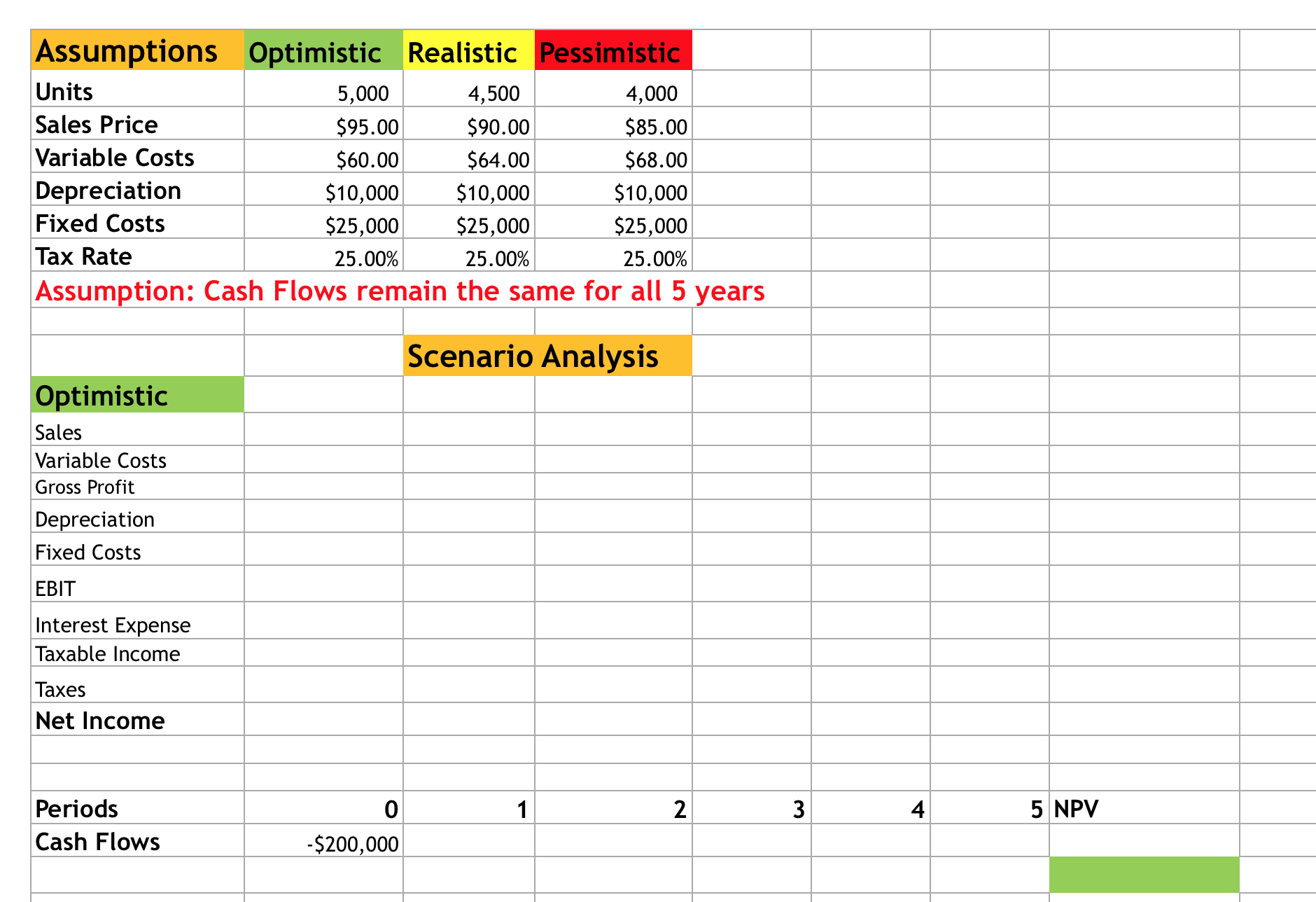

Question: Use the information provided to create optimistic, realistic, and pessimistic scenarios for this project.Your Income Statements need to take the proper form. Assume all cash

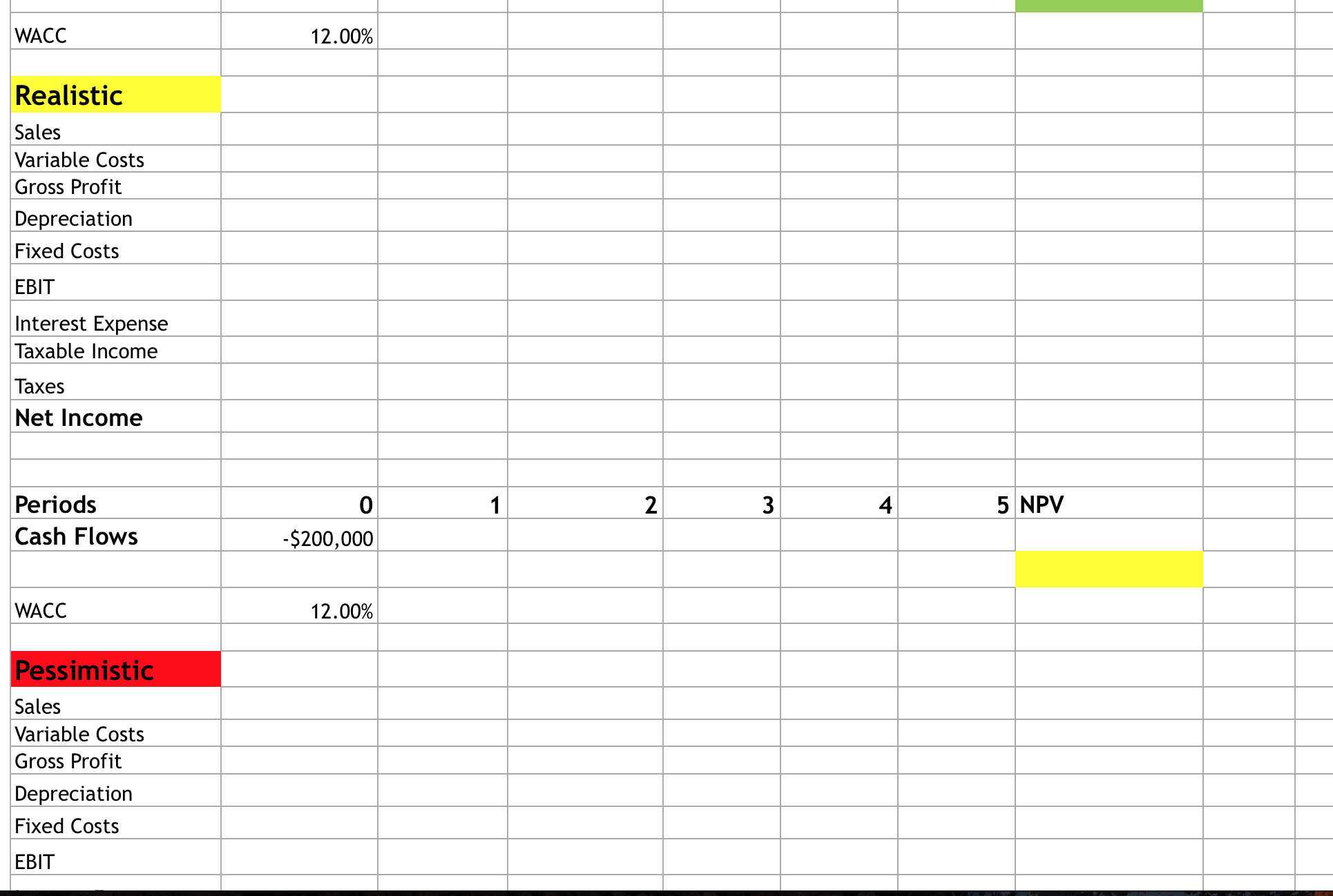

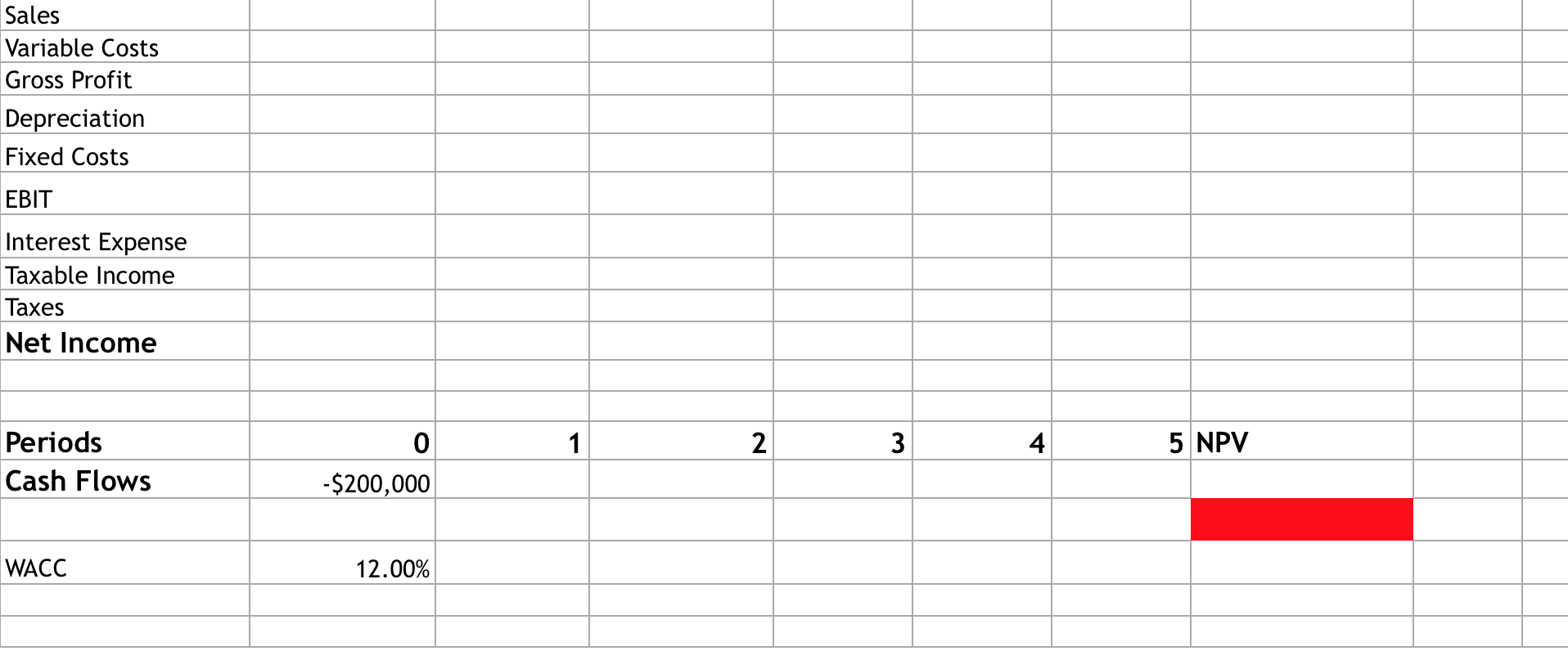

- Use the information provided to create optimistic, realistic, and pessimistic scenarios for this project.Your Income Statements need to take the proper form.

- Assume all cash flows remain constant for 5 years.Calculate NPV for this project using both TVM concepts and the NPV function in Excel.

- Use the What If function of Excel to make a Sensitivity Analysis for both unit price and variable costs.

- Assume all cash flows remain constant for 5 years.Calculate NPV for this project with your new sensitivity numbers.

- Explain what the numbers tell you about the viability of this project.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock