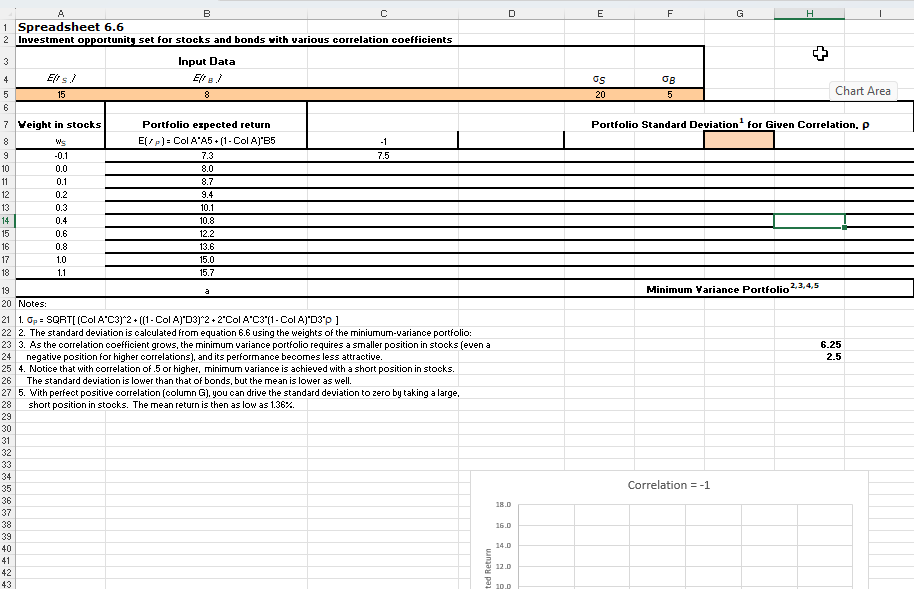

Question: 1 . sP = SQRT [ ( Col A * C 3 ) ^ 2 + ( ( 1 - Col A ) * D

sP SQRTCol AC Col ADCol AC Col ADr The standard deviation is calculated from equation using the weights of the miniumumvariance portfolio: As the correlation coefficient grows, the minimum variance portfolio requires a smaller position in stocks even a negative position for higher correlations and its performance becomes less attractive. Notice that with correlation of or higher, minimum variance is achieved with a short position in stocks. The standard deviation is lower than that of bonds, but the mean is lower as well. With perfect positive correlation column G you can drive the standard deviation to zero by taking a large, short position in stocks. The mean return is then as low as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock