Question: I need help with questiond 5-15 please :) Question 5 1 pts (TRUE or FALSE?) Whenever a bond's coupon rate is lower than the market

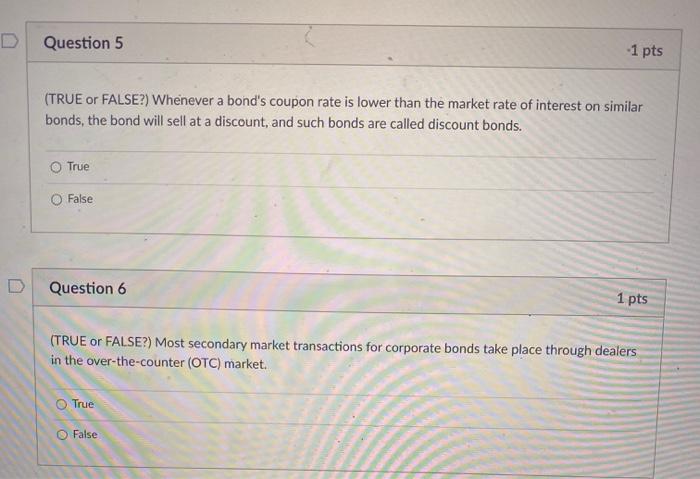

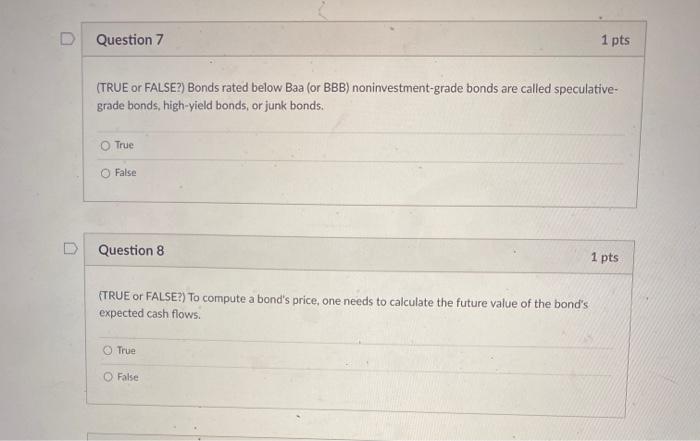

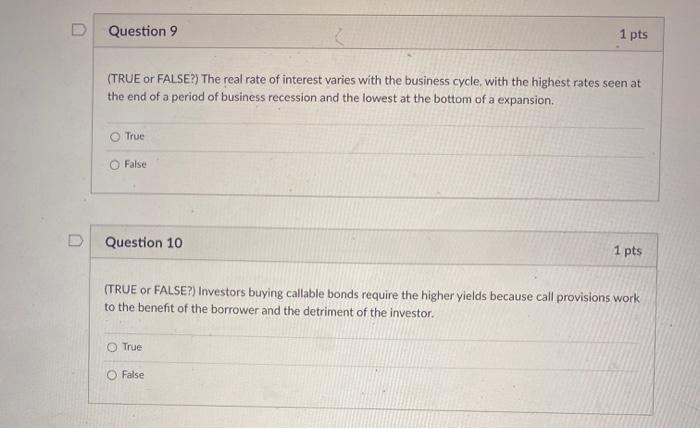

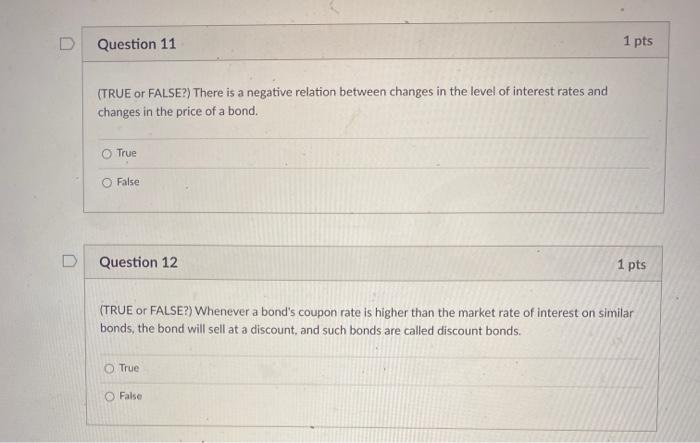

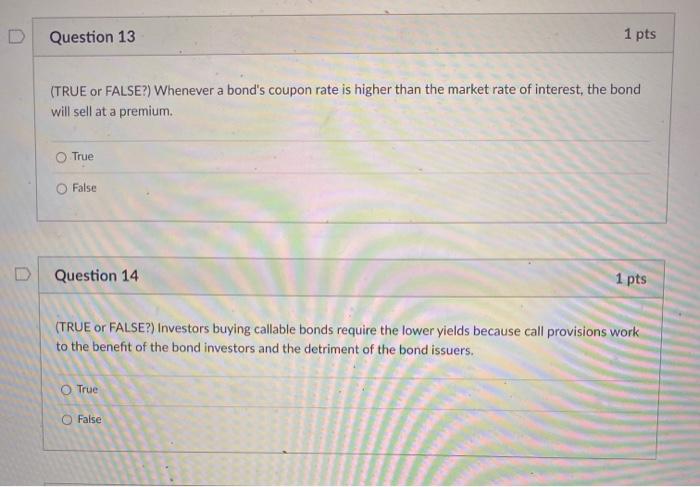

Question 5 1 pts (TRUE or FALSE?) Whenever a bond's coupon rate is lower than the market rate of interest on similar bonds, the bond will sell at a discount, and such bonds are called discount bonds. True False Question 6 1 pts (TRUE or FALSE?) Most secondary market transactions for corporate bonds take place through dealers in the over-the-counter (OTC) market. O True False Question 7 1 pts (TRUE or FALSE?) Bonds rated below Baa (or BBB) noninvestment-grade bonds are called speculative- grade bonds, high-yield bonds, or junk bonds. True False Question 8 1 pts (TRUE or FALSE?) To compute a bond's price, one needs to calculate the future value of the bond's expected cash flows. True False Question 9 1 pts (TRUE or FALSE?) The real rate of interest varies with the business cycle, with the highest rates seen at the end of a period of business recession and the lowest at the bottom of a expansion True False D Question 10 1 pts (TRUE or FALSE?) Investors buying callable bonds require the higher yields because call provisions work to the benefit of the borrower and the detriment of the investor. O True False Question 11 1 pts (TRUE or FALSE?) There is a negative relation between changes in the level of interest rates and changes in the price of a bond. True False D Question 12 1 pts (TRUE or FALSE?) Whenever a bond's coupon rate is higher than the market rate of interest on similar bonds, the bond will sell at a discount, and such bonds are called discount bonds. True False Question 13 1 pts (TRUE or FALSE?) Whenever a bond's coupon rate is higher than the market rate of interest, the bond will sell at a premium True False Question 14 1 pts (TRUE or FALSE?) Investors buying callable bonds require the lower yields because call provisions work to the benefit of the bond investors and the detriment of the bond issuers. O True O False Question 15 1 pts (TRUE or FALSE?) The face or par value for most corporate bonds is equal to $1,000, and it is the principal amount owed to bondholders at maturity. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts