Question: 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and

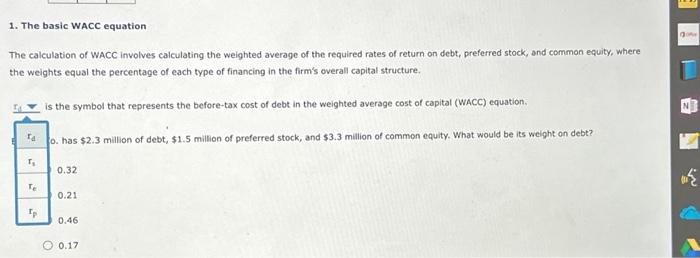

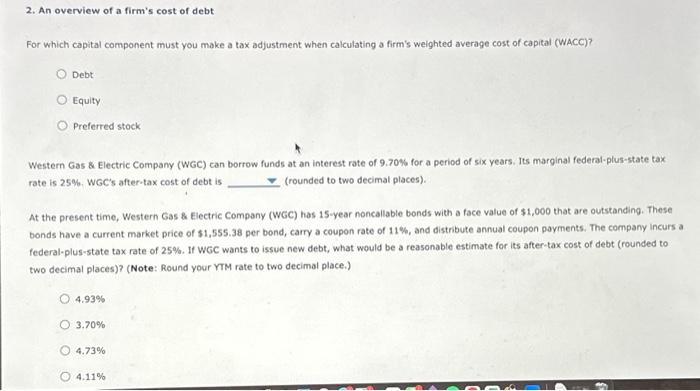

1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation. 0. has $2.3 million of debt, $1.5 million of preferred stock, and $3.3 million of common equity. What would be its weight on debt? 0.32 0.21 0.46 0.17 2. An overview of a firm's cost of debt For which capital component must you make a tax adjustment when calculating a firm's weighted average cost of capital (WACC)? Debt Equity Preferred stock Western Gas \& Electric Company (WGC) can borrow funds at an interest rate of 9.70% for a period of six years. Its marginal federal-plus-state tax rate is 25%. WGC's after-tax cost of debt is (rounded to two decimal places). At the present time, Western Gas \& Electric Company (WGC) has 15 -year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,555.38 per bond, carry a coupon rate of 11%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 25%. If wGC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 4.93% 3.70% 4.73% 4.11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts