Question: 1 Required information Problem 11-1A Short-term notes payable transactions and entries LO P1 The following information applies to the questions displayed below) Tyrell Co. entered

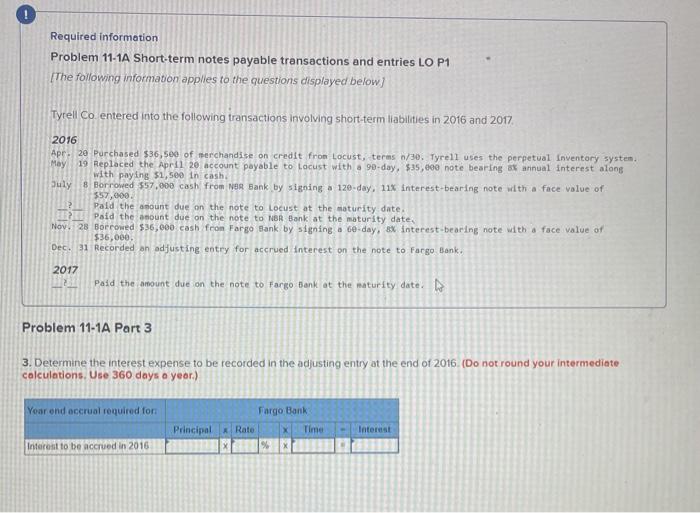

1 Required information Problem 11-1A Short-term notes payable transactions and entries LO P1 The following information applies to the questions displayed below) Tyrell Co. entered into the following transactions involving short-term liabilities in 2016 and 2017 2016 Apr. 20 Purchased $36,500 of merchandise on credit from Locust, terms 6/30. Tyrell uses the perpetual Inventory system May 19 Replaced the April 20 account payable to locust with a 90-day, $35,000 note bearing of annual interest along with paying $1,500 in cash July 8 Borrowed $57.000 cash from NR Bank by signing a 120-day, 11% Interest-bearing note with a face value of $57,000 ? Paid the amount due on the note to Locust at the maturity date. Poid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $36,000 cash from Fargo Bank by signing a 6e-day, 8X interest-bearing note with a face value of $36,000. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. 2017 2 Paid the amount due on the note to Fargo Bank at the maturity date. Problem 11-1A Part 3 3. Determine the interest expense to be recorded in the adjusting entry at the end of 2016 (Do not round your intermediate calculations. Use 360 days a year.) Year end accrual required for Fargo Bank Principal Rate Time Interest Interest to be accrued in 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts