Question: 1) Use the data below to compute the VaRt+10 using a model in which the innovation term is distributed as a standard normal and

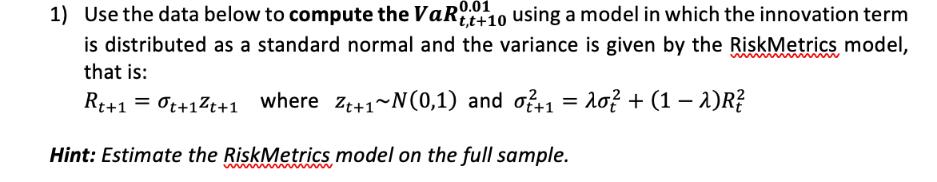

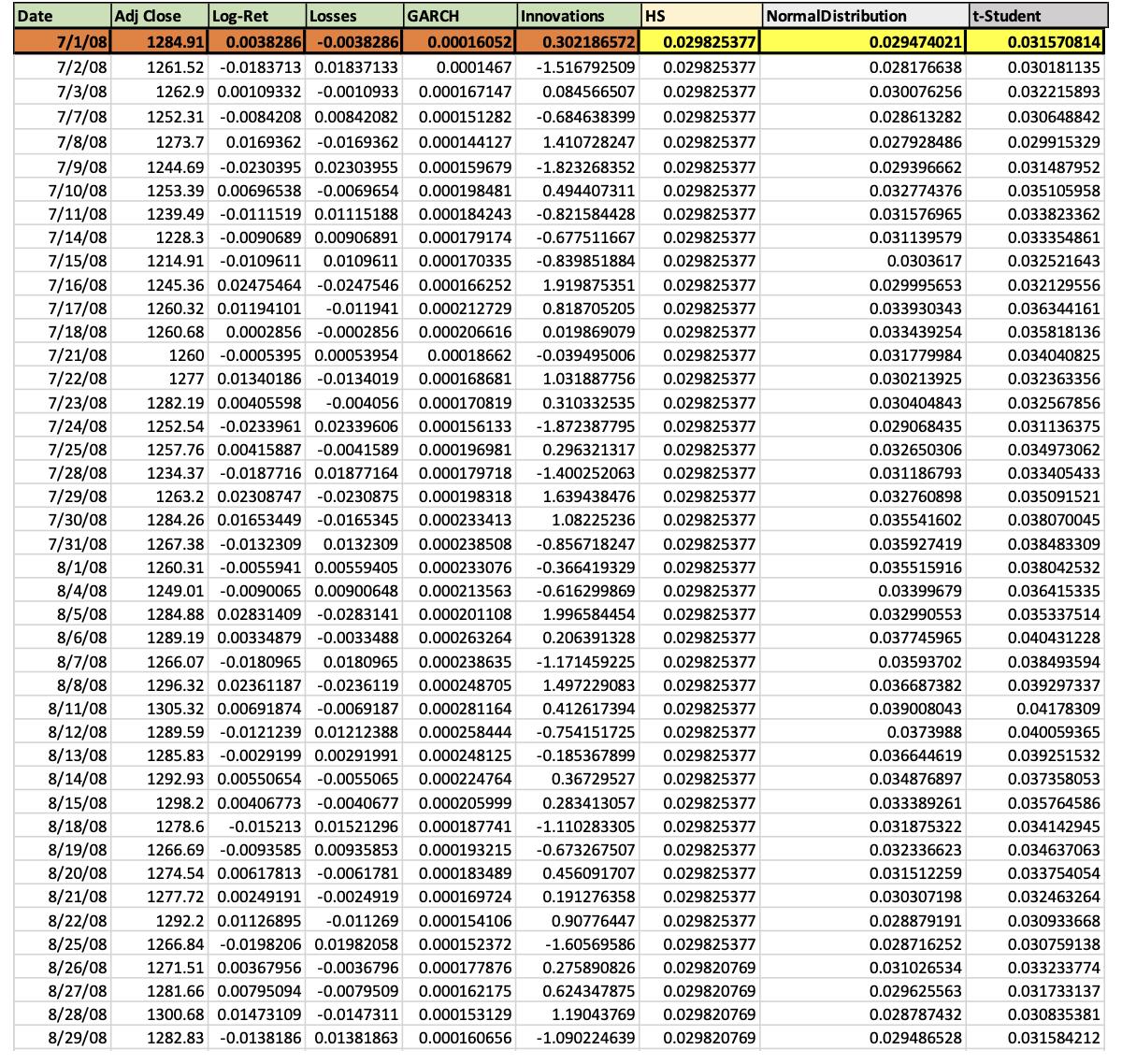

1) Use the data below to compute the VaRt+10 using a model in which the innovation term is distributed as a standard normal and the variance is given by the RiskMetrics model, that is: Rt+1 = Ot+1t+1 where Zt+1~N(0,1) and o+ = 2o + (1 - 1)R Hint: Estimate the RiskMetrics model on the full sample. Innovations 0.029825377 Adj Close Log-Ret Losses 7/1/08 1284.91 0.0038286 -0.0038286 0.00016052 0.302186572 0.029825377 7/2/08 1261.52 -0.0183713 0.01837133 0.0001467 -1.516792509 0.029825377 7/3/08 1262.9 0.00109332 -0.0010933 0.000167147 0.084566507 0.029825377 7/7/08 1252.31 -0.0084208 0.00842082 0.000151282 -0.684638399 0.029825377 7/8/08 1273.7 0.0169362 -0.0169362 0.000144127 1.410728247 0.029825377 7/9/08 1244.69 -0.0230395 0.02303955 0.000159679 -1.823268352 0.029825377 7/10/08 1253.39 0.00696538 -0.0069654 0.000198481 0.494407311 0.029825377 7/11/08 1239.49 -0.0111519 0.01115188 0.000184243 -0.821584428 0.029825377 7/14/08 1228.3 -0.0090689 0.00906891 0.000179174 -0.677511667 0.029825377 7/15/08 1214.91 -0.0109611 0.0109611 0.000170335 -0.839851884 0.029825377 7/16/08 1245.36 0.02475464 -0.0247546 0.000166252 1.919875351 0.029825377 7/17/08 1260.32 0.01194101 -0.011941 0.000212729 0.818705205 0.029825377 7/18/08 1260.68 0.0002856 -0.0002856 0.000206616 0.019869079 0.029825377 7/21/08 1260 -0.0005395 0.00053954 0.00018662 -0.039495006 0.029825377 7/22/08 1277 0.01340186 -0.0134019 0.000168681 1.031887756 0.029825377 7/23/08 1282.19 0.00405598 -0.004056 0.000170819 0.310332535 0.029825377 7/24/08 1252.54 -0.0233961 0.02339606 0.000156133 -1.872387795 0.029825377 7/25/08 1257.76 0.00415887 -0.0041589 0.000196981 0.296321317 0.029825377 7/28/08 1234.37 -0.0187716 0.01877164 0.000179718 -1.400252063 0.029825377 7/29/08 1263.2 0.02308747 -0.0230875 0.000198318 1.639438476 7/30/08 1284.26 0.01653449 -0.0165345 0.000233413 1.08225236 0.029825377 7/31/08 1267.38 -0.0132309 0.0132309 0.000238508 -0.856718247 0.029825377 8/1/08 1260.31 -0.0055941 0.00559405 0.000233076 -0.366419329 0.029825377 8/4/08 1249.01 -0.0090065 0.00900648 0.000213563 -0.616299869 0.029825377 8/5/08 1284.88 0.02831409 -0.0283141 0.000201108 1.996584454 0.029825377 8/6/08 1289.19 0.00334879 -0.0033488 0.000263264 0.206391328 0.029825377 8/7/08 1266.07 -0.0180965 0.0180965 0.000238635 -1.171459225 0.029825377 8/8/08 1296.32 0.02361187 -0.0236119 0.000248705 1.497229083 0.029825377 8/11/08 1305.32 0.00691874 -0.0069187 0.000281164 0.412617394 0.029825377 8/12/08 1289.59 -0.0121239 0.01212388 0.000258444 -0.754151725 0.029825377 8/13/08 1285.83 -0.0029199 0.00291991 0.000248125 -0.185367899 0.029825377 8/14/08 1292.93 0.00550654 -0.0055065 0.000224764 0.36729527 0.029825377 8/15/08 1298.2 0.00406773 -0.0040677 0.000205999 0.283413057 0.029825377 8/18/08 1278.6 -0.015213 0.01521296 0.000187741 -1.110283305 0.029825377 8/19/08 1266.69 -0.0093585 0.00935853 0.000193215 -0.673267507 0.029825377 8/20/08 1274.54 0.00617813 -0.0061781 0.000183489 0.456091707 0.029825377 8/21/08 1277.72 0.00249191 -0.0024919 0.000169724 0.191276358 0.029825377 8/22/08 1292.2 0.01126895 -0.011269 0.000154106 0.90776447 0.029825377 8/25/08 1266.84 -0.0198206 0.01982058 0.000152372 -1.60569586 0.029825377 8/26/08 1271.51 0.00367956 -0.0036796 0.000177876 0.275890826 0.029820769 8/27/08 1281.66 0.00795094 -0.0079509 0.000162175 0.624347875 0.029820769 8/28/08 1300.68 0.01473109 -0.0147311 0.000153129 1.19043769 0.029820769 8/29/08 1282.83 -0.0138186 0.01381863 0.000160656 -1.090224639 0.029820769 Date GARCH HS NormalDistribution 0.029474021 0.028176638 0.030076256 0.028613282 0.027928486 0.029396662 0.032774376 0.031576965 0.031139579 0.0303617 0.029995653 0.033930343 0.033439254 0.031779984 0.030213925 0.030404843 0.029068435 0.032650306 0.031186793 0.032760898 0.035541602 0.035927419 0.035515916 0.03399679 0.032990553 0.037745965 0.03593702 0.036687382 0.039008043 0.0373988 0.036644619 0.034876897 0.033389261 0.031875322 0.032336623 0.031512259 0.030307198 0.028879191 0.028716252 0.031026534 0.029625563 0.028787432 0.029486528 t-Student 0.031570814 0.030181135 0.032215893 0.030648842 0.029915329 0.031487952 0.035105958 0.033823362 0.033354861 0.032521643 0.032129556 0.036344161 0.035818136 0.034040825 0.032363356 0.032567856 0.031136375 0.034973062 0.033405433 0.035091521 0.038070045 0.038483309 0.038042532 0.036415335 0.035337514 0.040431228 0.038493594 0.039297337 0.04178309 0.040059365 0.039251532 0.037358053 0.035764586 0.034142945 0.034637063 0.033754054 0.032463264 0.030933668 0.030759138 0.033233774 0.031733137 0.030835381 0.031584212

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Data R 001 002 003 004 005 006 007 008 009 01 daily returns 1 Est... View full answer

Get step-by-step solutions from verified subject matter experts