Question: 1- what is The expected return on security 1 2- what is The expected return on security 2 3-what is the covariance between the returns

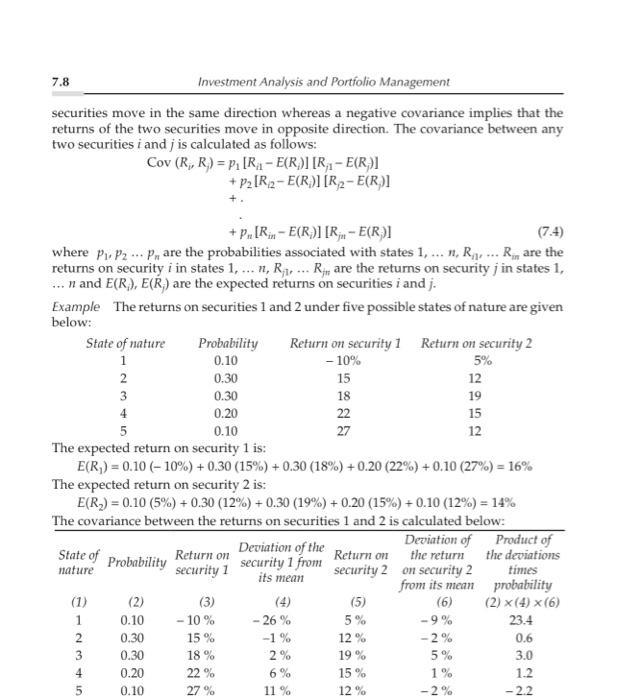

7.8 Investment Analysis and Portfolio Management securities move in the same direction whereas a negative covariance implies that the returns of the two securities move in opposite direction. The covariance between any two securities i and j is calculated as follows: Cov (R, R) = P1 [RA - E(R)] [R, - E(R)] + P2 [R2-E(R)][R2-E(R) +. + p.[Rin-E(R)][RA - E(R)] (7.4) where Pi-P2 ... Por are the probabilities associated with states 1, ... , R ... R. are the returns on security i in states 1, ... , R,1... R are the returns on security j in states 1, ... n and E(R), E(R) are the expected returns on securities i and j. Example The returns on securities 1 and 2 under five possible states of nature are given below: State of nature Probability Return on security 1 Return on security 2 1 0.10 - 10% 5% 2 0.30 15 12 3 0.30 18 19 4 0.20 22 15 5 0.10 27 12 The expected return on security 1 is: E(R,) = 0.10 (-10%) + 0.30 (15%) + 0.30 (18%) +0.20 (22%) + 0.10 (27%) = 16% The expected return on security 2 is: E(R2) = 0.10 (5%) + 0.30 (12%) + 0.30 (19%) + 0.20 (15%) + 0.10 (12%) = 14% The covariance between the returns on securities 1 and 2 is calculated below: Deviation of Product of State of Deviation of the Return on Probability Return on the return the deviations nature security 1 from security 1 its mean security 2 on security 2 times from its mean probability (1) (2) (3) (5) (6) (2) (4) (6) 0.10 - 10% 26% 5% 23.4 15% -1% 12% -2% 0.6 0.30 18 % 2% 19 % 5 % 3.0 22 % 15 % 5 0.10 11% - 2.2 0.30 UWN 0.20 6 % 1.2 27% 12% 70 Example The returns on securities 1 and 2 under five possible states of nature are given below: State of nature Probability Return on security 1 Return on security 2 1 0.10 - 10% 5% 2 0.30 15 3 0.30 18 19 4 0.20 22 15 5 0.10 27 12 12 UN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts