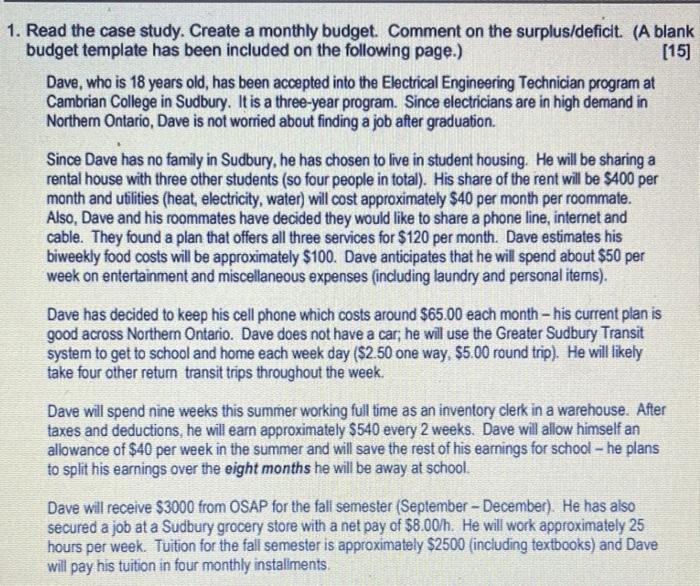

Question: 1. Read the case study. Create a monthly budget. Comment on the surplus/deficit. (A blank budget template has been included on the following page.) [15]

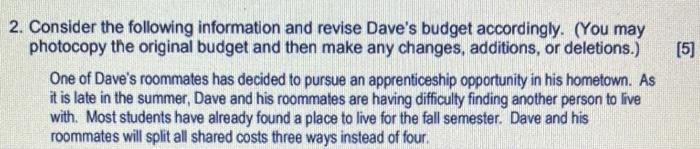

1. Read the case study. Create a monthly budget. Comment on the surplus/deficit. (A blank budget template has been included on the following page.) [15] Dave, who is 18 years old, has been accepted into the Electrical Engineering Technician program at Cambrian College in Sudbury. It is a three-year program. Since electricians are in high demand in Northem Ontario, Dave is not worried about finding a job after graduation. Since Dave has no family in Sudbury, he has chosen to live in student housing. He will be sharing a rental house with three other students (so four people in total). His share of the rent will be $400 per month and utilities (heat, electricity, water) will cost approximately $40 per month per roommate. Also, Dave and his roommates have decided they would like to share a phone line, internet and cable. They found a plan that offers all three services for $120 per month. Dave estimates his biweekly food costs will be approximately $100. Dave anticipates that he will spend about $50 per week on entertainment and miscellaneous expenses (including laundry and personal items). Dave has decided to keep his cell phone which costs around $65.00 each month his current plan is good across Northern Ontario. Dave does not have a car, he will use the Greater Sudbury Transit system to get to school and home each week day ($2.50 one way, $5.00 round trip). He will likely take four other return transit trips throughout the week. Dave will spend nine weeks this summer working full time as an inventory clerk in a warehouse. After taxes and deductions, he will earn approximately $540 every 2 weeks. Dave will allow himself an allowance of $40 per week in the summer and will save the rest of his earnings for school he plans to split his earnings over the eight months he will be away at school. Dave will receive $3000 from OSAP for the fall semester (September - December). He has also secured a job at a Sudbury grocery store with a net pay of $8.00/h. He will work approximately 25 hours per week. Tuition for the fall semester is approximately $2500 (including textbooks) and Dave will pay his tuition in four monthly instaliments, [5] 2. Consider the following information and revise Dave's budget accordingly. (You may photocopy the original budget and then make any changes, additions, or deletions.) One of Dave's roommates has decided to pursue an apprenticeship opportunity in his hometown. As it is late in the summer, Dave and his roommates are having difficulty finding another person to live with. Most students have already found a place to live for the fall semester. Dave and his roommates will split all shared costs three ways instead of four 3. Your revised budget for Dave should indicate that his expenses are greater than his income. Identify two expense categories where you think that Dave should reduce his spending and suggest ways that Dave could go about spending less in these areas. [4] 1. Read the case study. Create a monthly budget. Comment on the surplus/deficit. (A blank budget template has been included on the following page.) [15] Dave, who is 18 years old, has been accepted into the Electrical Engineering Technician program at Cambrian College in Sudbury. It is a three-year program. Since electricians are in high demand in Northem Ontario, Dave is not worried about finding a job after graduation. Since Dave has no family in Sudbury, he has chosen to live in student housing. He will be sharing a rental house with three other students (so four people in total). His share of the rent will be $400 per month and utilities (heat, electricity, water) will cost approximately $40 per month per roommate. Also, Dave and his roommates have decided they would like to share a phone line, internet and cable. They found a plan that offers all three services for $120 per month. Dave estimates his biweekly food costs will be approximately $100. Dave anticipates that he will spend about $50 per week on entertainment and miscellaneous expenses (including laundry and personal items). Dave has decided to keep his cell phone which costs around $65.00 each month his current plan is good across Northern Ontario. Dave does not have a car, he will use the Greater Sudbury Transit system to get to school and home each week day ($2.50 one way, $5.00 round trip). He will likely take four other return transit trips throughout the week. Dave will spend nine weeks this summer working full time as an inventory clerk in a warehouse. After taxes and deductions, he will earn approximately $540 every 2 weeks. Dave will allow himself an allowance of $40 per week in the summer and will save the rest of his earnings for school he plans to split his earnings over the eight months he will be away at school. Dave will receive $3000 from OSAP for the fall semester (September - December). He has also secured a job at a Sudbury grocery store with a net pay of $8.00/h. He will work approximately 25 hours per week. Tuition for the fall semester is approximately $2500 (including textbooks) and Dave will pay his tuition in four monthly instaliments, [5] 2. Consider the following information and revise Dave's budget accordingly. (You may photocopy the original budget and then make any changes, additions, or deletions.) One of Dave's roommates has decided to pursue an apprenticeship opportunity in his hometown. As it is late in the summer, Dave and his roommates are having difficulty finding another person to live with. Most students have already found a place to live for the fall semester. Dave and his roommates will split all shared costs three ways instead of four 3. Your revised budget for Dave should indicate that his expenses are greater than his income. Identify two expense categories where you think that Dave should reduce his spending and suggest ways that Dave could go about spending less in these areas. [4]