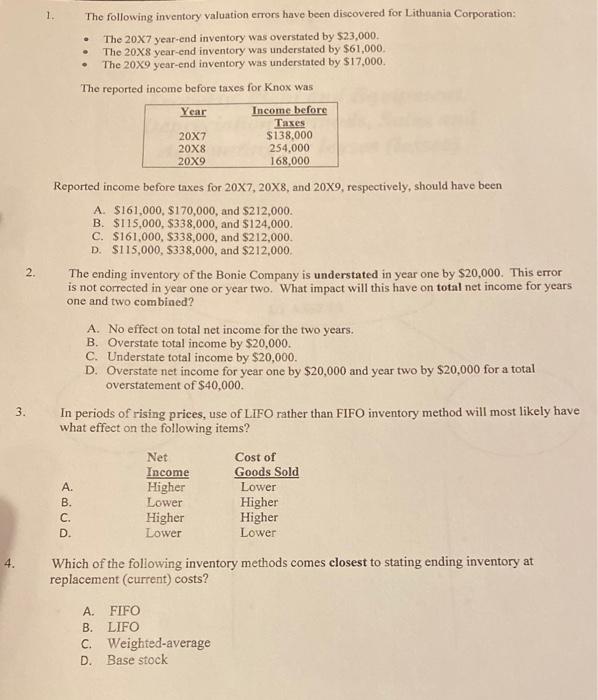

Question: 1. . The following inventory valuation errors have been discovered for Lithuania Corporation: The 20x7 year-end inventory was overstated by $23,000 The 20x8 year-end inventory

1. . The following inventory valuation errors have been discovered for Lithuania Corporation: The 20x7 year-end inventory was overstated by $23,000 The 20x8 year-end inventory was understated by $61,000. The 20x9 year-end inventory was understated by $17.000 The reported income before taxes for Knox was Year Income before Taxes 20X7 $138.000 20X8 254,000 20X9 168,000 2. Reported income before taxes for 20X7, 20x8, and 20x9, respectively, should have been A $161,000, $170,000, and $212,000. B. $115,000, $338,000, and $124.000. C. $161,000, $338,000, and $212,000. D. $115,000, 5338,000, and $212,000. The ending inventory of the Bonie Company is understated in year one by $20,000. This error is not corrected in year one or year two. What impact will this have on total net income for years one and two combined? A. No effect on total net income for the two years. B. Overstate total income by $20,000. C. Understate total income by $20,000. D. Overstate net income for year one by $20,000 and year two by $20,000 for a total overstatement of $40,000. In periods of rising prices, use of LIFO rather than FIFO inventory method will most likely have what effect on the following items? 3. A. B. C. D Net Income Higher Lower Higher Lower Cost of Goods Sold Lower Higher Higher Lower 4. Which of the following inventory methods comes closest to stating ending inventory at replacement (current) costs? A. FIFO B. LIFO C. Weighted average D. Base stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts