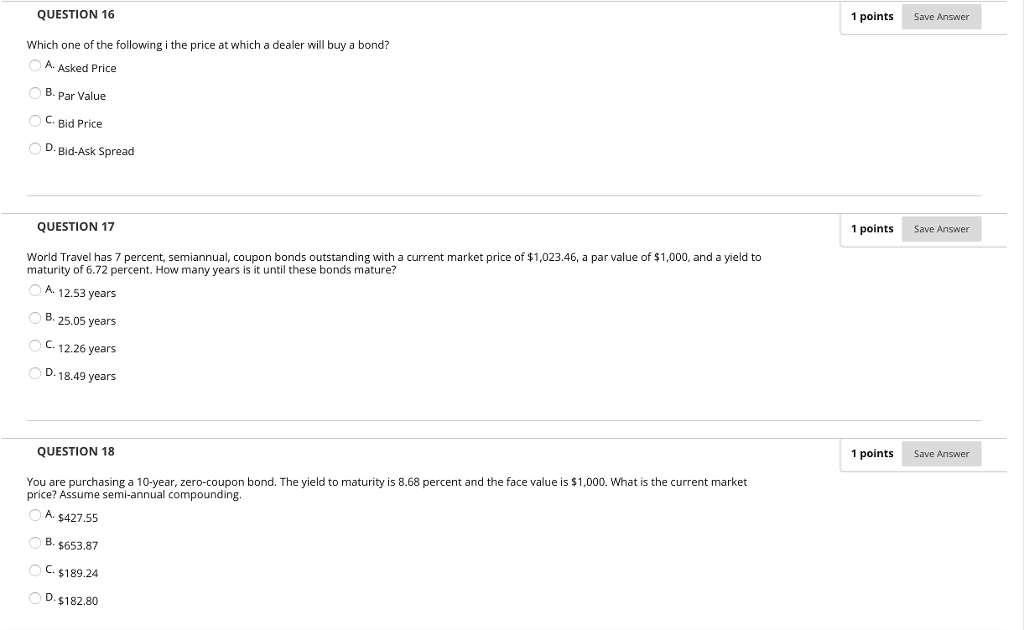

1 points Save Answer QUESTION 16 Which one of the following i the price at which a dealer will buy a bond? A. Asked Price B. Par Value CBid Price D. Bid-Ask Spread 1 points Save Answer QUESTION 17 World Travel has 7 percent, semiannual, coupon bonds outstanding with a current market price of $1,023.46, a par value of $1,000, and a yield to maturity of 6.72 percent. How many years is it until these bonds mature? A. 12.53 years B. 25.05 years 12.26 years D. 18.49 years 1 points Save Answer QUESTION 18 You are purchasing a 10-year, zero-coupon bond. The yield to maturity is 8.68 percent and the face value is $1,000. What is the current market price? Assume semi-annual compounding A. $427.55 B. $653.87 C. $189.24 D. $182.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts