Question: 1) Solve ALL problems using a financial calculator; please do not use annuity formulas 2) Please show all work!!! This helps me understand how you

1) Solve ALL problems using a financial calculator; please do not use annuity formulas 2) Please show all work!!! This helps me understand how you are thinking

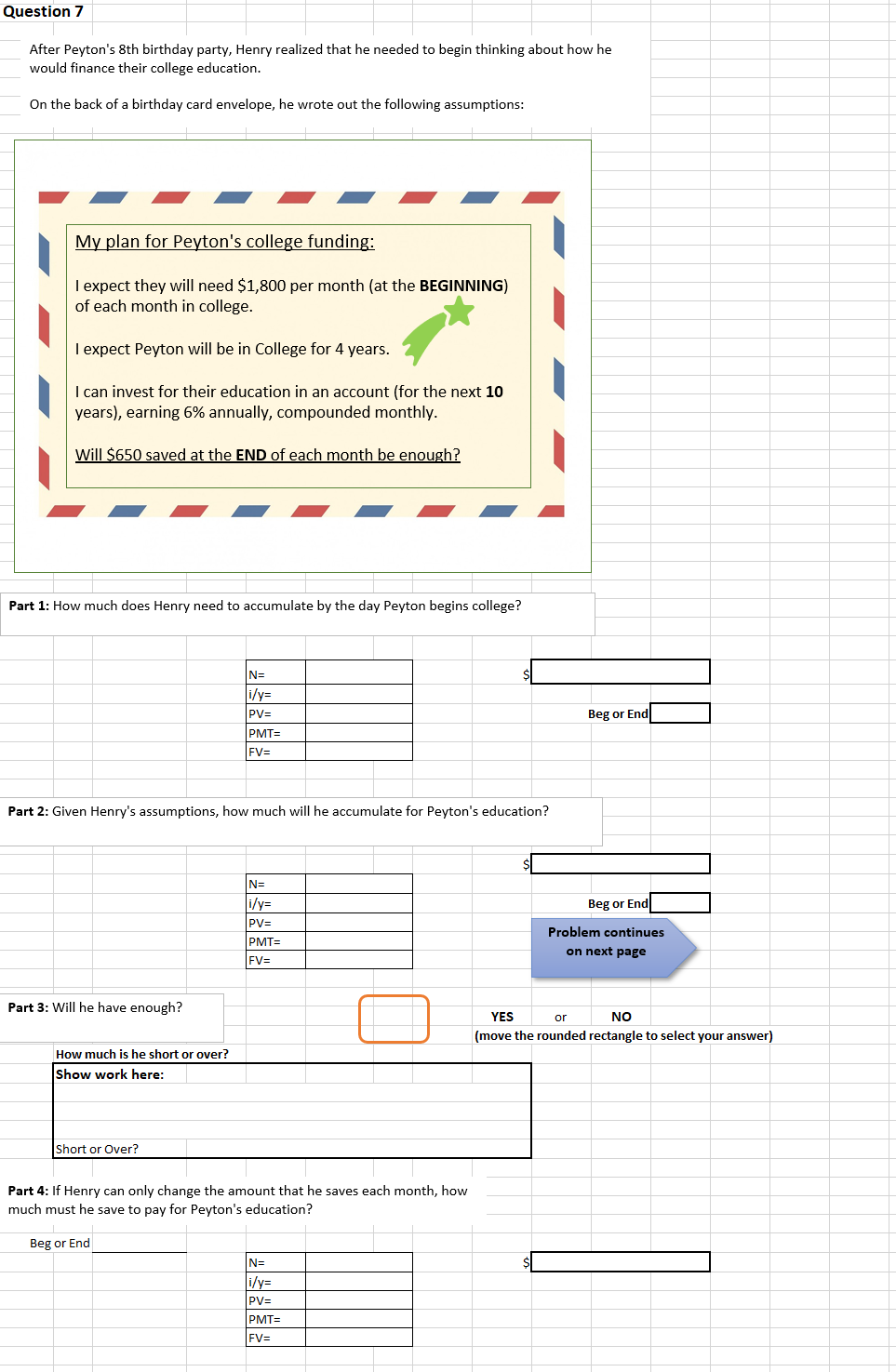

After Peyton's 8th birthday party, Henry realized that he needed to begin thinking about how he would finance their college education. On the back of a birthday card envelope, he wrote out the following assumptions: My plan for Peyton's college funding: I expect they will need $1,800 per month (at the BEGINNING) of each month in college. I expect Peyton will be in College for 4 years. I can invest for their education in an account (for the next 10 years), earning 6% annually, compounded monthly. Will $650 saved at the END of each month be enough? Part 1: How much does Henry need to accumulate by the day Peyton begins college? Part 2: Given Henry's assumptions, how much will he accumulate for Peyton's education? Part 4: If Henry can only change the amount that he saves each month, how much must he save to pay for Peyton's education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts