Question: 1. Use the information provided to create optimistic, realistic, and pessimistic scenarios for this project. You Income Statements need to take the proper form. 2.

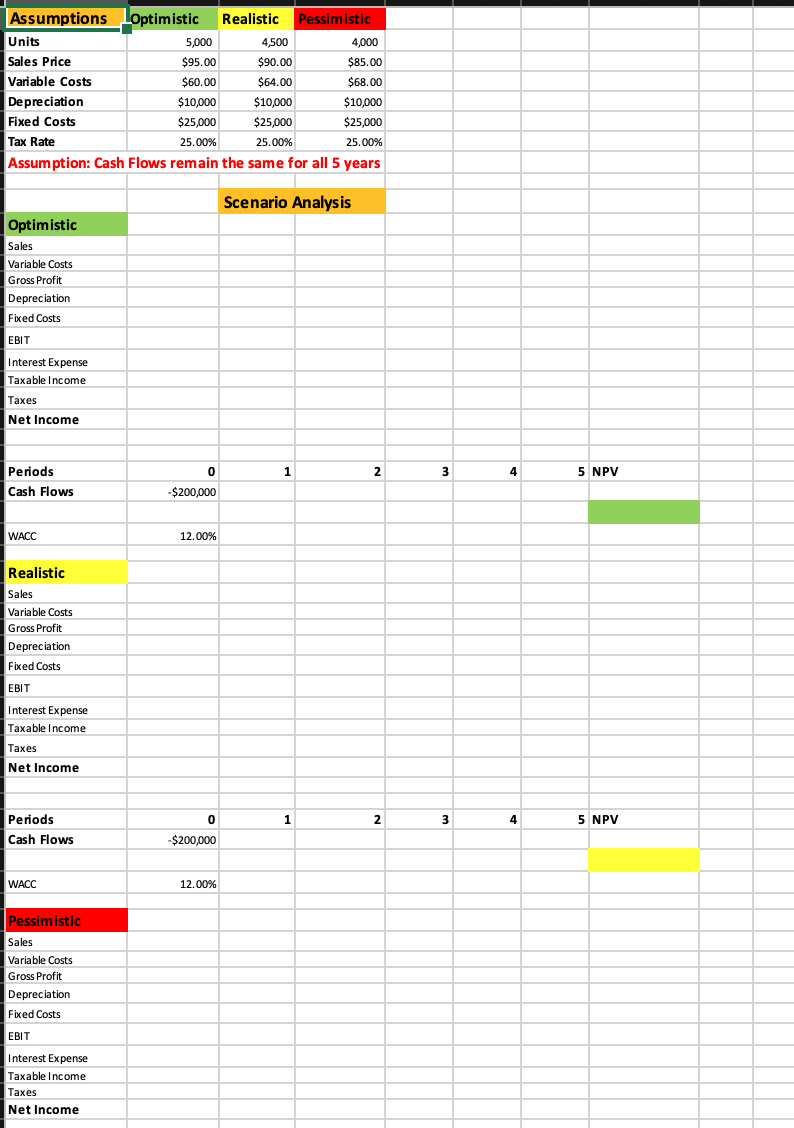

1. Use the information provided to create optimistic, realistic, and pessimistic scenarios for this project. You Income Statements need to take the proper form. 2. Assume all cash flows remain constant for 5 years. Calculate NPV for this project. You may either use the math time line formulas or the Excel funciton formula \begin{tabular}{|l|r|r|r|} \hline Assumptions & Optimistic & \multicolumn{1}{|c|}{ Realistic } & \multicolumn{1}{l|}{ Pessimistic } \\ \hline Units & 5,000 & 4,500 & 4,000 \\ \hline Sales Price & $95.00 & $90.00 & $85.00 \\ \hline Variable Costs & $60.00 & $64.00 & $68.00 \\ \hline Depreciation & $10,000 & $10,000 & $10,000 \\ \hline Fixed Costs & $25,000 & $25,000 & $25,000 \\ \hline Tax Rate & 25.00% & 25.00% & 25.00% \\ \hline \end{tabular} Assumption: Cash Flows remain the same for all 5 years Scenario Analysis Optimistic Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable Income Taxes Net Income \begin{tabular}{|l|} \hline Periods \\ \hline Cash Flows \\ \hline WaCC \\ \hline Realistic \\ \hline \end{tabular} 5 NPV Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable Income Taxes Net Income Periods \begin{tabular}{|l|l|} \hline 0 & 1 \\ \hline \end{tabular} 2 \begin{tabular}{|l|r|r|r|} \hline 3 & 4 & 5 & NPV \\ \hline \end{tabular} Cash Flows $200,000 WACC 12.00% Pessimistic Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable Income Taxes Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts