Question: 1. True or false? (a) When a coupon bond's YTM exceeds its coupon rate, the bond sells for less than face value. (b) A bond's

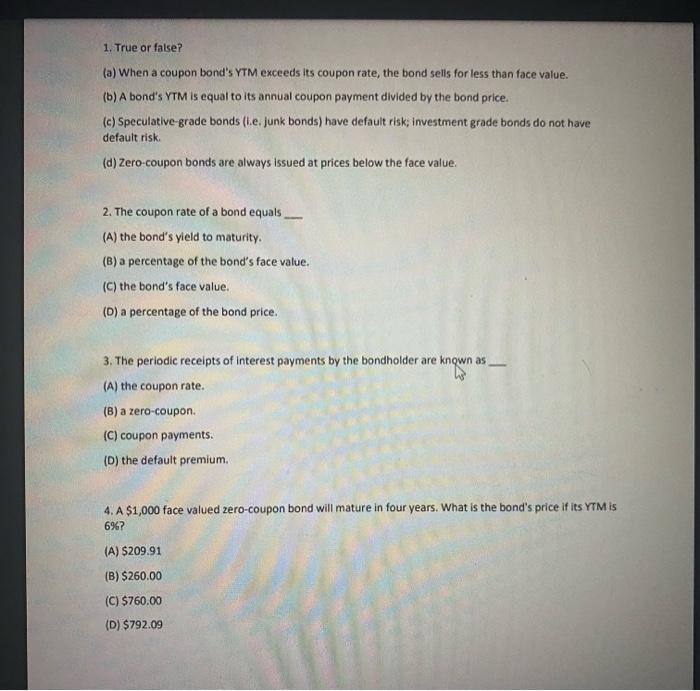

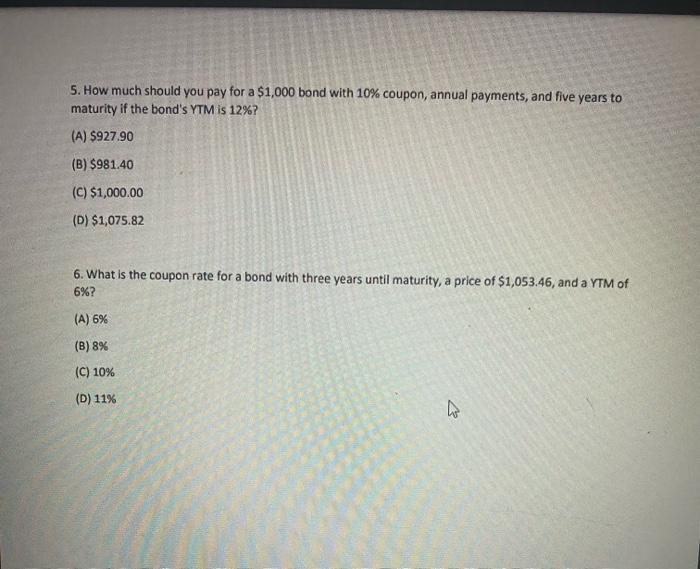

1. True or false? (a) When a coupon bond's YTM exceeds its coupon rate, the bond sells for less than face value. (b) A bond's YTM is equal to its annual coupon payment divided by the bond price. (c) Speculative-grade bonds (i.e. junk bonds) have default risk; investment grade bonds do not have default risk. (d) Zero-coupon bonds are always issued at prices below the face value. 2. The coupon rate of a bond equals (A) the bond's yield to maturity. (B) a percentage of the bond's face value. (C) the bond's face value. (D) a percentage of the bond price. 3. The periodic receipts of interest payments by the bondholder are known as (A) the coupon rate. (B) a zero-coupon. (C) coupon payments. (D) the default premium. 4. A $1,000 face valued zero-coupon bond will mature in four years. What is the bond's price if its YTM is 6% ? (A) $209.91 (B) $260.00 (C) $760.00 (D) $792.09 5. How much should you pay for a $1,000 bond with 10% coupon, annual payments, and five years to maturity if the bond's YTM is 12% ? (A) $927.90 (B) $981.40 (C) $1,000.00 (D) $1,075.82 6. What is the coupon rate for a bond with three years until maturity, a price of $1,053.46, and a YTM of 6%? (A) 6% (B) 8% (C) 10% (D) 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts