Question: 1. The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the

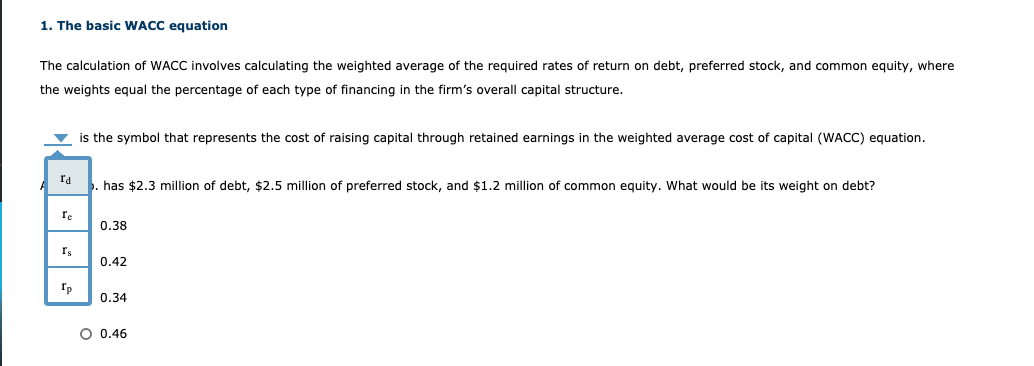

1. The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firms overall capital structure.

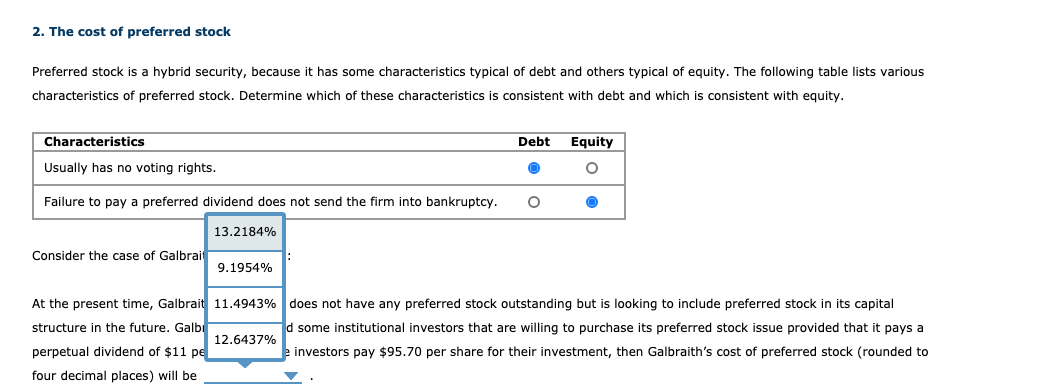

2. At the present time, Galbraith Enterprises does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in the future. Galbraith has found some institutional investors that are willing to purchase its preferred stock issue provided that it pays a perpetual dividend of $11 per share. If the investors pay $95.70 per share for their investment, then Galbraiths cost of preferred stock (rounded to four decimal places) will be

1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of raising capital through retained earnings in the weighted average cost of capital (WACC) equation. ra has $2.3 million of debt, $2.5 million of preferred stock, and $1.2 million of common equity. What would be its weight on debt? re 0.38 IS 0.42 0.34 O 0.46 2. The cost of preferred stock Preferred stock is a hybrid security, because it has some characteristics typical of debt and others typical of equity. The following table lists various characteristics of preferred stock. Determine which of these characteristics is consistent with debt and which is consistent with equity. Characteristics Debt Equity Usually has no voting rights. Failure to pay a preferred dividend does not send the firm into bankruptcy. O 13.2184% Consider the case of Galbrai 9.1954% At the present time, Galbrait 11.4943% does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in the future. Galbi d some institutional investors that are willing to purchase its preferred stock issue provided that it pays a 12.6437% perpetual dividend of $11 pe investors pay $95.70 per share for their investment, then Galbraith's cost of preferred stock (rounded to four decimal places) will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts